Question

PLEASE SOLVE FOR PART B Exercise 16-2 John, Jake, and Joe are partners with capital accounts of $86,000, $76,000, and $61,000 respectively. They share profits

PLEASE SOLVE FOR PART B

Exercise 16-2

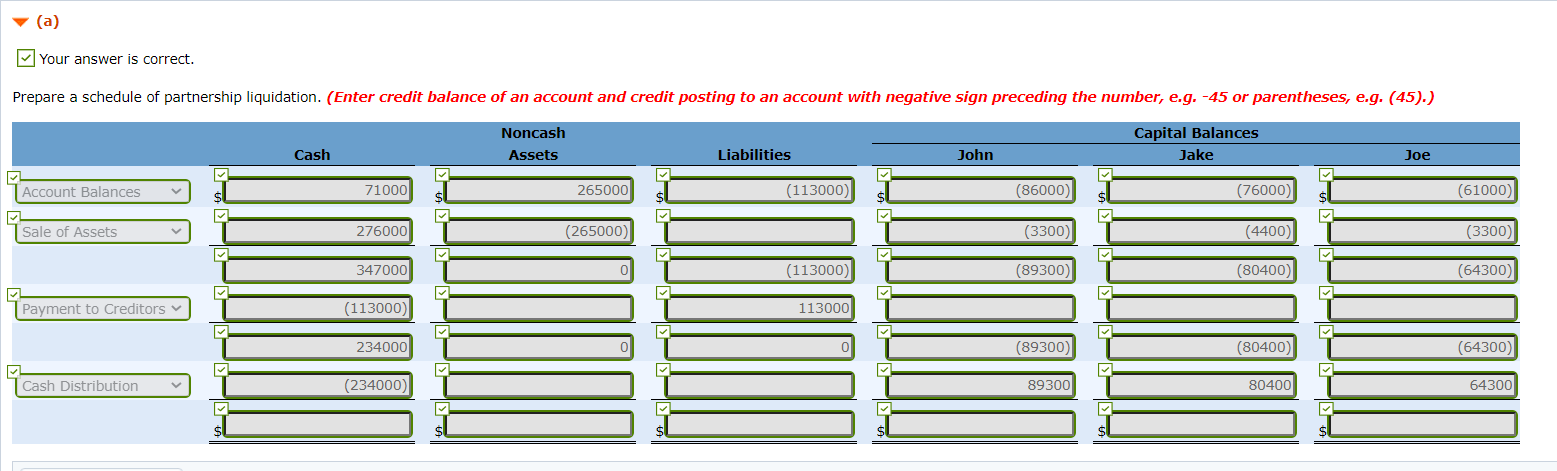

John, Jake, and Joe are partners with capital accounts of $86,000, $76,000, and $61,000 respectively. They share profits and losses in the ratio of 30:40:30. When the partners decide to liquidate, the business has $71,000 in cash, noncash assets totaling $265,000, and $113,000 in liabilities. The noncash assets are sold for $276,000, and the creditors are paid.

Note: You can right-click the image then open in a new tab to better see the problem Note: You can right-click the image then open in a new tab to better see the problem

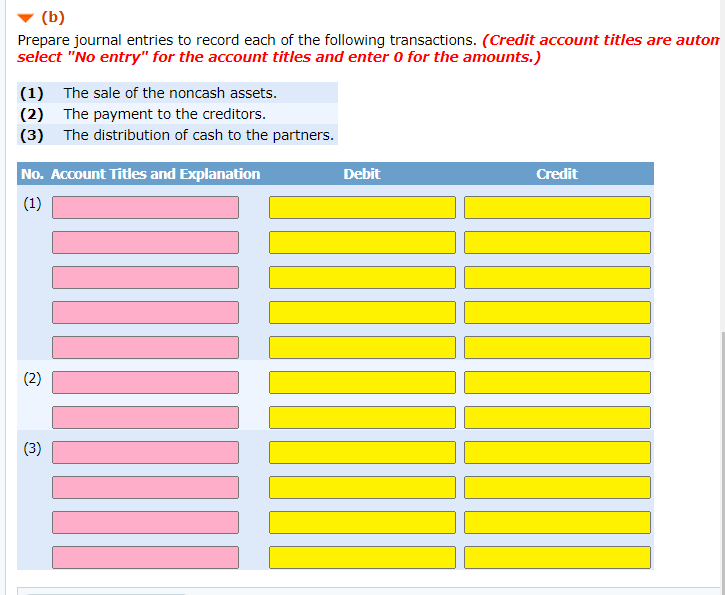

(a) Your answer is correct. Prepare a schedule of partnership liquidation. (Enter credit balance of an account and credit posting to an account with negative sign preceding the number, e.g. -45 or parentheses, e.g. (45).) Noncash Assets Capital Balances Jake Cash Liabilities John Joe Account Balances 71000 265000 sl (113000) (86000) (76000) (61000) Sale of Assets 276000 (265000) (3300) (4400) (3300) 347000 (113000) (89300) (80400) (64300) Payment to Creditors (113000) 113000 234000 (89300) (80400) (64300) Cash Distribution (234000) 89300 80400 64300 (b) Prepare journal entries to record each of the following transactions. (Credit account titles are auton select "No entry" for the account titles and enter o for the amounts.) (1) The sale of the noncash assets. (2) The payment to the creditors. (3) The distribution of cash to the partners. Debit Credit No. Account Titles and Explanation (1) (2) (3) List Of Accounts Exercise 16-1 Accounts Payable Accounts Receivable Accumulated Depreciation Additional Paid-in Capital Allen, Capital Allowance for Uncollectibles Argo, Capital Building Capital Stock Cash Cook, Capital Current Net Income Dawson, Capital Feeney, Capital Furniture and Fixtures Hardin, Capital Income Summary Inventory Jake, Capital Jan, Capital Jan, Loan Joe, Capital John, Capital Land Liabilities Liquidation Gain Liquidation Loss Malone, Capital Malone, Drawing Matt, Capital Matt, Loan Mortgage Payable Norwood, Capital Office Equipment Operating Gain Operating Loss Other Assets Parks, Capital Parks, Loan Partner 1, Capital Partner 2, Capital Partner 3, Capital Partner 4, Capital Partner 5, Capital Partner 6, Capital Partner 7, Capital Cook, Capital Current Net Income Dawson, Capital Feeney, Capital Furniture and Fixtures Hardin, Capital Income Summary Inventory Jake, Capital Jan, Capital Jan, Loan Joe, Capital John, Capital Land Liabilities Liquidation Gain Liquidation Loss Malone, Capital Malone, Drawing Matt, Capital Matt, Loan Mortgage Payable Norwood, Capital Office Equipment Operating Gain Operating Loss Other Assets Parks, Capital Parks, Loan Partner 1, Capital Partner 2, Capital Partner 3, Capital Partner 4, Capital Partner 5, Capital Partner 6, Capital Partner 7, Capital Partner 8, Capital Partner 9, Capital Partner 10, Capital Partner 11, Capital Partners 1-9, Capital Partners 10-11, Capital Patton, Capital Spencer, Capital Starns, Capital Starns, Loan Sue, Capital Valuation AdjustmentStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started