Please solve (I'II GIVE 4 UPVOTES THANKS!)

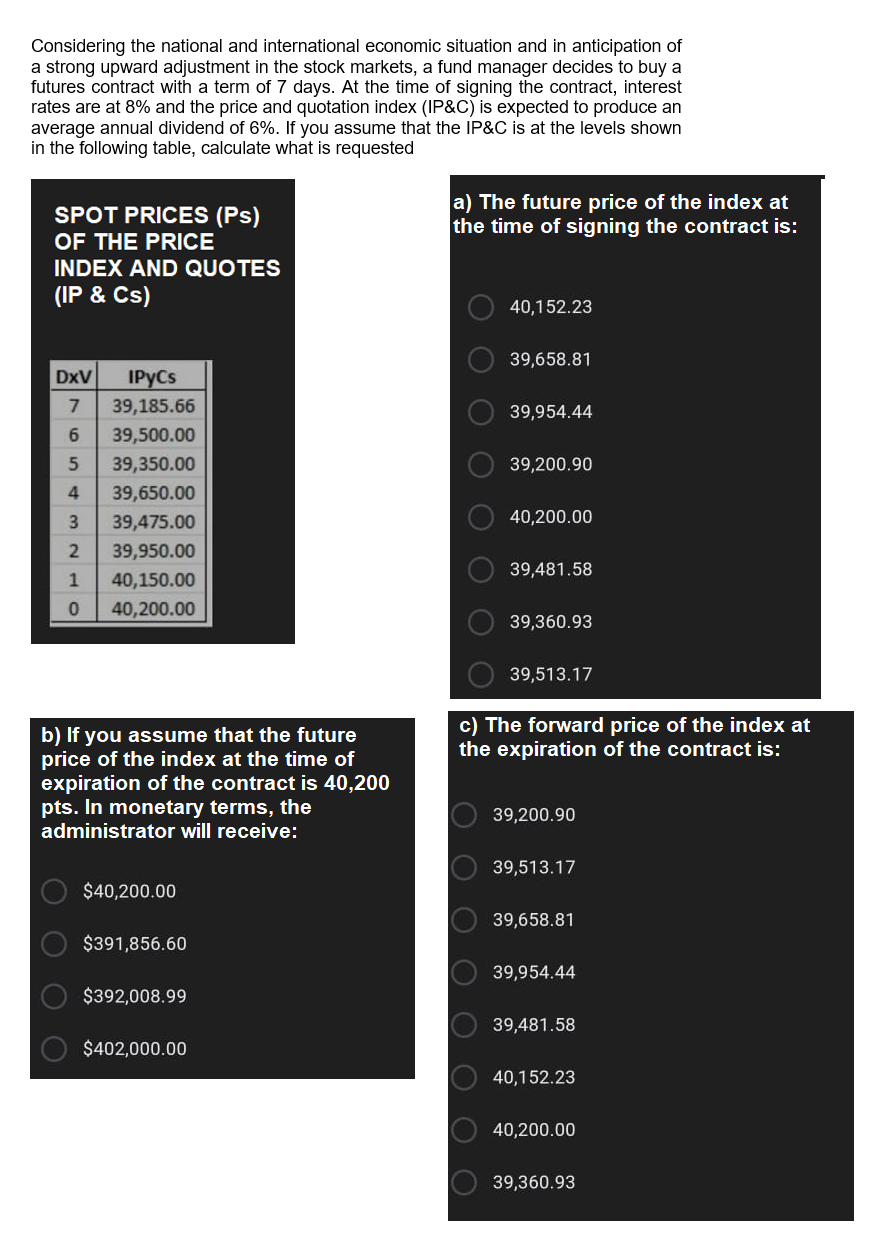

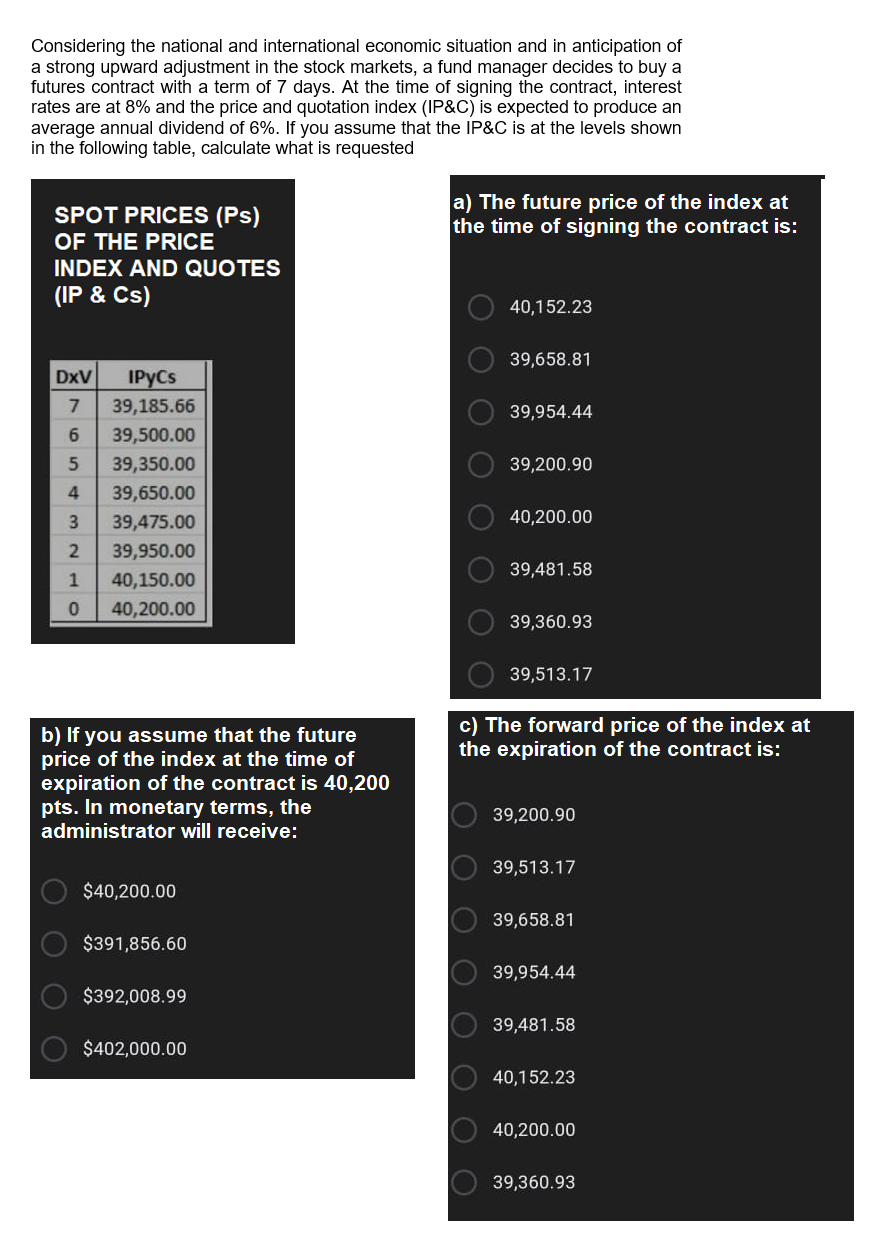

Considering the national and international economic situation and in anticipation of a strong upward adjustment in the stock markets, a fund manager decides to buy a futures contract with a term of 7 days. At the time of signing the contract, interest rates are at 8% and the price and quotation index (IP&C) is expected to produce an average annual dividend of 6%. If you assume that the IP&C is at the levels shown in the following table, calculate what is requested a) The future price of the index at the time of signing the contract is: SPOT PRICES (Ps) OF THE PRICE INDEX AND QUOTES (IP & Cs) 40,152.23 39,658.81 DxV 39,954.44 39,200.90 O Nwa IPyCs 39,185.66 39,500.00 39,350.00 39,650.00 39,475.00 39,950.00 40,150.00 40,200.00 40,200.00 39,481.58 1 O O 39,360.93 39,513.17 c) The forward price of the index at the expiration of the contract is: b) If you assume that the future price of the index at the time of expiration of the contract is 40,200 pts. In monetary terms, the administrator will receive: 39,200.90 39,513.17 $40,200.00 39,658.81 $391,856.60 39,954.44 O $392,008.99 39,481.58 $402,000.00 40,152.23 40,200.00 39,360.93 Considering the national and international economic situation and in anticipation of a strong upward adjustment in the stock markets, a fund manager decides to buy a futures contract with a term of 7 days. At the time of signing the contract, interest rates are at 8% and the price and quotation index (IP&C) is expected to produce an average annual dividend of 6%. If you assume that the IP&C is at the levels shown in the following table, calculate what is requested a) The future price of the index at the time of signing the contract is: SPOT PRICES (Ps) OF THE PRICE INDEX AND QUOTES (IP & Cs) 40,152.23 39,658.81 DxV 39,954.44 39,200.90 O Nwa IPyCs 39,185.66 39,500.00 39,350.00 39,650.00 39,475.00 39,950.00 40,150.00 40,200.00 40,200.00 39,481.58 1 O O 39,360.93 39,513.17 c) The forward price of the index at the expiration of the contract is: b) If you assume that the future price of the index at the time of expiration of the contract is 40,200 pts. In monetary terms, the administrator will receive: 39,200.90 39,513.17 $40,200.00 39,658.81 $391,856.60 39,954.44 O $392,008.99 39,481.58 $402,000.00 40,152.23 40,200.00 39,360.93