Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve in 60 mins i need all subparts please help. i will give thumbs up Question 3 (17 points) You are the CEO of

please solve in 60 mins i need all subparts please help. i will give thumbs up

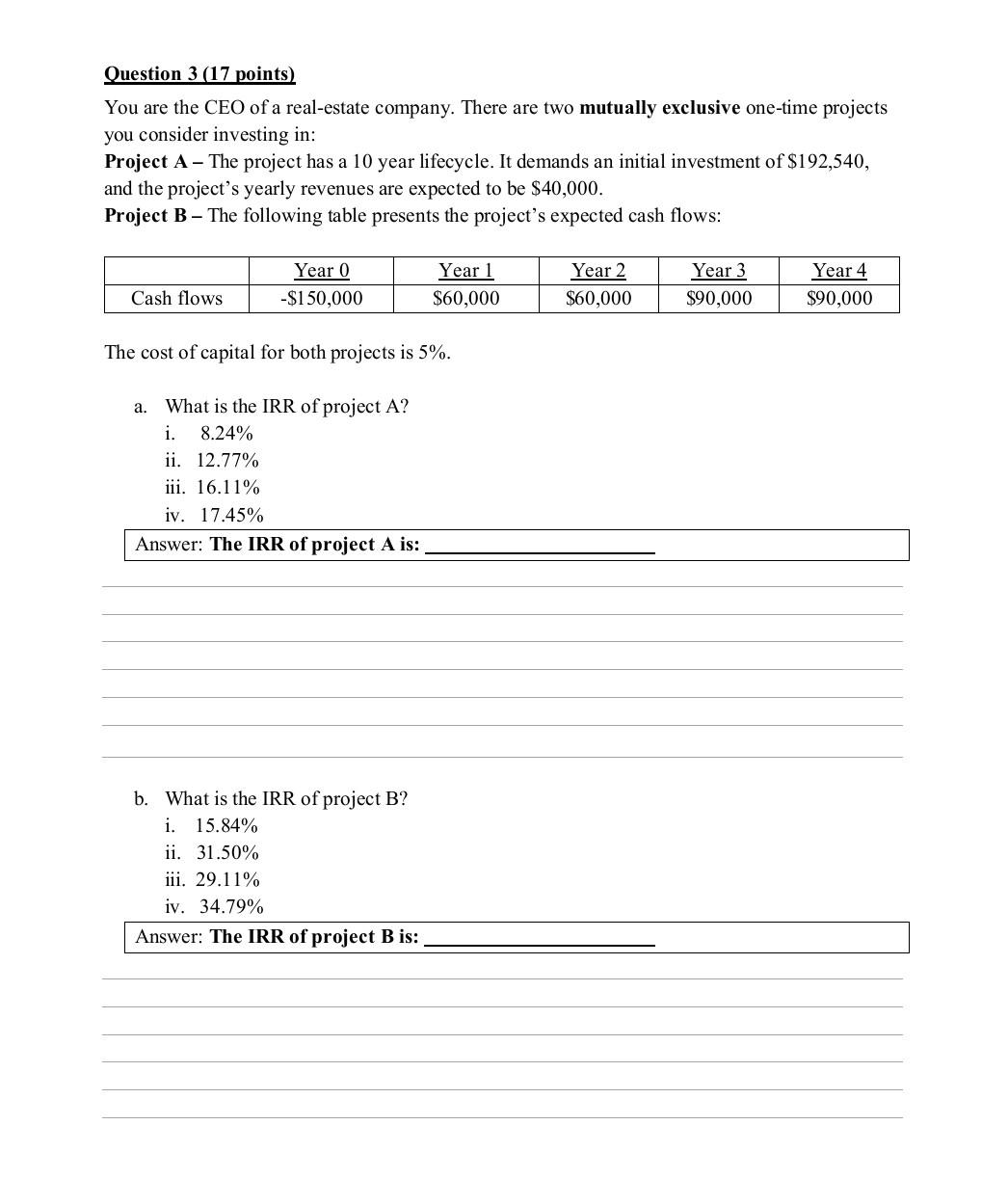

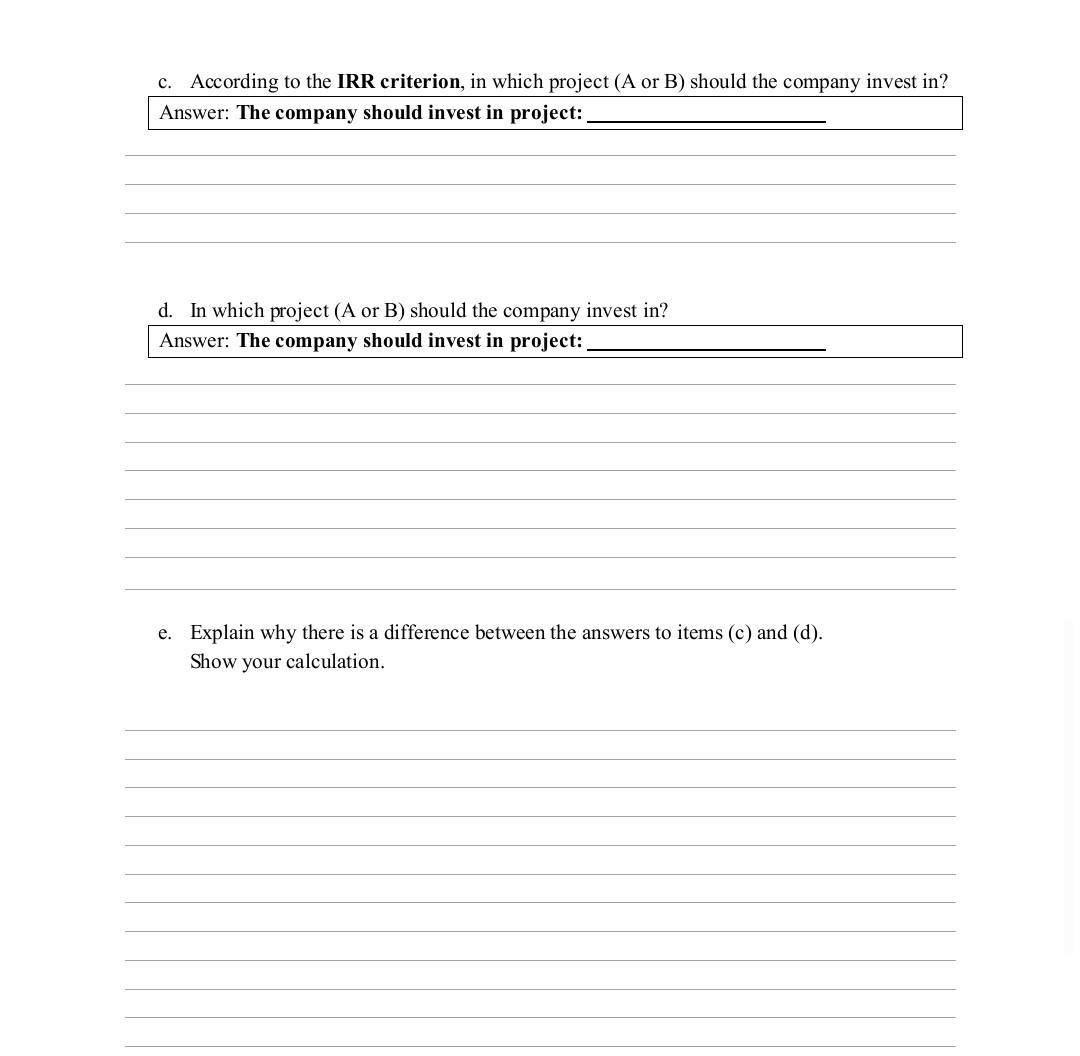

Question 3 (17 points) You are the CEO of a real-estate company. There are two mutually exclusive one-time projects you consider investing in: Project A - The project has a 10 year lifecycle. It demands an initial investment of $192,540, and the project's yearly revenues are expected to be $40,000. Project B- The following table presents the project's expected cash flows: Cash flows Year 0 -$150,000 Year 1 $60,000 The cost of capital for both projects is 5%. a. What is the IRR of project A? i. 8.24% ii. 12.77% iii. 16.11% iv. 17.45% Answer: The IRR of project A is: b. What is the IRR of project B? i. 15.84% ii. 31.50% iii. 29.11% iv. 34.79% Answer: The IRR of project B is: Year 2 $60,000 Year 3 $90,000 Year 4 $90,000 c. According to the IRR criterion, in which project (A or B) should the company invest in? Answer: The company should invest in project: d. In which project (A or B) should the company invest in? Answer: The company should invest in project: e. Explain why there is a difference between the answers to items (c) and (d). Show your calculationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started