Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve in details this is the whole question, table should be filled using the information provided above. NMC Labs is a diagnostic laboratory that

please solve in details

please solve in details

this is the whole question, table should be filled using the information provided above.

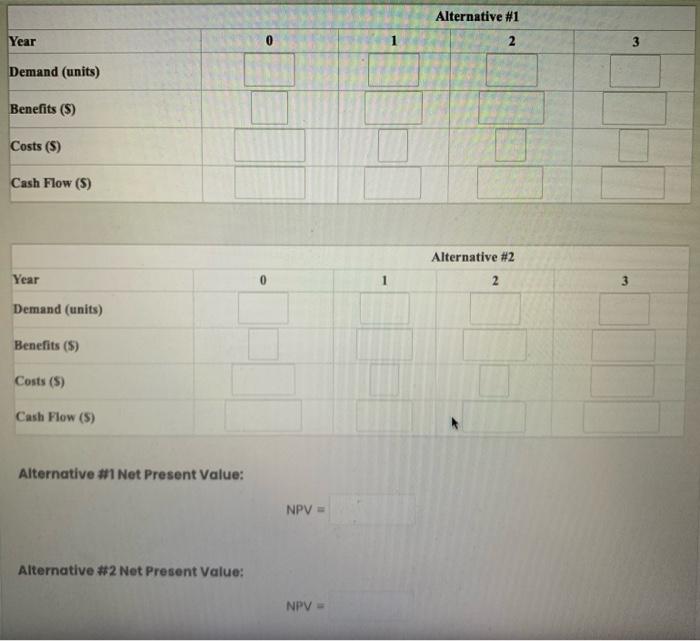

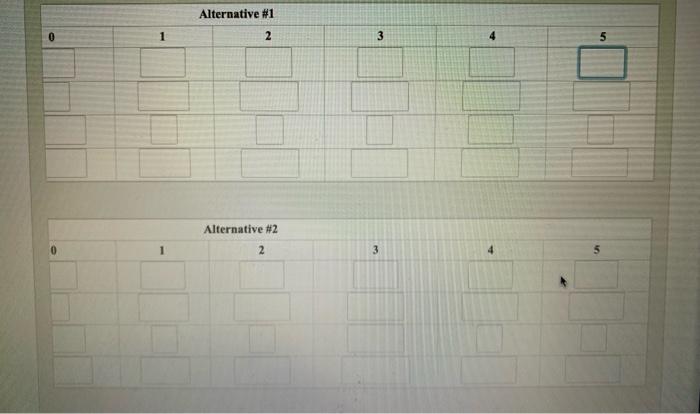

NMC Labs is a diagnostic laboratory that does various tests (blood tests, urine tests, etc.) for doctors' offices. Test specimens are picked up at the doctors' offices and are transported to the testing facility, with uniform arrivals throughout the day. All tests go through two testing centers in the testing facility, Test Center A and Test Center B. A has a current capacity of 1,000 units per week, and B is capable of 1,500 units per week. The facility operates 50 weeks per year. This year (year 0 ), test volumes are expected to reach 1,000 units per week. Growth is projected at an additional 200 units each week through year 5. Pre-tax profits are expected to be $6 per test throughout the 5year planning period. Two alternatives are being considered: a) Expand both Test Centers A and B at the end of year 0 to a capacity of 2,000 units per week, at a total cost for both Test Centers of $300,000; b) Expand Test Center A at the end of year 0 to 1,500 units per week, matching Test Center B, at a cost of $100,000, then expanding both Test Centers to 2,000 units per year at the end of year 3 , at an additional cost at that time of $250,000. NMC Labs will not consider projects that don't show a 5 th-year positive net present value using a discount rate of 15%. What are the pre-tax cash flows for the two alternatives compared to the base case of doing nothing for the next five years, and what action, if aty, should NMC take? Answer: Alternative \#1 Net Present Value: Alternative \$2 Net Present Value: Alternative \#1 \begin{tabular}{|} 0 \\ \hline \\ \hline \\ \hline \end{tabular} Alternative #2 0 1 2 3 4 5 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started