Question

Please solve in IFRS format. In 2016, assume Vacquero Toys spent 80,000 on research and 120,600 on development of a new rocking horse process. Of

Please solve in IFRS format.

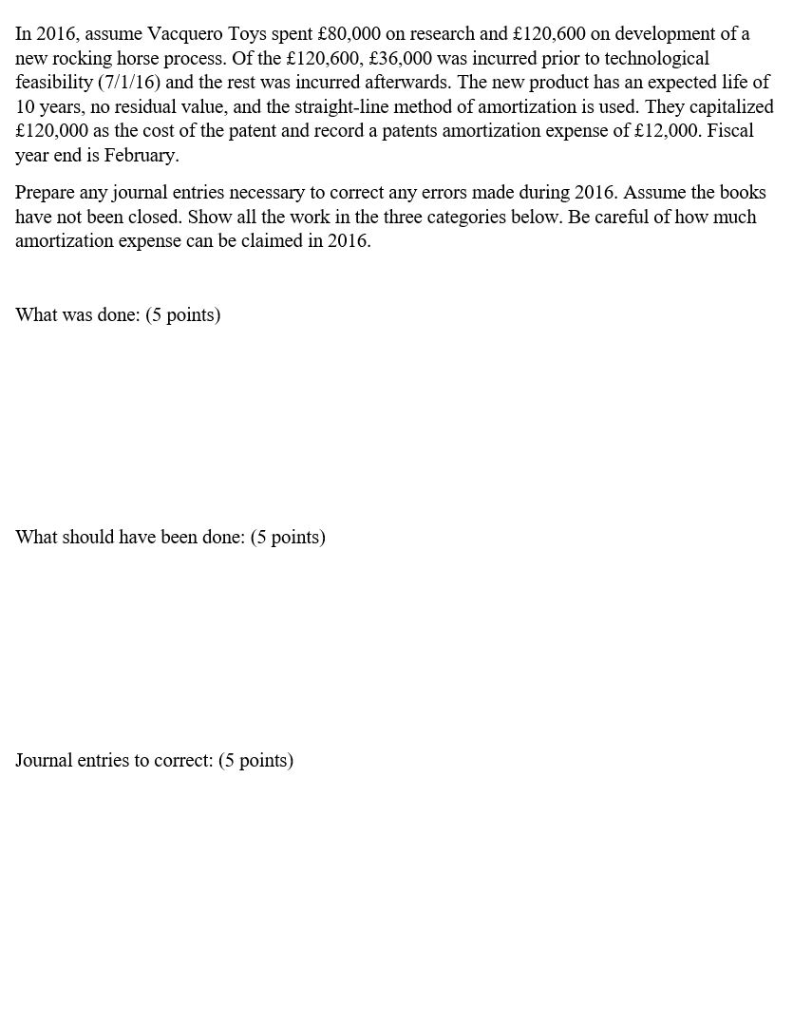

In 2016, assume Vacquero Toys spent 80,000 on research and 120,600 on development of a new rocking horse process. Of the 120,600, 36,000 was incurred prior to technological feasibility (7/1/16) and the rest was incurred afterwards. The new product has an expected life of 10 years, no residual value, and the straight-line method of amortization is used. They capitalized 120,000 as the cost of the patent and record a patents amortization expense of 12,000. Fiscal year end is February. Prepare any journal entries necessary to correct any errors made during 2016. Assume the books have not been closed. Show all the work in the three categories below. Be careful of how much amortization expense can be claimed in 2016.

Should look like:

1)

| Date | Account title | Debit | credit |

| a | Research and development expense | ||

| Patent | |||

| cash | |||

| [being research and development cost incurred] | |||

| b | Amortization expense | ||

| Accumulated amortization |

2)

| Date | Account title | Debit | credit |

| a | Research and development expense | ||

| Patent | |||

| cash | |||

| [being research and development cost incurred] | |||

| b | Amortization expense | ||

| Accumulated amortization |

3)

| Date | Account title | Debit | credit |

| a | Research and development expense | ||

| Patent | |||

| b | Accumulated amortization | ||

| Amortization expense |

In 2016, assume Vacquero Toys spent 80,000 on research and 120,600 on development of a new rocking horse process. Of the 120,600, 36,000 was incurred prior to technological feasibility (7/1/16) and the rest was incurred afterwards. The new product has an expected life of 10 years, no residual value, and the straight-line method of amortization is used. They capitalized 120,000 as the cost of the patent and record a patents amortization expense of 12,000. Fiscal year end is February Prepare any journal entries necessary to correct any errors made during 2016. Assume the books have not been closed. Show all the work in the three categories below. Be careful of how much amortization expense can be claimed in 2016. What was done: (5 points) What should have been done: (5 points) Journal entries to correct: (5 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started