please solve

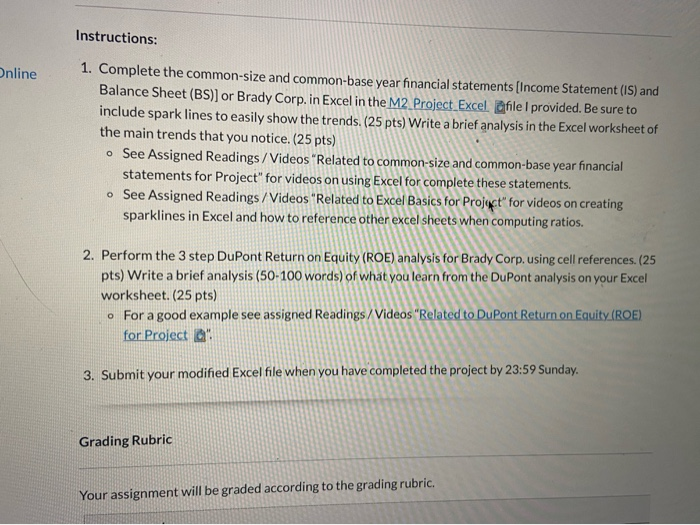

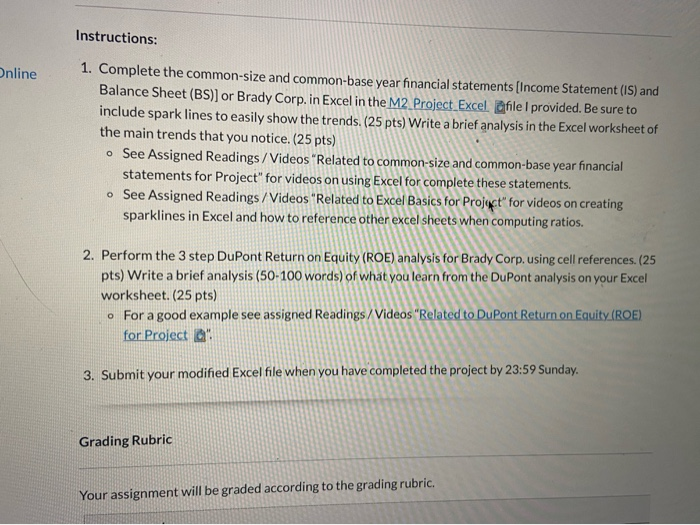

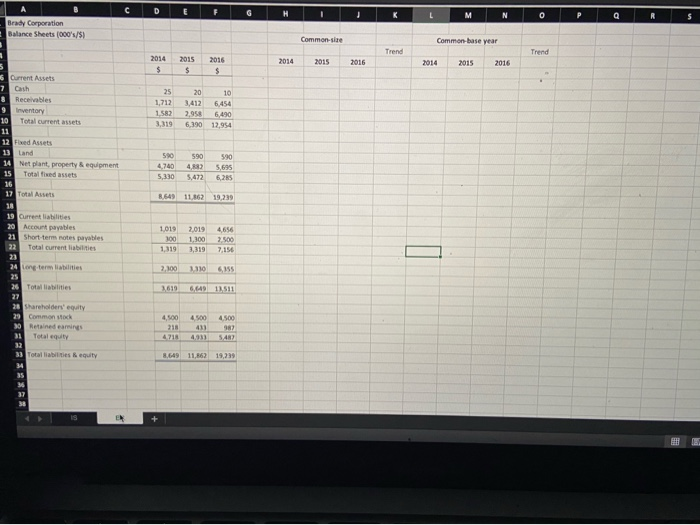

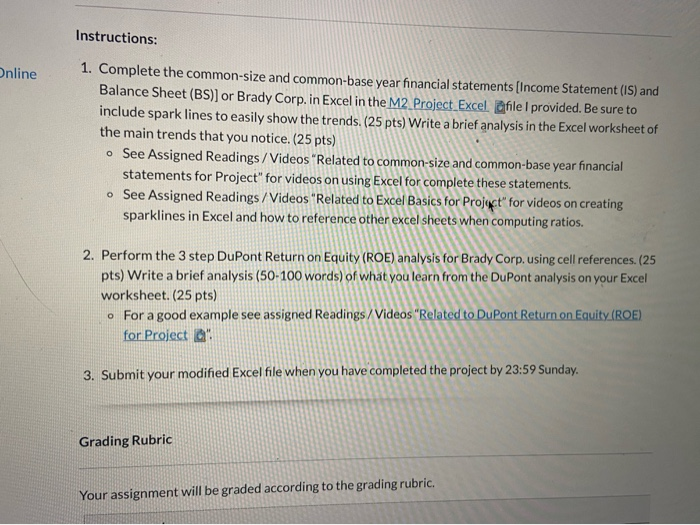

Instructions: Online 1. Complete the common-size and common-base year financial statements (Income Statement (IS) and Balance Sheet (BS)] or Brady Corp. in Excel in the M2 Project Excel. Ofile I provided. Be sure to include spark lines to easily show the trends. (25 pts) Write a brief analysis in the Excel worksheet of the main trends that you notice. (25 pts) o See Assigned Readings / Videos "Related to common-size and common-base year financial statements for Project" for videos on using Excel for complete these statements. See Assigned Readings / Videos "Related to Excel Basics for Project" for videos on creating sparklines in Excel and how to reference other excel sheets when computing ratios. 2. Perform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. (25 pts) Write a brief analysis (50-100 words) of what you learn from the DuPont analysis on your Excel worksheet. (25 pts) . For a good example see assigned Readings / Videos "Related to DuPont Return on Equity (ROE) for Project " 3. Submit your modified Excel file when you have completed the project by 23:59 Sunday. Grading Rubric Your assignment will be graded according to the grading rubric. D E F G H K L M N O Q R S Brady Corporation Balance Sheets (000's/5) Commonsi Commonbase year Trend Trend 2014 $ 2014 2015 $ 2016 $ 2015 2016 2014 2015 2016 25 1,712 1.582 3,319 20 10 3,412 6,454 2,958 6,490 6,390 12,954 590 Current Assets 7 Cash Receivables 9 Inventory Total current assets 11 12 Fred Assets 13 Land 14 Net plant, property & equipment 15 Totalfiwed assets 16 17 Total Assets 11 19 Current liabilities 20 Account payables 21 Short term notes payables 22 Total current liabilities 590 4,832 5,472 590 5,695 6,285 5,330 8,649 11.062 19,239 1.019 300 1,319 2,019 1,300 3,319 4,656 2.500 7,154 24 long-term liabilities 2,100 10 5155 1619 6.649 11511 26 Totallilities 27 28 Shareholders' equity 20 Cormon stock 30 Retained earnings 31 Total equity 12 33 Total abilities Requity 34 4,500 218 4718 4.500 433 4.983 4.500 987 5.482 8,649 11,862 19,239 Calibrl (Body) 11 VAA Wrap Text General Inse Hilili BIU Merge & Center IH $ %) 22 Dele Forn Conditional Format Cell Formatting as Table Styles 26 fx D E G H M Q R S Schedule One Brady Corporation Income Statements 1000/5) Common die Common-base year Trend Trend 2014 2015 2016 2014 2015 2016 2014 2015 $ $ 18,675 28,675 15.932 24,393 2,743 4.282 2016 $ 48,845 42,007 6,838 Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling 2 General Administrative 3 Total Operating Experves 4 Operating Profit s Interest Expense 16 Earnings Before Taxes 17 Taxes 38 Earnings Alter Taxes 1 251 1,090 2,341 402 210 192 67 125 1,851 1,590 1441 841 510 331 2,734 2,192 4,926 1,912 1.059 853 299 554 215 20 3 Step DuPont ROE Analysis 21 23 24 26 27 28 29 30 31 33 34 35 36 40 4 44 IS BS Instructions: Online 1. Complete the common-size and common-base year financial statements (Income Statement (IS) and Balance Sheet (BS)] or Brady Corp. in Excel in the M2 Project Excel. Ofile I provided. Be sure to include spark lines to easily show the trends. (25 pts) Write a brief analysis in the Excel worksheet of the main trends that you notice. (25 pts) o See Assigned Readings / Videos "Related to common-size and common-base year financial statements for Project" for videos on using Excel for complete these statements. See Assigned Readings / Videos "Related to Excel Basics for Project" for videos on creating sparklines in Excel and how to reference other excel sheets when computing ratios. 2. Perform the 3 step DuPont Return on Equity (ROE) analysis for Brady Corp. using cell references. (25 pts) Write a brief analysis (50-100 words) of what you learn from the DuPont analysis on your Excel worksheet. (25 pts) . For a good example see assigned Readings / Videos "Related to DuPont Return on Equity (ROE) for Project " 3. Submit your modified Excel file when you have completed the project by 23:59 Sunday. Grading Rubric Your assignment will be graded according to the grading rubric. D E F G H K L M N O Q R S Brady Corporation Balance Sheets (000's/5) Commonsi Commonbase year Trend Trend 2014 $ 2014 2015 $ 2016 $ 2015 2016 2014 2015 2016 25 1,712 1.582 3,319 20 10 3,412 6,454 2,958 6,490 6,390 12,954 590 Current Assets 7 Cash Receivables 9 Inventory Total current assets 11 12 Fred Assets 13 Land 14 Net plant, property & equipment 15 Totalfiwed assets 16 17 Total Assets 11 19 Current liabilities 20 Account payables 21 Short term notes payables 22 Total current liabilities 590 4,832 5,472 590 5,695 6,285 5,330 8,649 11.062 19,239 1.019 300 1,319 2,019 1,300 3,319 4,656 2.500 7,154 24 long-term liabilities 2,100 10 5155 1619 6.649 11511 26 Totallilities 27 28 Shareholders' equity 20 Cormon stock 30 Retained earnings 31 Total equity 12 33 Total abilities Requity 34 4,500 218 4718 4.500 433 4.983 4.500 987 5.482 8,649 11,862 19,239 Calibrl (Body) 11 VAA Wrap Text General Inse Hilili BIU Merge & Center IH $ %) 22 Dele Forn Conditional Format Cell Formatting as Table Styles 26 fx D E G H M Q R S Schedule One Brady Corporation Income Statements 1000/5) Common die Common-base year Trend Trend 2014 2015 2016 2014 2015 2016 2014 2015 $ $ 18,675 28,675 15.932 24,393 2,743 4.282 2016 $ 48,845 42,007 6,838 Revenue Cost of Goods Sold Gross Profit Operating Expenses Selling 2 General Administrative 3 Total Operating Experves 4 Operating Profit s Interest Expense 16 Earnings Before Taxes 17 Taxes 38 Earnings Alter Taxes 1 251 1,090 2,341 402 210 192 67 125 1,851 1,590 1441 841 510 331 2,734 2,192 4,926 1,912 1.059 853 299 554 215 20 3 Step DuPont ROE Analysis 21 23 24 26 27 28 29 30 31 33 34 35 36 40 4 44 IS BS