Please solve it and show me your steps?

These is a numbe in question which is not clear 1250000$

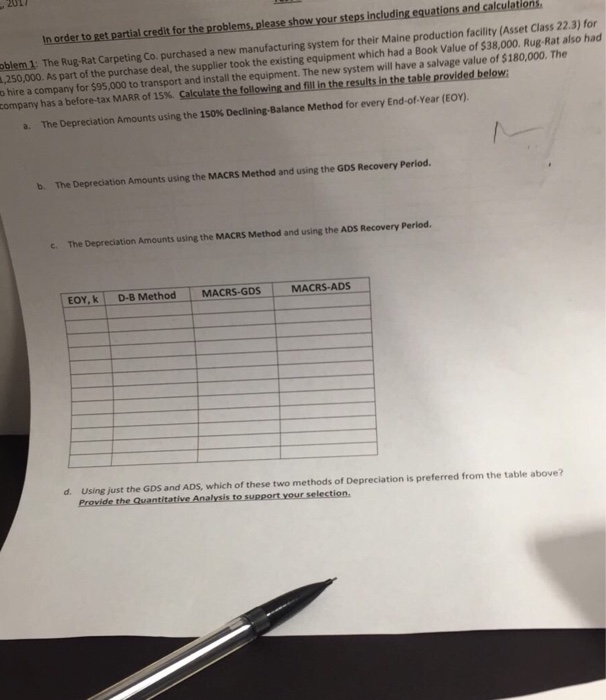

,250,000. steps including equations and of (Asset class 22.3 for Rat also had $180,000. The Rug In order to get partial credit for the problems, please show your calculatons, The Rug Rat Carpeting Co. purchased a new manufacturing for their Maine production facility As part of the purchase deal, the supplier took the equipment which had a Book of $38,000. hire a company for $95,000 to transport and install the equipment. The new system will have a salvage value company has a before-tax MARR of 15%. Calculate the following and fi resultsin the table provided below a. The Depreciation Amounts using the 150% Declining Balance Method for every End-of-year (Eon. b. The Depreciation Amounts using the MACRS Method and using the GDs Recovery Period. c The Depreciation using the MACRS Method and using the ADs Recovery period, Amounts EoY,k D-B Method MACRS-GDS. MACRS-ADS d. Using just the GDs and ADs, which of these two methods of Depreciation is preferred from the table above? Provide the Quantitative Analysis to support your selection. ,250,000. steps including equations and of (Asset class 22.3 for Rat also had $180,000. The Rug In order to get partial credit for the problems, please show your calculatons, The Rug Rat Carpeting Co. purchased a new manufacturing for their Maine production facility As part of the purchase deal, the supplier took the equipment which had a Book of $38,000. hire a company for $95,000 to transport and install the equipment. The new system will have a salvage value company has a before-tax MARR of 15%. Calculate the following and fi resultsin the table provided below a. The Depreciation Amounts using the 150% Declining Balance Method for every End-of-year (Eon. b. The Depreciation Amounts using the MACRS Method and using the GDs Recovery Period. c The Depreciation using the MACRS Method and using the ADs Recovery period, Amounts EoY,k D-B Method MACRS-GDS. MACRS-ADS d. Using just the GDs and ADs, which of these two methods of Depreciation is preferred from the table above? Provide the Quantitative Analysis to support your selection