Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it fast and i have done first 4 requirements remaining all solve it please i have not much time to post it again

please solve it fast and i have done first 4 requirements remaining all solve it please i have not much time to post it again

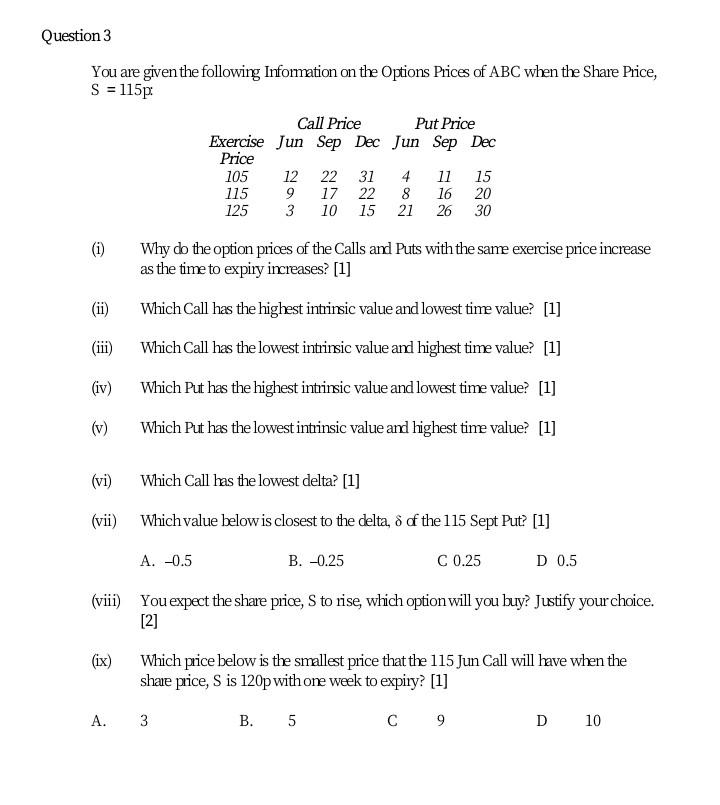

Question 3 You are given the following Information on the Options Prices of ABC when the Share Price, S = 115p Call Price Put Price Exercise Jun Sep Dec Jun Sep Dec Price 105 12 22 31 4 11 15 115 9 17 22 8 16 20 125 3 10 15 21 26 30 (i) (ii) (iii) Why do the option prices of the Calls and Puts with the same exercise price increase as the time to expiry increases? [1] Which Call has the highest intrinsic value and lowest time value? [1] Which Call has the lowest intrinsic value and highest time value? [1] Which Put has the highest intrinsic value and lowest time value? [1] Which Put has the lowest intrinsic value and highest time value? [1] (iv) (vi) Which Call has the lowest delta? [1] (vii) Which value below is closest to the delta, o of the 115 Sept Put? [1] A. -0.5 B. -0.25 C 0.25 D 0.5 (viii) You expect the share price, S to rise, which option will you buy? Justify your choice. [2] (ix) Which price below is the smallest price that the 115 Jun Call will have when the share price, S is 120p with one week to expiry? [1] A. 3 B.5 C 9 D 10

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started