Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it for me is about cash budget Question 1(a) Cash Budget Simone Limited distributes specialist wines on wholesale basis to its customers. Some

please solve it for me

is about cash budget

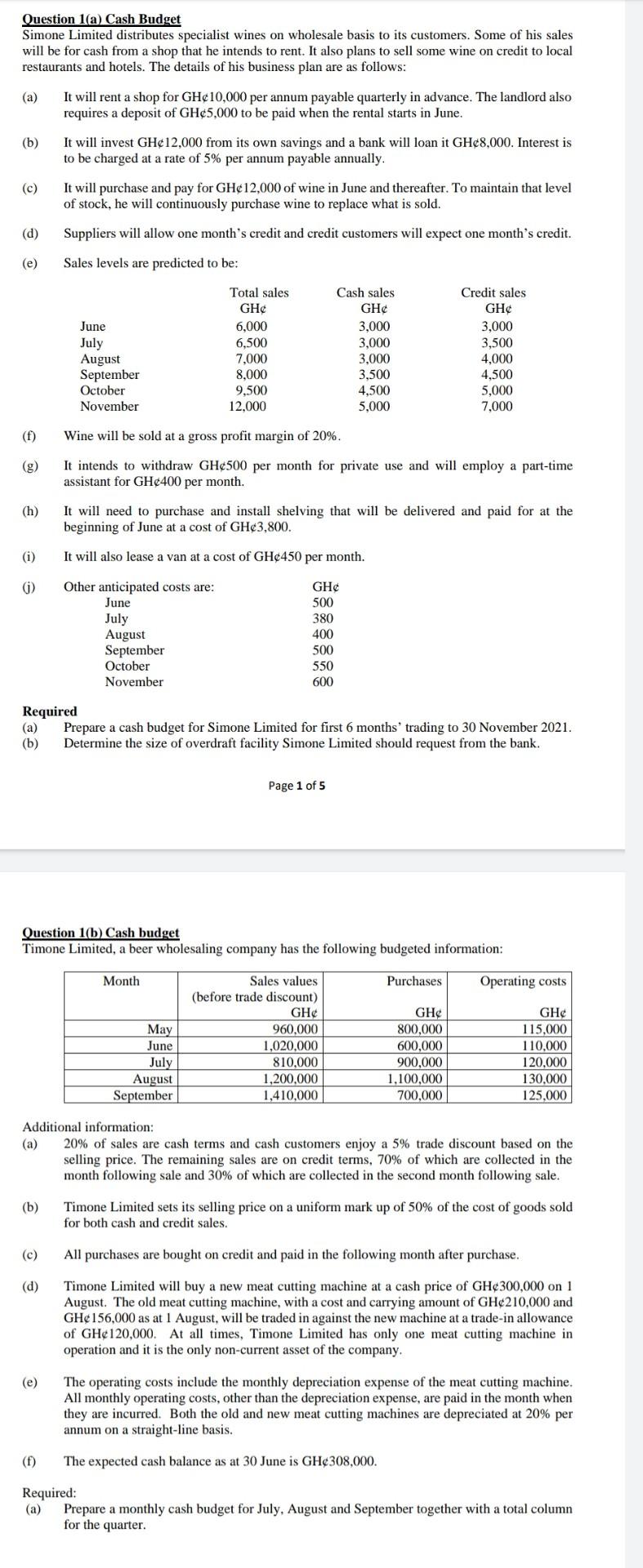

Question 1(a) Cash Budget Simone Limited distributes specialist wines on wholesale basis to its customers. Some of his sales will be for cash from a shop that he intends to rent. It also plans to sell some wine on credit to local restaurants and hotels. The details of his business plan are as follows: (a) It will rent a shop for GH10,000 per annum payable quarterly in advance. The landlord also requires a deposit of GH5,000 to be paid when the rental starts in June. (b) (c) It will invest GH12,000 from its own savings and a bank will loan it GH8,000. Interest is to be charged at a rate of 5% per annum payable annually. It will purchase and pay for GH12,000 of wine in June and thereafter. To maintain that level of stock, he will continuously purchase wine to replace what is sold. Suppliers will allow one month's credit and credit customers will expect one month's credit. Sales levels are predicted to be: (d) (e) June July August September October November Total sales GH 6,000 6,500 7,000 8,000 9,500 12,000 Cash sales GH 3,000 3,000 3,000 3,500 4,500 Credit sales GH 3,000 3,500 4,000 4,500 5,000 7,000 5,000 (f) Wine will be sold at a gross profit margin of 20%. It intends to withdraw GH500 per month for private use and will employ a part-time assistant for GH400 per month. It will need to purchase and install shelving that will be delivered and paid for at the beginning of June at a cost of GH3,800. (h) (i) It will also lease a van at a cost of GH450 per month. (1) Other anticipated costs are: June July August September October November GHC 500 380 400 500 550 600 Required (a) Prepare a cash budget for Simone Limited for first 6 months' trading to 30 November 2021. (b) Determine the size of overdraft facility Simone Limited should request from the bank. Page 1 of 5 Question 1(b) Cash budget Timone Limited, a beer wholesaling company has the following budgeted information: Month Purchases Operating costs May June July August September Sales values (before trade discount) GHC 960,000 1,020,000 810,000 1,200,000 1,410,000 GH 800,000 600,000 900,000 1.100.000 700,000 GH 115,000 110,000 120,000 130.000 125,000 Additional information: (a) 20% of sales are cash terms and cash customers enjoy a 5% trade discount based on the selling price. The remaining sales are on credit terms, 70% of which are collected in the month following sale and 30% of which are collected in the second month following sale. (b) Timone Limited sets its selling price on a uniform mark up of 50% of the cost of goods sold for both cash and credit sales. (c) All purchases are bought on credit and paid in the following month after purchase. (d) Timone Limited will buy a new meat cutting machine at a cash price of GH300,000 on 1 August. The old meat cutting machine, with a cost and carrying amount of GH210,000 and GH156,000 as at 1 August, will be traded in against the new machine at a trade-in allowance of GH120,000. At all times, Timone Limited has only one meat cutting machine in operation and it is the only non-current asset of the company. (e) The operating costs include the monthly depreciation expense of the meat cutting machine. All monthly operating costs, other than the depreciation expense, are paid in the month when they are incurred. Both the old and new meat cutting machines are depreciated at 20% per annum on a straight-line basis. (f) The expected cash balance as at 30 June is GH308,000. Required: (a) Prepare a monthly cash budget for July, August and September together with a total column for the quarterStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started