Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it handwritten showing all steps without using excel sheet. use AEC analysis ; AEC= CR+OC annual equivalent cost = AEC ; capital recovery

please solve it handwritten showing all steps without using excel sheet.

please solve it handwritten showing all steps without using excel sheet.

use AEC analysis ; AEC= CR+OC

annual equivalent cost = AEC ; capital recovery = CR ; operating cots =OC

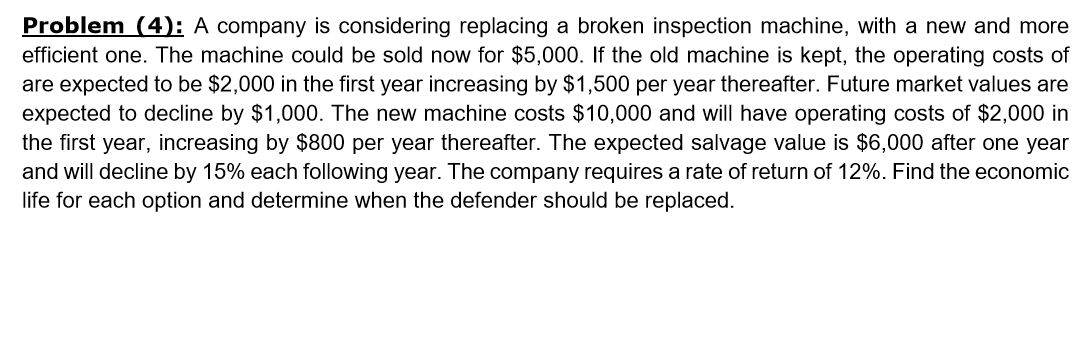

Problem (4: A company is considering replacing a broken inspection machine, with a new and more efficient one. The machine could be sold now for $5,000. If the old machine is kept, the operating costs of are expected to be $2,000 in the first year increasing by $1,500 per year thereafter. Future market values are expected to decline by $1,000. The new machine costs $10,000 and will have operating costs of $2,000 in the first year, increasing by $800 per year thereafter. The expected salvage value is $6,000 after one year and will decline by 15% each following year. The company requires a rate of return of 12%. Find the economic life for each option and determine when the defender should be replaced. Problem (4: A company is considering replacing a broken inspection machine, with a new and more efficient one. The machine could be sold now for $5,000. If the old machine is kept, the operating costs of are expected to be $2,000 in the first year increasing by $1,500 per year thereafter. Future market values are expected to decline by $1,000. The new machine costs $10,000 and will have operating costs of $2,000 in the first year, increasing by $800 per year thereafter. The expected salvage value is $6,000 after one year and will decline by 15% each following year. The company requires a rate of return of 12%. Find the economic life for each option and determine when the defender should be replacedStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started