please solve it if you are 100 percent sure

please solve it if you are 100 percent sure

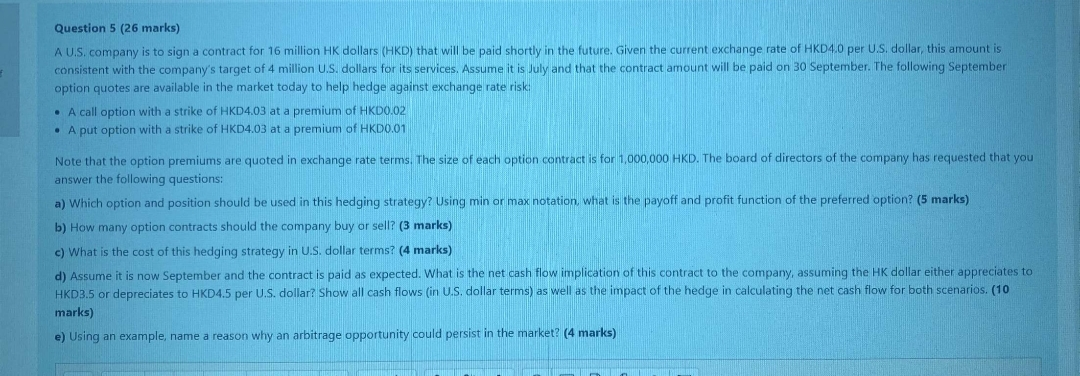

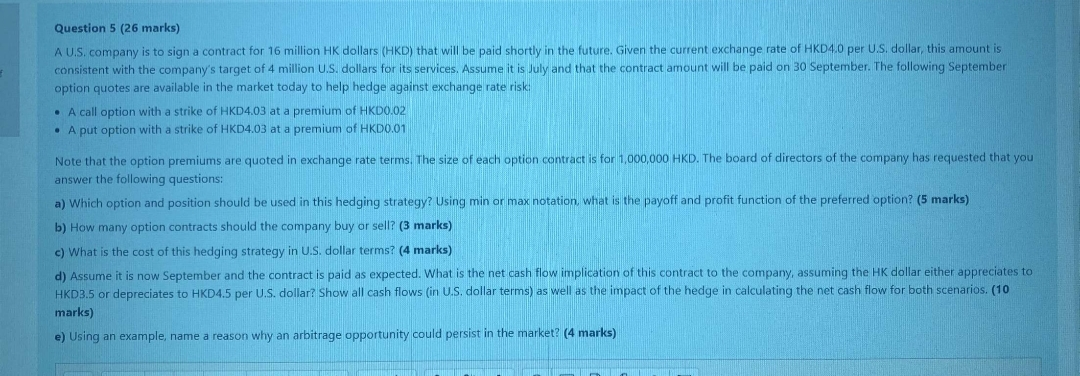

Question 5 (26 marks) A U.S. company is to sign a contract for 16 million HK dollars (HKD) that will be paid shortly in the future. Given the current exchange rate of HKD4.0 per U.S. dollar, this amount is consistent with the company's target of 4 million U.S. dollars for its services. Assume it is July and that the contract amount will be paid on 30 September. The following September option quotes are available in the market today to help hedge against exchange rate risk A call option with a strike of HKD4.03 at a premium of HKD0.02 A put option with a strike of HKD4.03 at a premium of HKD0.01 Note that the option premiums are quoted in exchange rate terms. The size of each option contract is for 1,000,000 HKD. The board of directors of the company has requested that you answer the following questions: a) Which option and position should be used in this hedging strategy? Using min or max notation, what is the payoff and profit function of the preferred option? (5 marks) b) How many option contracts should the company buy or sell? (3 marks) c) What is the cost of this hedging strategy in U.S. dollar terms? (4 marks) d) Assume it is now September and the contract is paid as expected. What is the net cash flow implication of this contract to the company, assuming the HK dollar either appreciates to HKD3.5 or depreciates to HKD4.5 per U.S. dollar? Show all cash flows (in U.S. dollar terms) as well as the impact of the hedge in calculating the net cash flow for both scenarios. (10 marks) e) Using an example, name a reason why an arbitrage opportunity could persist in the market? (4 marks) Question 5 (26 marks) A U.S. company is to sign a contract for 16 million HK dollars (HKD) that will be paid shortly in the future. Given the current exchange rate of HKD4.0 per U.S. dollar, this amount is consistent with the company's target of 4 million U.S. dollars for its services. Assume it is July and that the contract amount will be paid on 30 September. The following September option quotes are available in the market today to help hedge against exchange rate risk A call option with a strike of HKD4.03 at a premium of HKD0.02 A put option with a strike of HKD4.03 at a premium of HKD0.01 Note that the option premiums are quoted in exchange rate terms. The size of each option contract is for 1,000,000 HKD. The board of directors of the company has requested that you answer the following questions: a) Which option and position should be used in this hedging strategy? Using min or max notation, what is the payoff and profit function of the preferred option? (5 marks) b) How many option contracts should the company buy or sell? (3 marks) c) What is the cost of this hedging strategy in U.S. dollar terms? (4 marks) d) Assume it is now September and the contract is paid as expected. What is the net cash flow implication of this contract to the company, assuming the HK dollar either appreciates to HKD3.5 or depreciates to HKD4.5 per U.S. dollar? Show all cash flows (in U.S. dollar terms) as well as the impact of the hedge in calculating the net cash flow for both scenarios. (10 marks) e) Using an example, name a reason why an arbitrage opportunity could persist in the market? (4 marks)

please solve it if you are 100 percent sure

please solve it if you are 100 percent sure