Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it in 10 mins I will thumb you up please I have 10 mins only Question 30 lon will save this res 5

please solve it in 10 mins I will thumb you up please I have 10 mins only

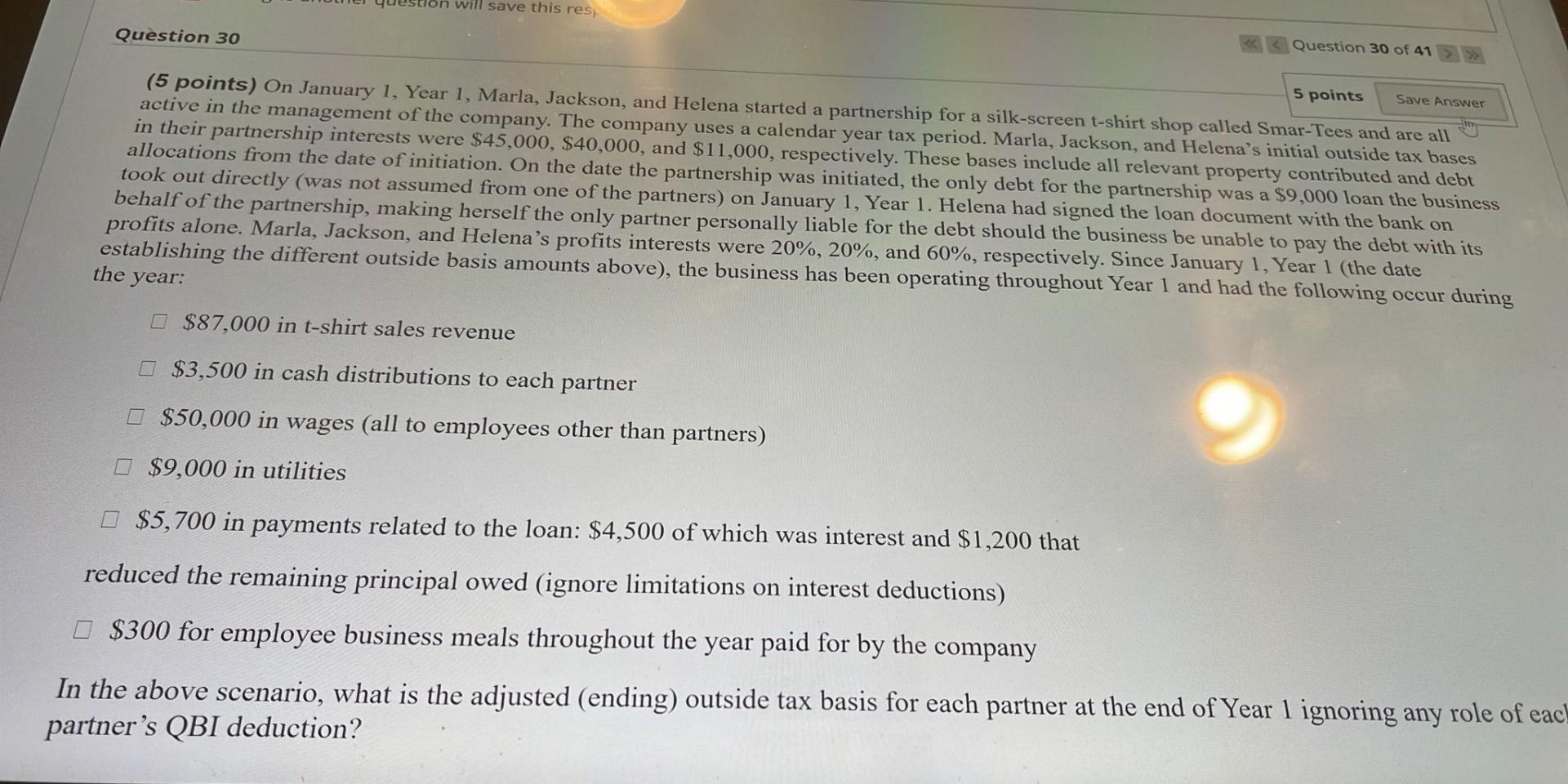

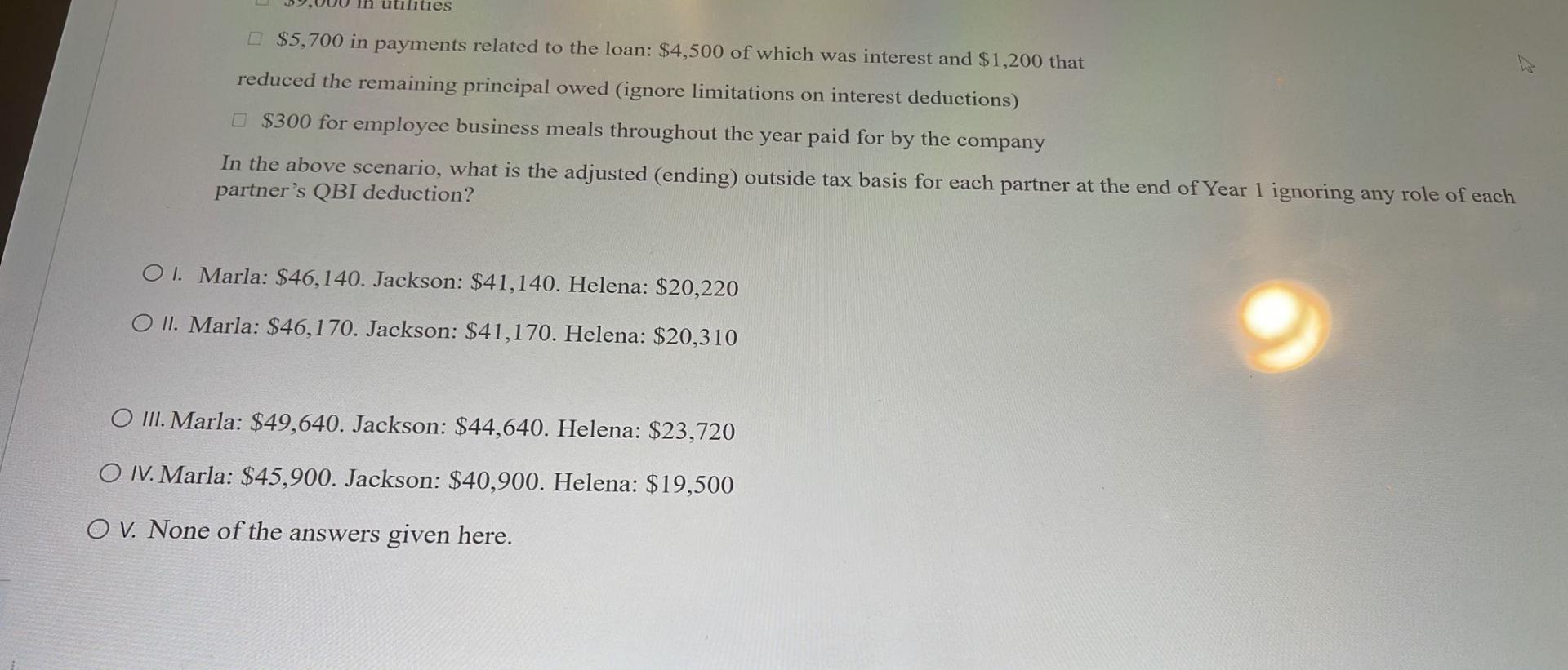

Question 30 lon will save this res 5 points Save Answer (5 points) On January 1, Year 1, Marla, Jackson, and Helena started a partnership for a silk-screen t-shirt shop called Smar-Tees and are all active in the management of the company. The company uses a calendar year tax period. Marla, Jackson, and Helena's initial outside tax bases in their partnership interests were $45,000, $40,000, and $11,000, respectively. These bases include all relevant property contributed and debt allocations from the date of initiation. On the date the partnership was initiated, the only debt for the partnership was a $9,000 loan the business took out directly (was not assumed from one of the partners) on January 1, Year 1. Helena had signed the loan document with the bank on behalf of the partnership, making herself the only partner personally liable for the debt should the business be unable to pay the debt with its profits alone. Marla, Jackson, and Helena's profits interests were 20%, 20%, and 60%, respectively. Since January 1, Year 1 (the date establishing the different outside basis amounts above), the business has been operating throughout Year 1 and had the following occur during the year: $87,000 in t-shirt sales revenue $3,500 in cash distributions to each partner $50,000 in wages (all to employees other than partners) $9,000 in utilities Question 30 of 41 $5,700 in payments related to the loan: $4,500 of which was interest and $1,200 that reduced the remaining principal owed (ignore limitations on interest deductions) $300 for employee business meals throughout the year paid for by the company In the above scenario, what is the adjusted (ending) outside tax basis for each partner at the end of Year 1 ignoring any role of each partner's QBI deduction? ilities $5,700 in payments related to the loan: $4,500 of which was interest and $1,200 that reduced the remaining principal owed (ignore limitations on interest deductions) $300 for employee business meals throughout the year paid for by the company In the above scenario, what is the adjusted (ending) outside tax basis for each partner at the end of Year 1 ignoring any role of each partner's QBI deduction? OI. Marla: $46,140. Jackson: $41,140. Helena: $20,220 O II. Marla: $46,170. Jackson: $41,170. Helena: $20,310 O III. Marla: $49,640. Jackson: $44,640. Helena: $23,720 O IV. Marla: $45,900. Jackson: $40,900. Helena: $19,500 OV. None of the answers given here

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started