Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve it in 30 minutes ch 18, 2022 (in 99 days). Panel A: S&P 500 index: S&P 500 index 4,687.94 0.70% Level Risk-free rate

Please solve it in 30 minutes

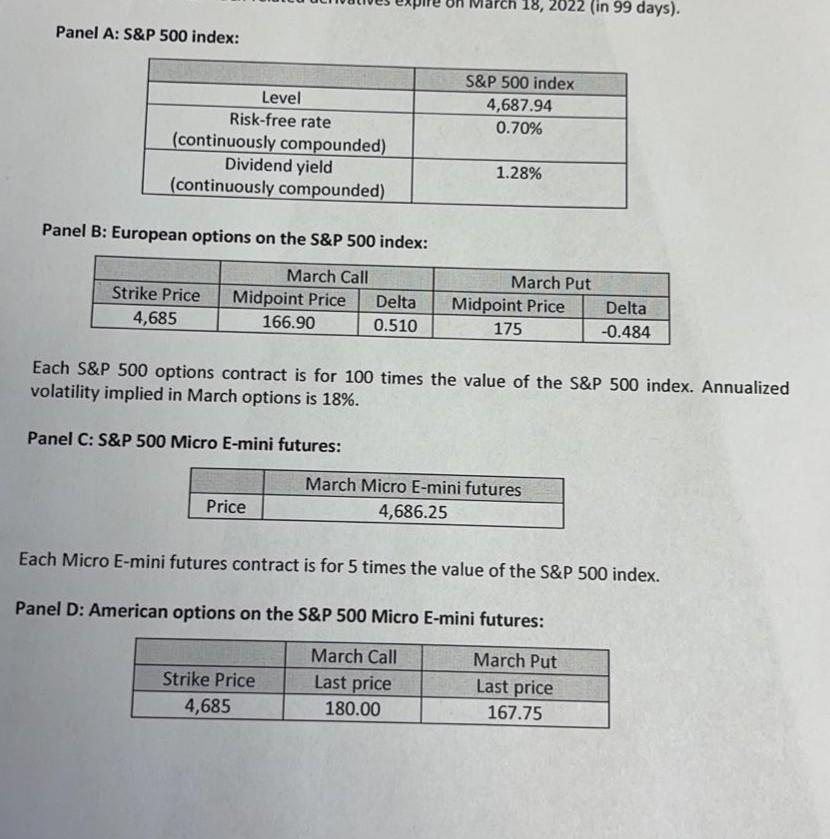

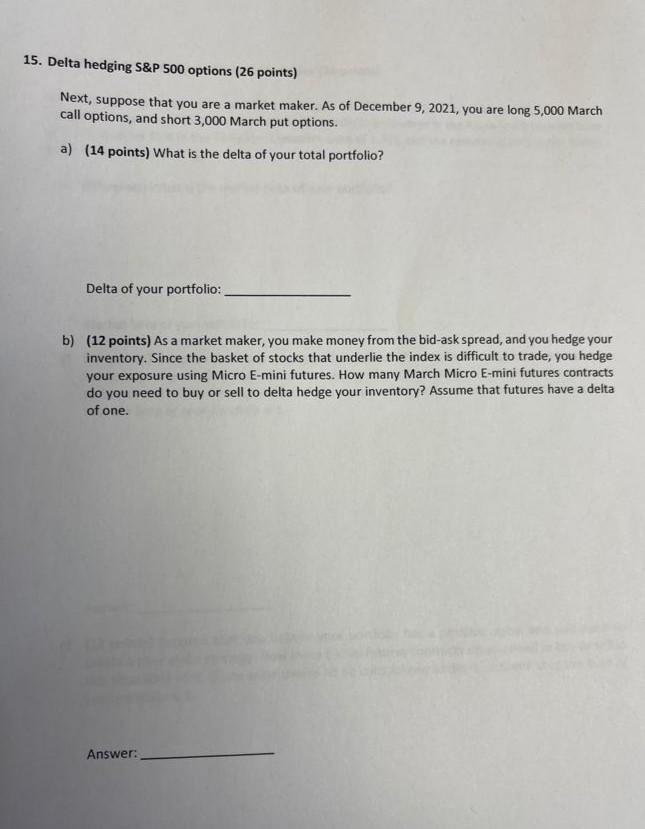

ch 18, 2022 (in 99 days). Panel A: S&P 500 index: S&P 500 index 4,687.94 0.70% Level Risk-free rate (continuously compounded) Dividend yield (continuously compounded) 1.28% Panel B: European options on the S&P 500 index: Strike Price 4,685 March Call Midpoint Price Delta 166.90 0.510 March Put Midpoint Price 175 Delta -0.484 Each S&P 500 options contract is for 100 times the value of the S&P 500 index. Annualized volatility implied in March options is 18%. Panel C: S&P 500 Micro E-mini futures: Price March Micro E-mini futures 4,686.25 Each Micro E-mini futures contract is for 5 times the value of the S&P 500 index. Panel D: American options on the S&P 500 Micro E-mini futures: Strike Price 4,685 March Call Last price 180.00 March Put Last price 167.75 15. Delta hedging S&P 500 options (26 points) Next, suppose that you are a market maker. As of December 9, 2021, you are long 5,000 March call options, and short 3,000 March put options. a) (14 points) What is the delta of your total portfolio? Delta of your portfolio: b) (12 points) As a market maker, you make money from the bid-ask spread, and you hedge your inventory. Since the basket of stocks that underlie the index is difficult to trade, you hedge your exposure using Micro E-mini futures. How many March Micro E-mini futures contracts do you need to buy or sell to delta hedge your inventory? Assume that futures have a delta of oneStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started