please solve it

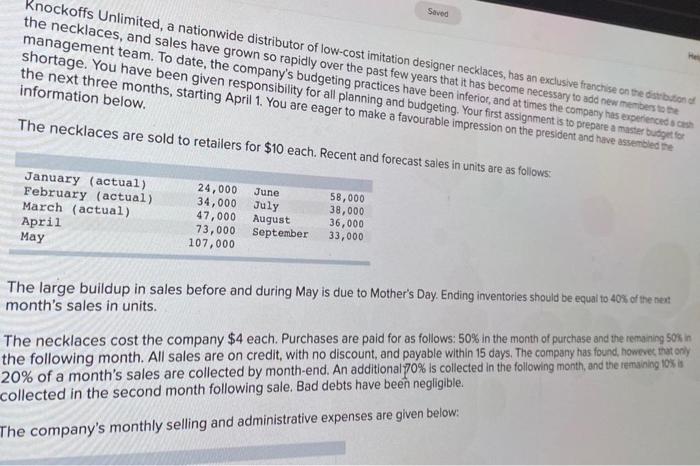

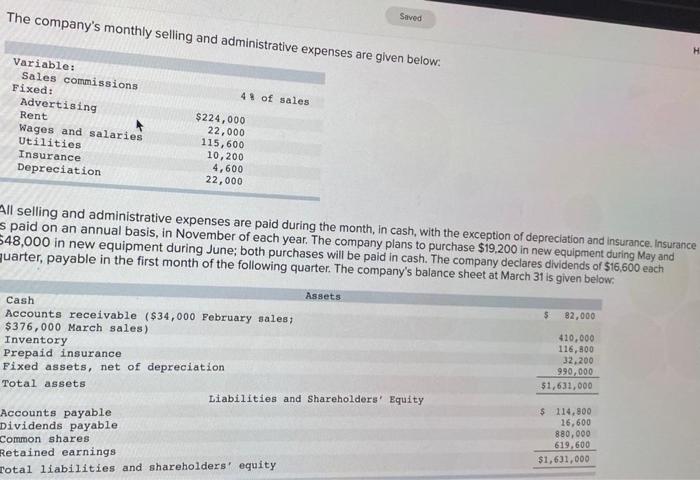

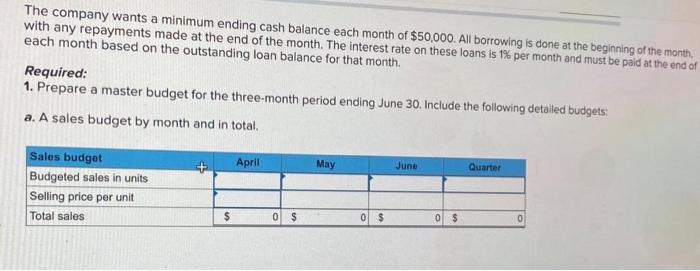

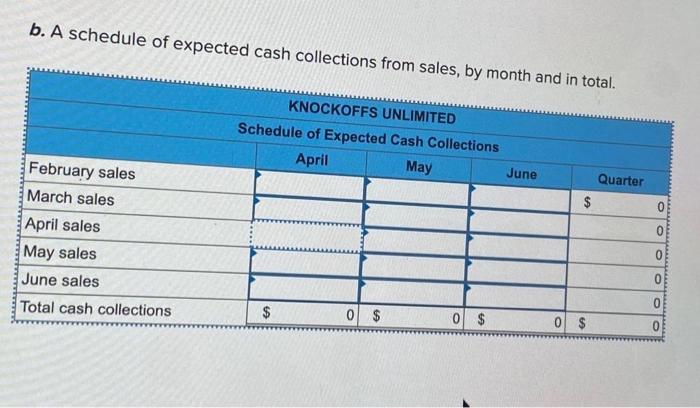

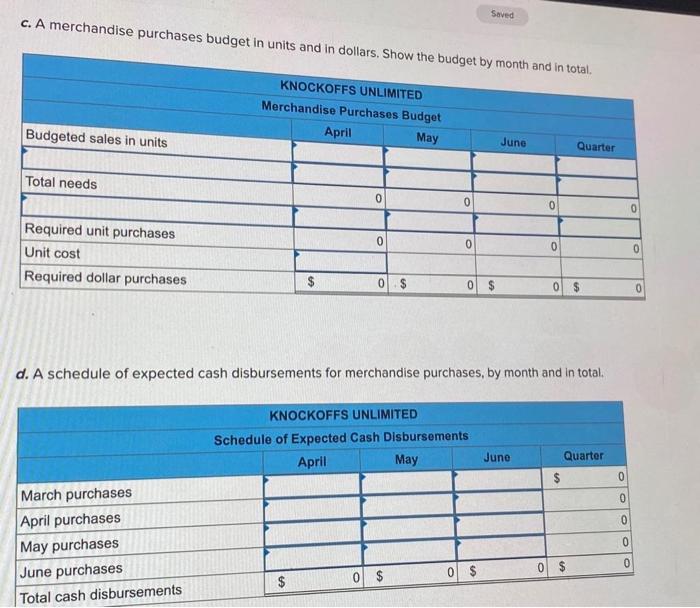

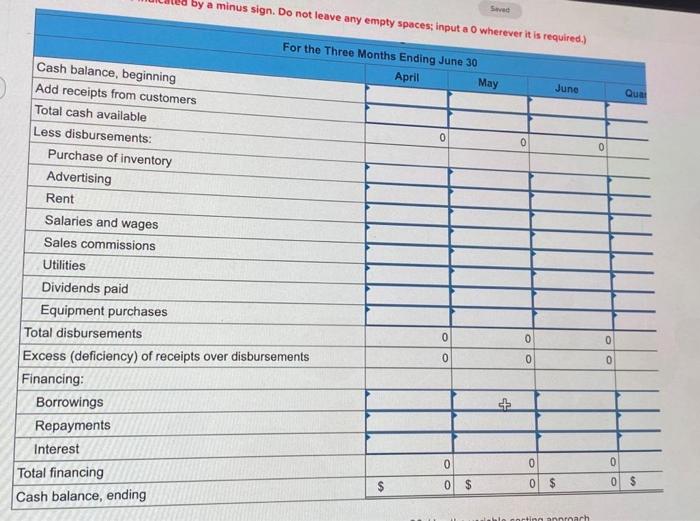

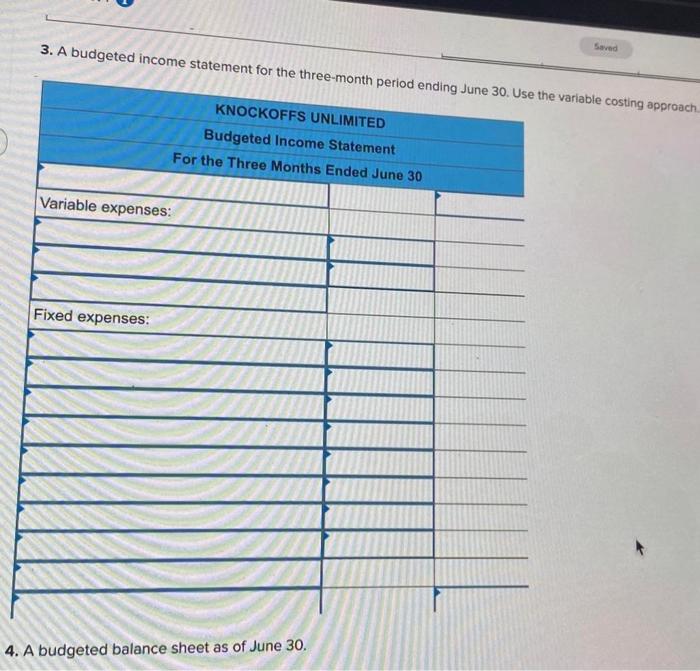

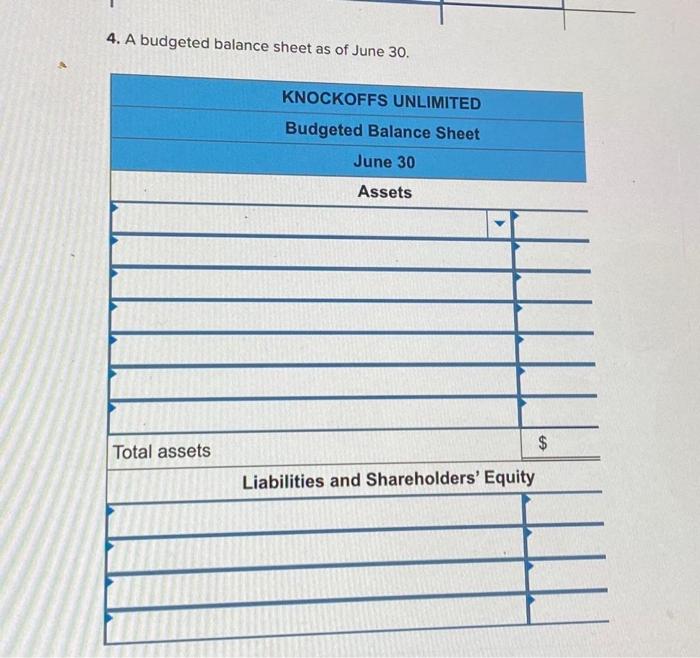

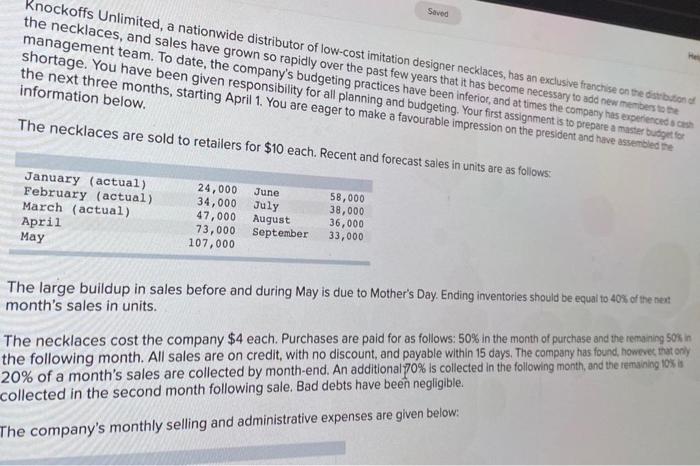

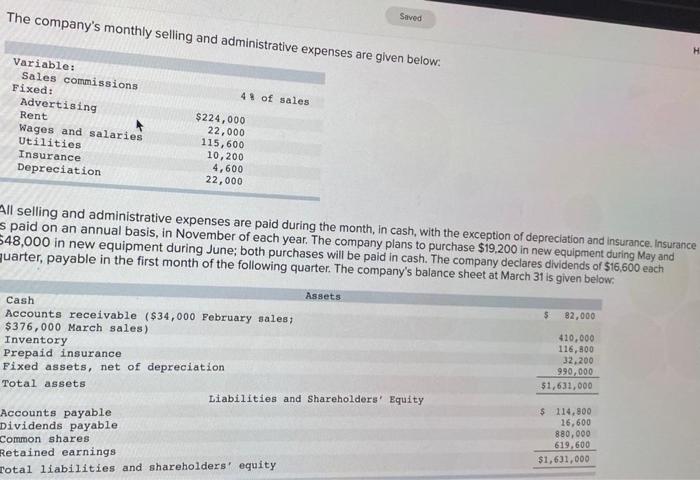

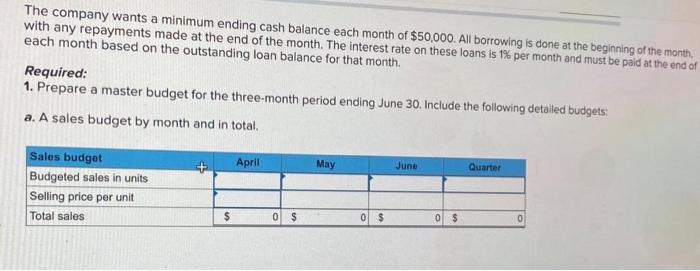

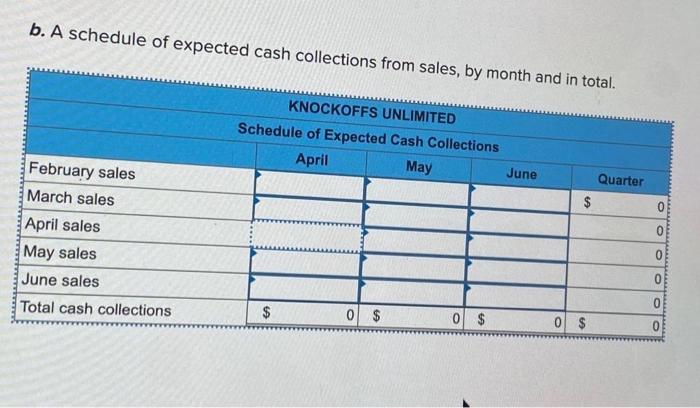

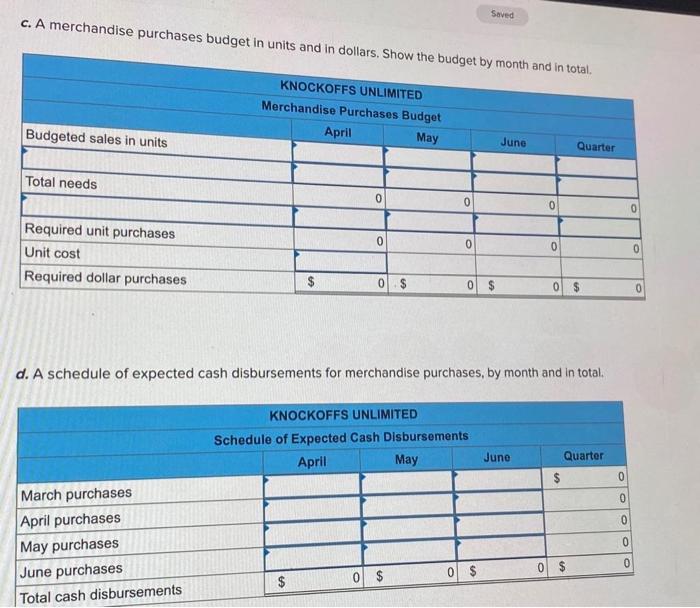

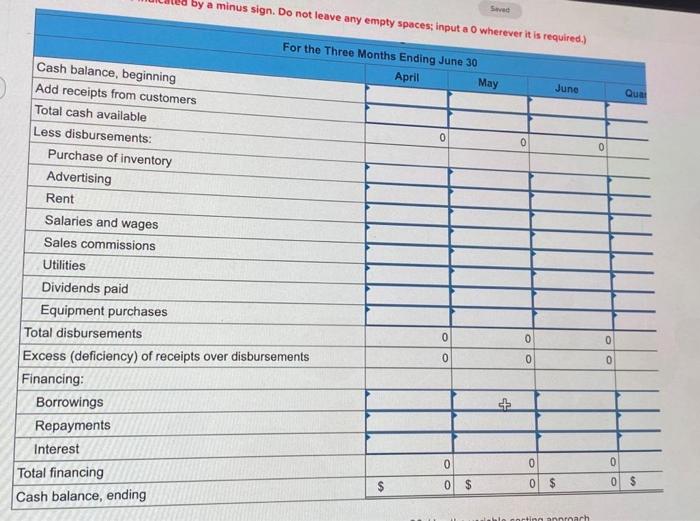

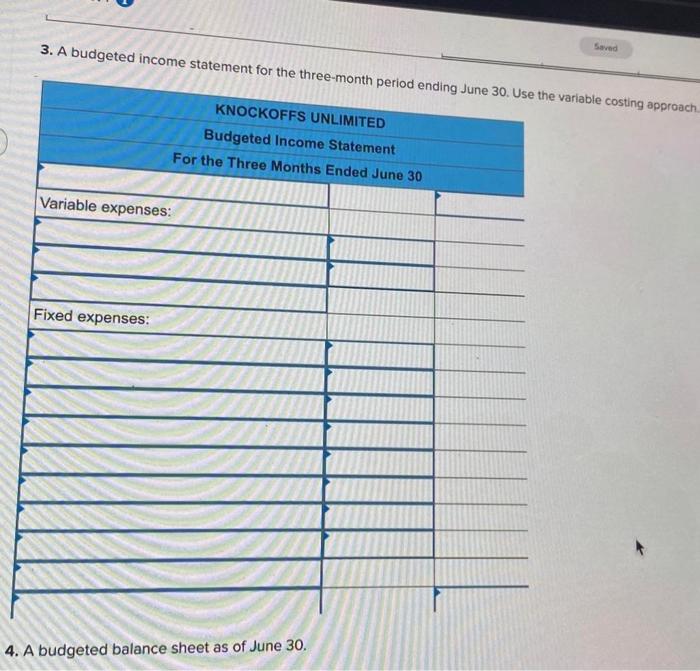

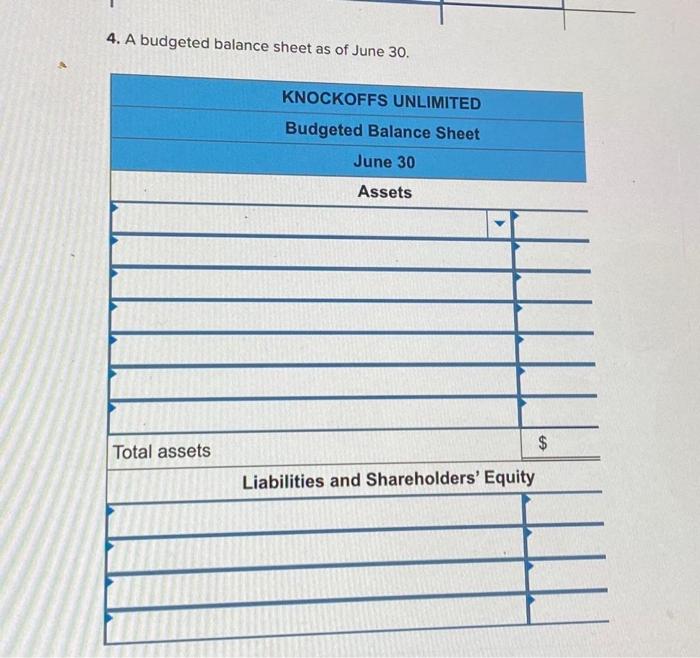

Knockoffs Unlimited, a nationwide distributor of low-cost imitation designer necklaces, has an exclusve franchise on re dsibs sot orecast sales in units are as follows: The large buildup in sales before and during May is due to Mother's Day. Ending inventories should be equal to 40% of the net: month's sales in units. The necklaces cost the company $4 each. Purchases are paid for as follows: 50% in the month of purchase and the remaning 50 in the following month. All sales are on credit, with no discount, and payable within 15 days. The company has found homere rat oney 20% of a month's sales are collected by month-end. An additional70\% is collected in the following month, and the remuining 105 is collected in the second month following sale. Bad debts have been negligible. The company's monthly selling and administrative expenses are given below: The company's monthly sellinn and All selling and administrative expenses are paid during the month, in cash, with the exception of depreciation and insurance. Insurance S paid on an annual basis, in November of each year. The company plans to purchase $19.200 in new equipment during May and $4,000 in new equipment during June; both purchases will be paid in cash. The company declares dividends of $16,600 each parter, payable in the first month of the following quarter. The company's balance sheet at March 31 is given below; The company wants a minimum ending cash balance each month of $50,000. All borrowing is done at the beginning of the month. with any repayments made at the end of the month. The interest rate on these loans is 1% per month and must be paid at the end of each month based on the outstanding loan balance for that month. Required: 1. Prepare a master budget for the three-month period ending June 30 . Include the following detailed budgets: a. A sales budget by month and in total. b. A schedule of expected cash collections from sales, by month and in .... c. A merchandise purchases budget in units and in dollars. Show the budaet hu d. A schedule of expected cash disbursements for merchandise purchases, by month and in total. by a minus sign. Do not leava Sisut? 3. A budgeted income statement for thn le variable costing approach 4. A budgeted balance sheet as of June 30 . 4. A budgeted balance sheet as of June 30