Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve it Question 3 [30 points] Weber Inc. is just finishing another year of operations. The company's unadjusted trial balance at August 31, 2014

please solve it

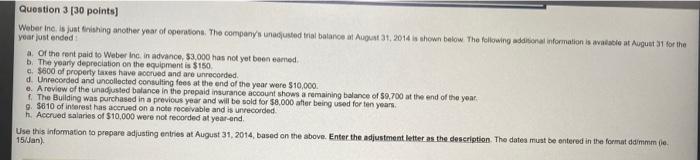

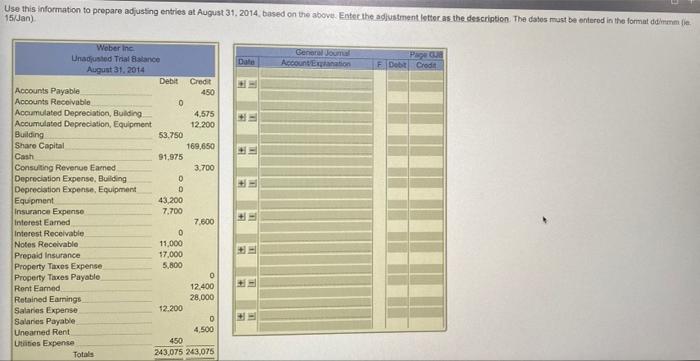

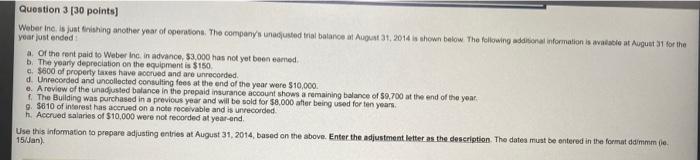

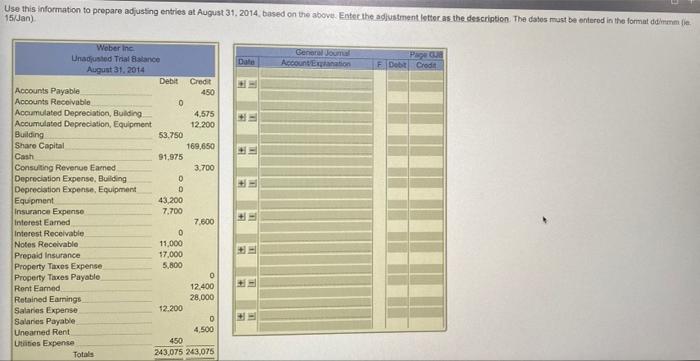

Question 3 [30 points] Weber Inc. is just finishing another year of operations. The company's unadjusted trial balance at August 31, 2014 is shown below The following additional information is available at August 31 for the year just ended a. Of the rent paid to Weber Inc., in advance, $3,000 has not yet been earned. b. The yearly depreciation on the equipment is $150. c. $600 of property taxes have accrued and are unrecorded. d. Unrecorded and uncollected consulting fees at the end of the year were $10,000 e. A review of the unadjusted balance in the prepaid insurance account shows a remaining balance of $9,700 at the end of the year. f. The Building was purchased in a previous year and will be sold for $8,000 after being used for ten years. g. $610 of interest has accrued on a note receivable and is unrecorded. h. Accrued salaries of $10,000 were not recorded at year-end. Use this information to prepare adjusting entries at August 31, 2014, based on the above. Enter the adjustment letter as the description. The dates must be entered in the format ddimmm (e. 15/Jan) Use this information to prepare adjusting entries at August 31, 2014, based on the above. Enter the adjustment letter as the description. The dates must be entered in the format ddimmm(le 15/Jan) Weber Inc. Unadjusted Trial Balance August 31, 2014 General Journal Account Explanation Page GUB Date F Debit Credit Debit Credit Accounts Payable 450 Accounts Receivable 0 Accumulated Depreciation, Building. 4,575 Accumulated Depreciation, Equipment 12,200 Building 53.750 169,650 Share Capital Cash 91,975 Consulting Revenue Earned 3,700 Depreciation Expense, Building 0 Depreciation Expense, Equipment 0 Equipment 43,200 7,700 Insurance Expense Interest Earned 7,600 0 Interest Receivable Notes Receivable 11,000 Prepaid Insurance 17,000 Property Taxes Expense 5,800 0 Property Taxes Payable Rent Earned 12,400 28,000 12.200 Retained Earnings Salaries Expense Salaries Payable Unearned Rent 0 4,500 450 Utilities Expense 243,075 243,075 Totals

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started