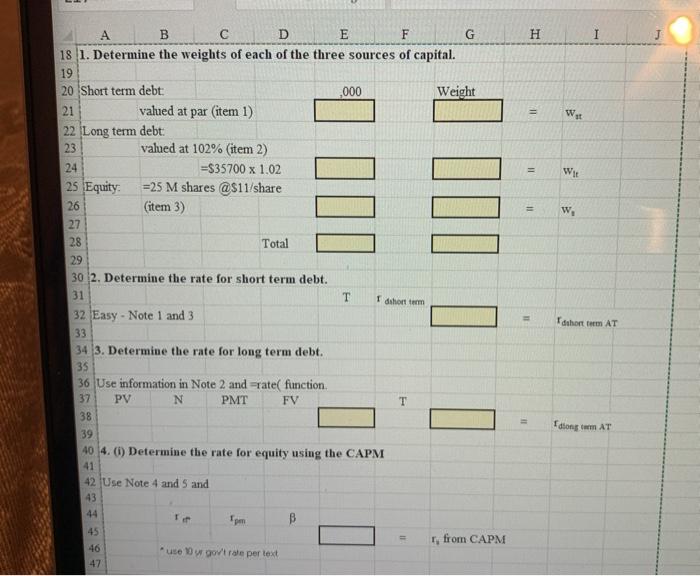

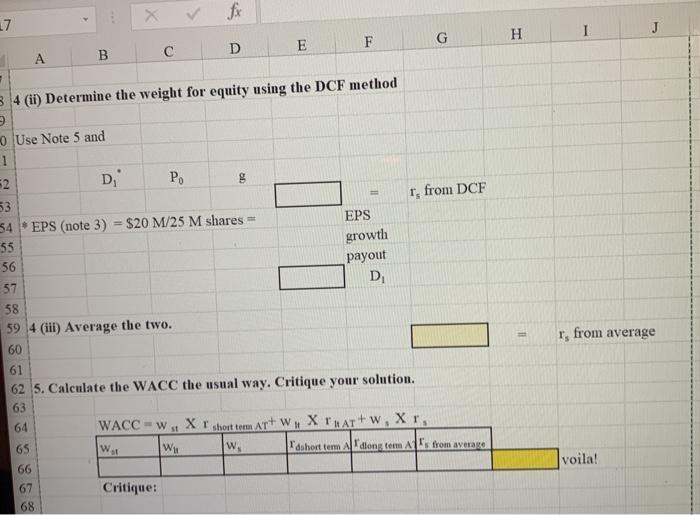

H 1 = W. = Wit (item 3) 11 w A B D E F G 18 1. Determine the weights of each of the three sources of capital. 19 20 Short term debt: ,000 Weight 21 valued at par (item 1) 22 Long term debt: 23 valued at 102% (item 2) 24 =$35700 x 1.02 25 Equity =25 M shares @$11/share 26 27 28 Total 29 30 2. Determine the rate for short term debt. 31 T 32 Easy - Note 1 and 3 33 34 3. Determine the rate for long term debt. 35 36 Use information in Note 2 and rate function 37 PV N PMT FV 38 39 40 4. () Determine the rate for equity using the CAPM 41 42 Use Note 4 and 5 and 43 44 T B 45 r, from CAPM 46 ute w govtrale per text 47 I dihotom Ghort trem AT Tdtong AT > 17 H I J G F E D B A 3 4 (ii) Determine the weight for equity using the DCF method D, Use Note 5 and 1 52 Po 8 53 r, from DCF 34 EPS (note 3) = $20 M/25 M shares EPS 55 growth 56 payout 57 D 58 59 4 (iii) Average the two. 60 61 62 5. Calculate the WACC the usual way. Critique your solution. 63 64 WACC - w X short term Art W.X THAT+w, Xr, 65 W. W w rdshort term Adlong term Alls from average 66 67 Critique: 68 r, from average voila! H 1 = W. = Wit (item 3) 11 w A B D E F G 18 1. Determine the weights of each of the three sources of capital. 19 20 Short term debt: ,000 Weight 21 valued at par (item 1) 22 Long term debt: 23 valued at 102% (item 2) 24 =$35700 x 1.02 25 Equity =25 M shares @$11/share 26 27 28 Total 29 30 2. Determine the rate for short term debt. 31 T 32 Easy - Note 1 and 3 33 34 3. Determine the rate for long term debt. 35 36 Use information in Note 2 and rate function 37 PV N PMT FV 38 39 40 4. () Determine the rate for equity using the CAPM 41 42 Use Note 4 and 5 and 43 44 T B 45 r, from CAPM 46 ute w govtrale per text 47 I dihotom Ghort trem AT Tdtong AT > 17 H I J G F E D B A 3 4 (ii) Determine the weight for equity using the DCF method D, Use Note 5 and 1 52 Po 8 53 r, from DCF 34 EPS (note 3) = $20 M/25 M shares EPS 55 growth 56 payout 57 D 58 59 4 (iii) Average the two. 60 61 62 5. Calculate the WACC the usual way. Critique your solution. 63 64 WACC - w X short term Art W.X THAT+w, Xr, 65 W. W w rdshort term Adlong term Alls from average 66 67 Critique: 68 r, from average voila