Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve it with all requirements please all questions 1. Jack is saving to buy a new car. He needs to have $21,000 in three

Please solve it with all requirements please all questions

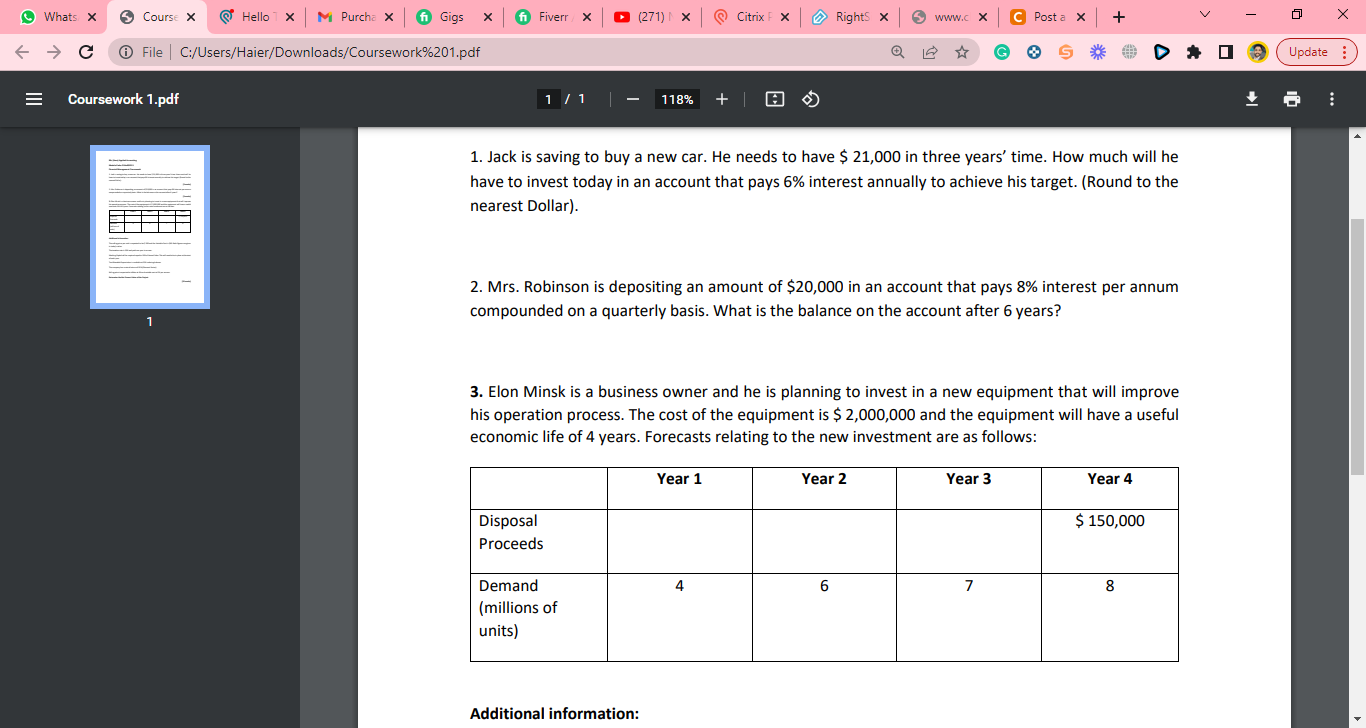

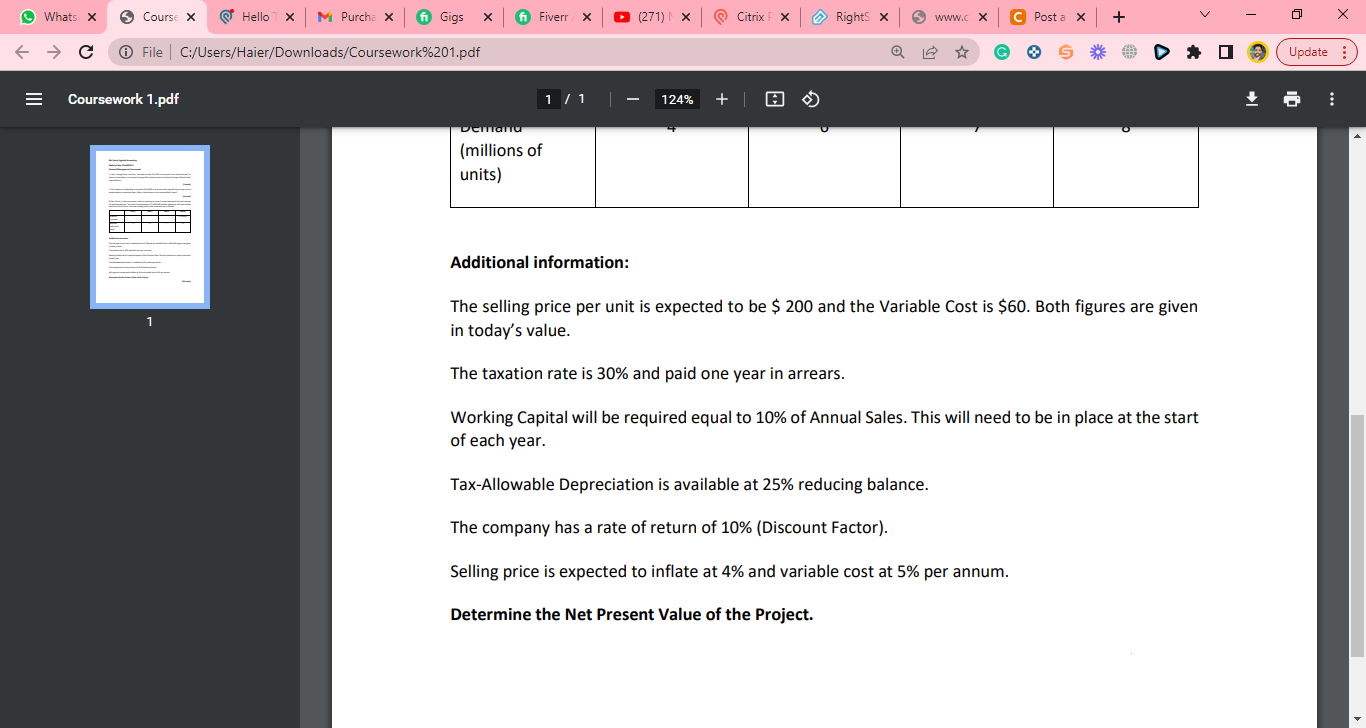

1. Jack is saving to buy a new car. He needs to have $21,000 in three years' time. How much will he have to invest today in an account that pays 6% interest annually to achieve his target. (Round to the nearest Dollar). 2. Mrs. Robinson is depositing an amount of $20,000 in an account that pays 8% interest per annum compounded on a quarterly basis. What is the balance on the account after 6 years? 3. Elon Minsk is a business owner and he is planning to invest in a new equipment that will improve his operation process. The cost of the equipment is $2,000,000 and the equipment will have a useful economic life of 4 years. Forecasts relating to the new investment are as follows: Additional information: Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. The taxation rate is 30% and paid one year in arrears. Working Capital will be required equal to 10% of Annual Sales. This will need to be in place at the start of each year. Tax-Allowable Depreciation is available at 25% reducing balance. The company has a rate of return of 10% (Discount Factor). Selling price is expected to inflate at 4% and variable cost at 5% per annum. Determine the Net Present Value of the Project. 1. Jack is saving to buy a new car. He needs to have $21,000 in three years' time. How much will he have to invest today in an account that pays 6% interest annually to achieve his target. (Round to the nearest Dollar). 2. Mrs. Robinson is depositing an amount of $20,000 in an account that pays 8% interest per annum compounded on a quarterly basis. What is the balance on the account after 6 years? 3. Elon Minsk is a business owner and he is planning to invest in a new equipment that will improve his operation process. The cost of the equipment is $2,000,000 and the equipment will have a useful economic life of 4 years. Forecasts relating to the new investment are as follows: Additional information: Additional information: The selling price per unit is expected to be $200 and the Variable Cost is $60. Both figures are given in today's value. The taxation rate is 30% and paid one year in arrears. Working Capital will be required equal to 10% of Annual Sales. This will need to be in place at the start of each year. Tax-Allowable Depreciation is available at 25% reducing balance. The company has a rate of return of 10% (Discount Factor). Selling price is expected to inflate at 4% and variable cost at 5% per annum. Determine the Net Present Value of the Project

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started