Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve Now determine the best type of fund and your rationale for each of the transactions listed below. Best Type of Fund Rationale Transaction

please solve

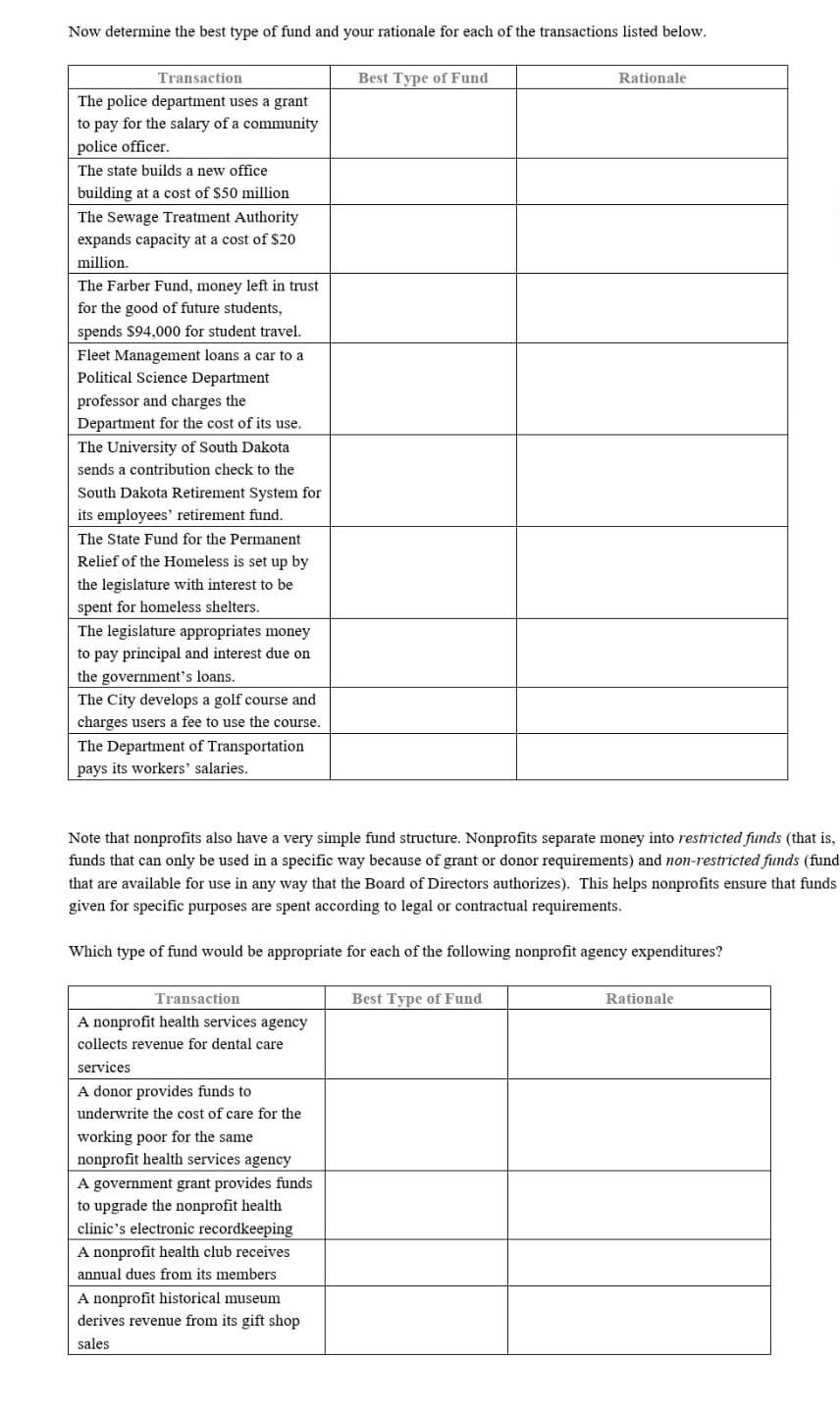

Now determine the best type of fund and your rationale for each of the transactions listed below. Best Type of Fund Rationale Transaction The police department uses a grant to pay for the salary of a community police officer. The state builds a new office building at a cost of $50 million The Sewage Treatment Authority expands capacity at a cost of $20 million. The Farber Fund, money left in trust for the good of future students, spends $94,000 for student travel. Fleet Management loans a car to a Political Science Department professor and charges the Department for the cost of its use. The University of South Dakota sends a contribution check to the South Dakota Retirement System for its employees' retirement fund. The State Fund for the Permanent Relief of the Homeless is set up by the legislature with interest to be spent for homeless shelters. The legislature appropriates money to pay principal and interest due on the government's loans. The City develops a golf course and charges users a fee to use the course. The Department of Transportation pays its workers' salaries. Note that nonprofits also have a very simple fund structure. Nonprofits separate money into restricted funds (that is, funds that can only be used in a specific way because of grant or donor requirements) and non-restricted funds (fund that are available for use in any way that the Board of Directors authorizes). This helps nonprofits ensure that funds given for specific purposes are spent according to legal or contractual requirements. Which type of fund would be appropriate for each of the following nonprofit agency expenditures? Best Type of Fund Rationale Transaction A nonprofit health services agency collects revenue for dental care services A donor provides funds to underwrite the cost of care for the working poor for the same nonprofit health services agency A government grant provides funds to upgrade the nonprofit health clinic's electronic recordkeeping A nonprofit health club receives annual dues from its members A nonprofit historical museum derives revenue from its gift shop sales Now determine the best type of fund and your rationale for each of the transactions listed below. Best Type of Fund Rationale Transaction The police department uses a grant to pay for the salary of a community police officer. The state builds a new office building at a cost of $50 million The Sewage Treatment Authority expands capacity at a cost of $20 million. The Farber Fund, money left in trust for the good of future students, spends $94,000 for student travel. Fleet Management loans a car to a Political Science Department professor and charges the Department for the cost of its use. The University of South Dakota sends a contribution check to the South Dakota Retirement System for its employees' retirement fund. The State Fund for the Permanent Relief of the Homeless is set up by the legislature with interest to be spent for homeless shelters. The legislature appropriates money to pay principal and interest due on the government's loans. The City develops a golf course and charges users a fee to use the course. The Department of Transportation pays its workers' salaries. Note that nonprofits also have a very simple fund structure. Nonprofits separate money into restricted funds (that is, funds that can only be used in a specific way because of grant or donor requirements) and non-restricted funds (fund that are available for use in any way that the Board of Directors authorizes). This helps nonprofits ensure that funds given for specific purposes are spent according to legal or contractual requirements. Which type of fund would be appropriate for each of the following nonprofit agency expenditures? Best Type of Fund Rationale Transaction A nonprofit health services agency collects revenue for dental care services A donor provides funds to underwrite the cost of care for the working poor for the same nonprofit health services agency A government grant provides funds to upgrade the nonprofit health clinic's electronic recordkeeping A nonprofit health club receives annual dues from its members A nonprofit historical museum derives revenue from its gift shop salesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started