Answered step by step

Verified Expert Solution

Question

1 Approved Answer

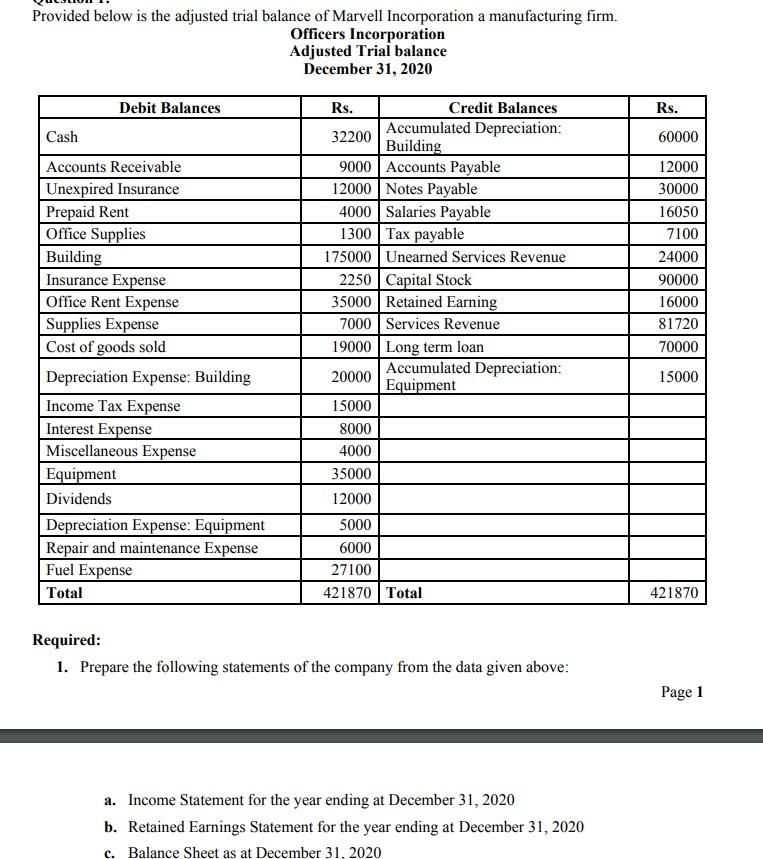

Please Solve on short notice. Neatly Solved on paper is also acceptable. Provided below is the adjusted trial balance of Marvell Incorporation a manufacturing firm.

Please Solve on short notice.

Neatly Solved on paper is also acceptable.

Provided below is the adjusted trial balance of Marvell Incorporation a manufacturing firm. Officers Incorporation Adjusted Trial balance December 31, 2020 Debit Balances Rs. Cash 60000 Rs. Credit Balances 32200 Accumulated Depreciation: Building 9000 Accounts Payable 12000 Notes Payable 4000 Salaries Payable 1300 Tax payable 175000 Unearned Services Revenue 2250 Capital Stock 35000 Retained Earning 7000 Services Revenue 19000 Long term loan Accumulated Depreciation: 20000 Equipment 15000 8000 4000 35000 12000 Accounts Receivable Unexpired Insurance Prepaid Rent Office Supplies Building Insurance Expense Office Rent Expense Supplies Expense Cost of goods sold Depreciation Expense: Building Income Tax Expense Interest Expense Miscellaneous Expense Equipment Dividends Depreciation Expense: Equipment Repair and maintenance Expense Fuel Expense Total 12000 30000 16050 7100 24000 90000 16000 81720 70000 15000 5000 6000 27100 421870 Total 421870 Required: 1. Prepare the following statements of the company from the data given above: Page 1 a. Income Statement for the year ending at December 31, 2020 b. Retained Earnings Statement for the year ending at December 31, 2020 c. Balance Sheet as at December 31, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started