Answered step by step

Verified Expert Solution

Question

1 Approved Answer

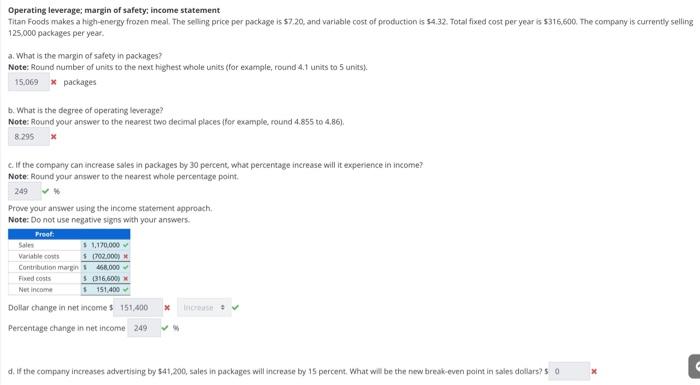

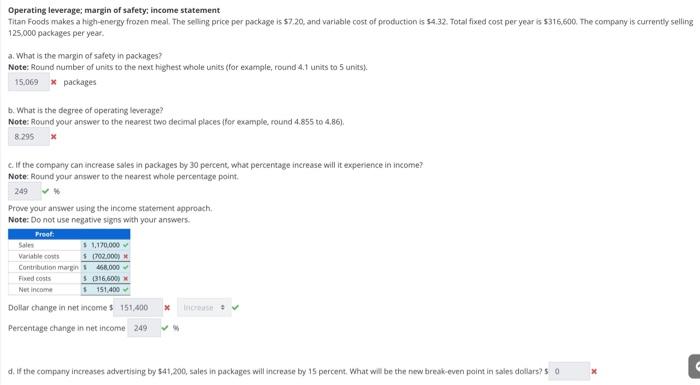

Please solve Operating leverage; margin of safety; income statement Titan Foods makes a high-energy frozen meal. The selling price per pockage is 57.20, and variable

Please solve

Operating leverage; margin of safety; income statement Titan Foods makes a high-energy frozen meal. The selling price per pockage is 57.20, and variable cost of production is 54.32. Total fixed cost per year is 5316.600. The company is currently selling 125,000 packages per year. a. What is the margin of safety in packages? Note: Round number of units to the next highest whole units (for example, round 4.1 units to 5 units). 16 packages b. What is the degree of operating leverage? Note: Round your answer to the nearest two decimal places ifor example, round 4.855 to 4.86 ), is c. If the company can increase sales in packages by 30 percent, what percentage increase will it experience in income? Note: Round your answer to the nearest whole percentage point. Prove your answer using the income statement approach, Note: Do not use negative signs with your answers: Dollar change in net incomes Percentage change in net income d. If the company increases advertising by 541,200 , sales in packages will increase by 15 percent. What will be the new tieeak-even point in sales dollars? 5 x

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started