Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve part A and B Give proportions invested in Part B A pension fund manager is considering three mutual funds. The first is a

Please solve part A and B Give proportions invested in Part B

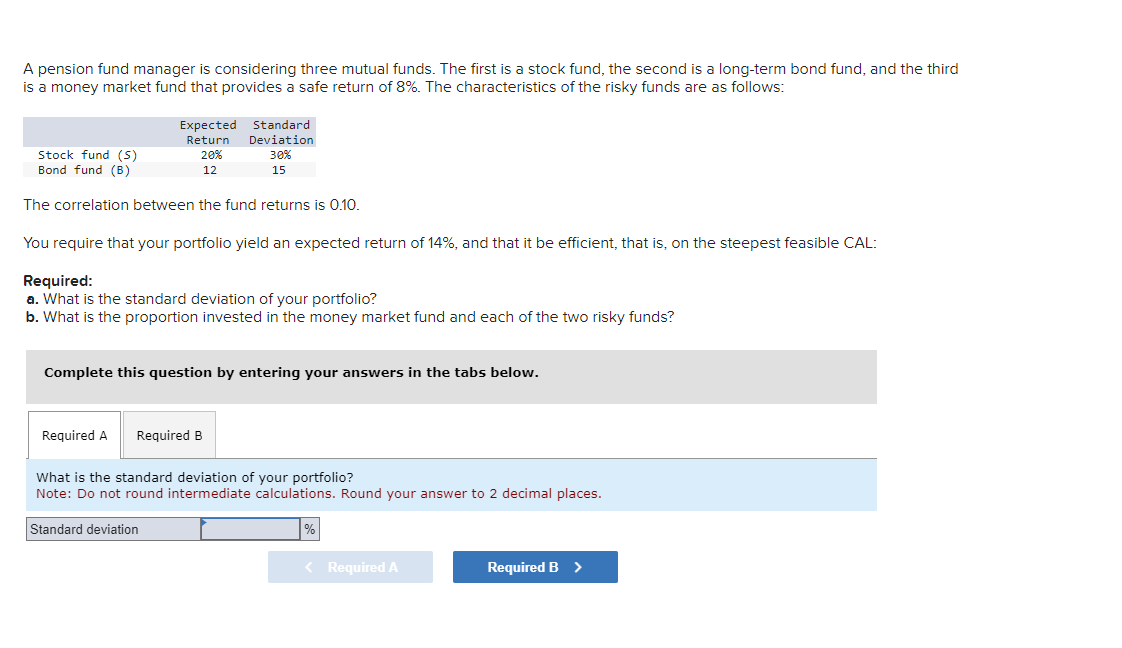

A pension fund manager is considering three mutual funds. The first is a stock fund, the second is a long-term bond fund, and the thir is a money market fund that provides a safe return of 8%. The characteristics of the risky funds are as follows: The correlation between the fund returns is 0.10 . You require that your portfolio yield an expected return of 14%, and that it be efficient, that is, on the steepest feasible CAL: Required: a. What is the standard deviation of your portfolio? b. What is the proportion invested in the money market fund and each of the two risky funds? Complete this question by entering your answers in the tabs below. What is the standard deviation of your portfolio? Note: Do not round intermediate calculations. Round your answer to 2 decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started