Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve please 1-Find the minimum capital requirement for X Bank Assets Liabilities and Equity Deposits $2,900 Residential mortgages 400 Commercial loans, CCC+ rated 2,200

please solve please

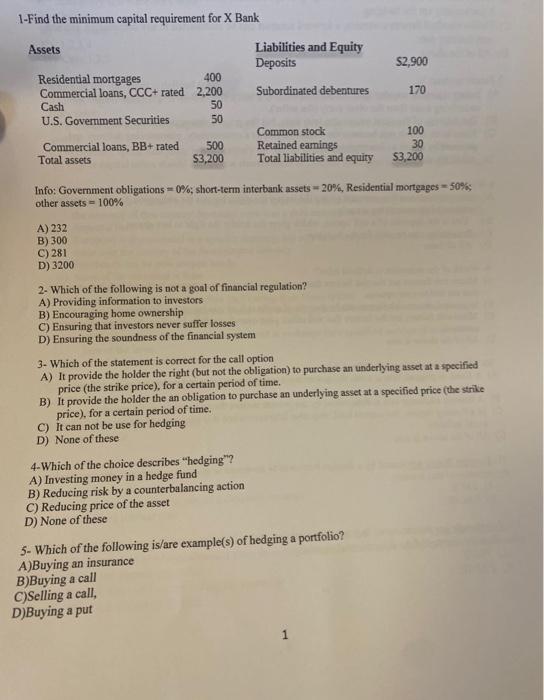

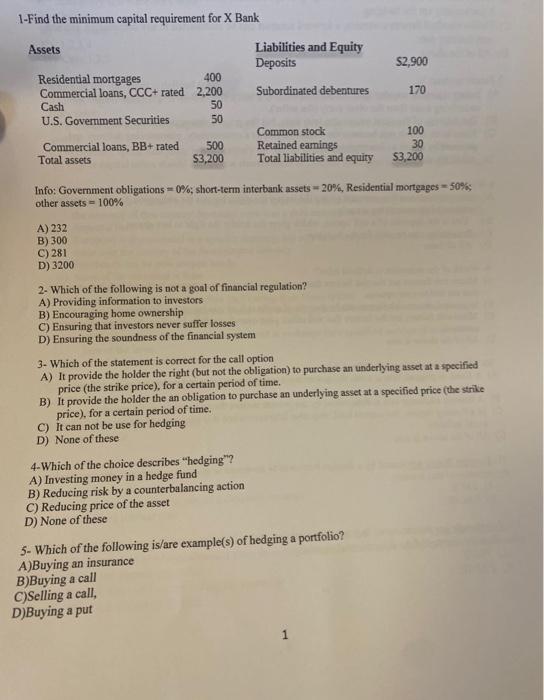

1-Find the minimum capital requirement for X Bank Assets Liabilities and Equity Deposits $2,900 Residential mortgages 400 Commercial loans, CCC+ rated 2,200 Subordinated debentures 170 Cash 50 U.S. Government Securities 50 Common stock 100 Commercial loans, BB+ rated Total assets 500 Retained earnings 30 $3,200 Total liabilities and equity $3,200 Info: Government obligations = 0%; short-term interbank assets-20%, Residential mortgages-50%; other assets 100% A) 232 B) 300 C) 281 D) 3200 2- Which of the following is not a goal of financial regulation? A) Providing information to investors B) Encouraging home ownership C) Ensuring that investors never suffer losses D) Ensuring the soundness of the financial system 3- Which of the statement is correct for the call option A) It provide the holder the right (but not the obligation) to purchase an underlying asset at a specified price (the strike price), for a certain period of time. B) It provide the holder the an obligation to purchase an underlying asset at a specified price (the strike price), for a certain period of time. C) It can not be use for hedging D) None of these 4-Which of the choice describes "hedging"? A) Investing money in a hedge fund B) Reducing risk by a counterbalancing action C) Reducing price of the asset D) None of these 5- Which of the following is/are example(s) of hedging a portfolio? A)Buying an insurance B)Buying a call C)Selling a call, D)Buying a put

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started