Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve problem 1 and 3 for me, thanks! A stock currently costs $4 per share. In each time period, the value of the stock

please solve problem 1 and 3 for me, thanks!

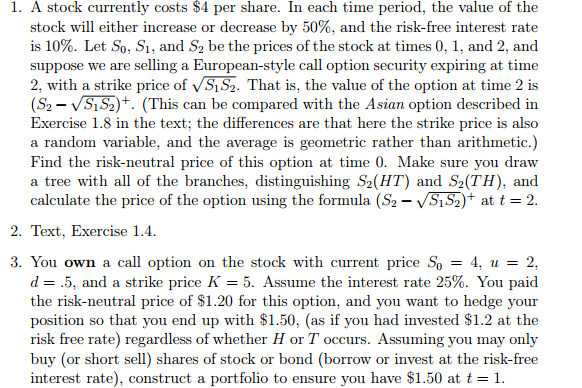

A stock currently costs $4 per share. In each time period, the value of the stock will either increase or decrease by 50%, and the risk-free interest rate is 10%. Let S_1, S_1, and S_2 be the prices of the stock at times 0, 1, and 2, and suppose we are selling a European-style call option security expiring at time 2, with a strike price of square root S_1 S_2. That is, the value of the option at time 2 is (S_2 - square root S_1 S_2)^+. (This can be compared with the Asian option described in Exercise 1.8 in the text; the differences are that here the strike price is also a random variable, and the average is geometric rather than arithmetic.) Find the risk-neutral price of this option at time 0. Make sure you draw a tree with all of the branches, distinguishing S_2(HT) and S_2(TH), and calculate the price of the option using the formula (S_2 - square root S_1 S_2)^+ at t = 2. Text, Exercise 1.4. 3. You own a call option on the stock with current price S_0 = 4, u = 2, d = .5, and a strike price K = 5. Assume the interest rate 25%. You paid the risk-neutral price of $1.20 for this option, and you want to hedge your position so that you end up with $1.50, (as if you had invested $1.2 at the risk free rate) regardless of whether H or T occurs. Assuming you may only buy (or short sell) shares of stock or bond (borrow or invest at the risk-ffee interest rate), construct a portfolio to ensure you have $1.50 at t = 1Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started