Answered step by step

Verified Expert Solution

Question

1 Approved Answer

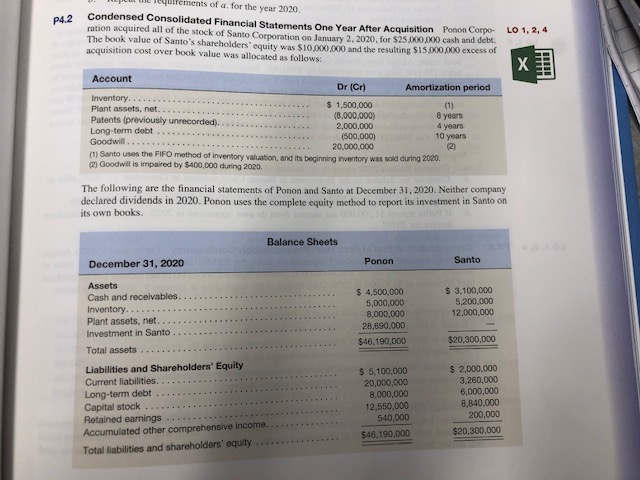

Please solve problems for P4.2 nts of a. for the year 2020. Condensed Consolidated Financial Statements One Year After Acquisition Ponon Corpo- ration acquired all

Please solve problems for P4.2

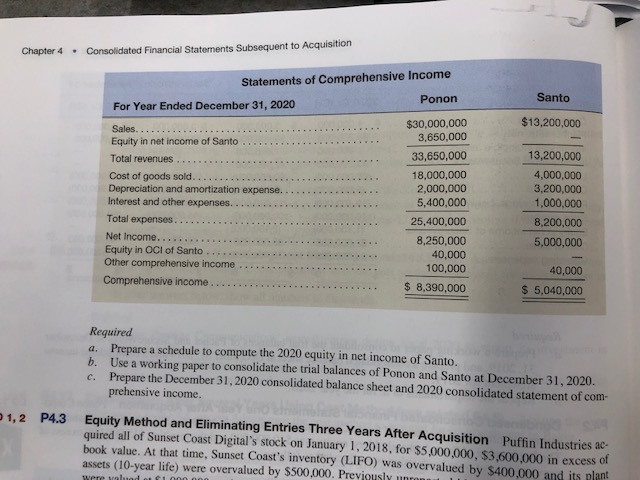

nts of a. for the year 2020. Condensed Consolidated Financial Statements One Year After Acquisition Ponon Corpo- ration acquired all of the stock of Santo Corporation on January 2, 2020, for $25,000,000 cash and debt The book value of Santo's shareholders' equity was $10,000,000 and the resulting SI5000,000 excess of acquisition cost over book value was allocated as follows: P4.2 LO 1, 2, 4 X ount Dr (Cr) Amortization period Inventory.... Plant assets, net. Patents (previously unrecorded). . Long-term debt Goodwill... $1,500,000 (8,000,000) 2,000,000 (500,000) 20,000,000 (1) 8 years 4 years 10 years (2) (1) Santo uses the FIFO method of inventory valuation, and its beginning inventory was sold during 2020. (2) Goodwill is impaired by $400,000 during 2020. The following are the financial statements of Ponon and Santo at December 31, 2020. Neither company declared dividends in 2020. Ponon uses the complete equity method to report its investment in Santo on its own books Balance Sheets Santo Ponon December 31, 2020 Assets $ 3,100,000 5,200,000 12,000,000 $ 4,500,000 5,000,000 Cash and receivables. Inventory... Plant assets, net. Investment in Santo 8,000,000 28,690,000 $20,300,000 $46,190,000 Total assets Liabilities and Shareholders' Equity Current liabilities. Long-term debt Capital stock Retained earnings Accumulated other comprehensive income. $ 2,000,000 3,260,000 6,000,000 8,840,000 200,000 $ 5,100,000 20,000,000 8,000,000 12.550,000 540,000 $20,300,000 $46,190,000 Total liabilities and shareholders' equity Consolidated Financial Statements Subsequent to Acquisition Chapter 4 Statements of Comprehensive Income Santo Ponon For Year Ended December 31, 2020 $13,200,000 $30,000,000 3,650,000 Sales...... Equity in net income of Santo 13,200,000 33,650,000 Total revenues. 18,000,000 2,000,000 5,400,000 4,000,000 Cost of goods sold. Depreciation and amortization expense. Interest and other expenses.. 3,200,000 1,000,000 Total expenses... 25,400,000 8,200,000 Net Income... Equity in OCI of Santo Other comprehensive income 8,250,000 40,000 100,000 5,000,000 40,000 Comprehensive income. $ 8,390,000 $ 5,040,000 Required Prepare a schedule to compute the 2020 equity in net income of Santo, b. Use a working paper to consolidate the trial balances of Ponon and Santo at December 31, 2020. c. Prepare the December 31, 2020 consolidated balance sheet and 2020 consolidated statement of com- prehensive income. a. 1, 2 P4.3 Equity Method and Eliminating Entries Three Years After Acquisition Puffin Industries ac- quired all of Sunset Coast Digital's stock on January 1, 2018, for $5,000,000, $3,600,000 in excess of book value. At that time, Sunset Coast's inventory (LIFO) was overvalued by $400,000 and its plant assets (10-year life) were overvalued by $500,000. Previously unrons were valuad et 1.000 ocStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started