Answered step by step

Verified Expert Solution

Question

1 Approved Answer

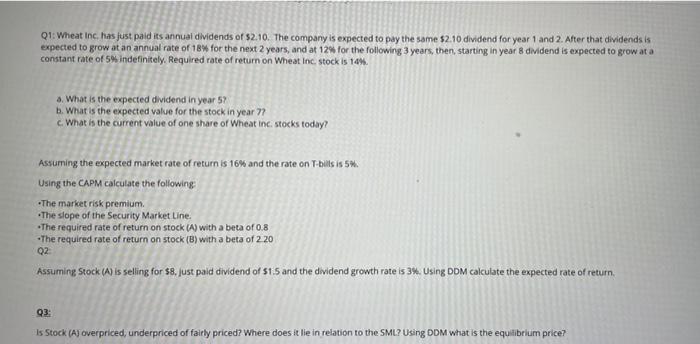

please solve Q1-Q3 showing all work/explanation in EXCEL please. thank you in advance, will upvote! Q1: Wheat Inc. has just paid its annual dividends of

please solve Q1-Q3 showing all work/explanation in EXCEL please. thank you in advance, will upvote!

Q1: Wheat Inc. has just paid its annual dividends of $2.10. The company is expected to pay the same $2.10 dividend for year 1 and 2. After that dividends is expected to grow at an annual rate of 18% for the next 2 years, and at 12% for the following 3 years, then, starting in year 8 dividend is expected to grow at a constant rate of 5% indefinitely. Required rate of return on Wheat Inc. stock is 14%. a. What is the expected dividend in year 57 b. What is the expected value for the stock in year 77 c. What is the current value of one share of Wheat Inc. stocks today? Assuming the expected market rate of return is 16% and the rate on T-bills is 5%. Using the CAPM calculate the following: The market risk premium. The slope of the Security Market Line. The required rate of return on stock (A) with a beta of 0.8 The required rate of return on stock (B) with a beta of 2.20 Q2: Assuming Stock (A) is selling for $8, just paid dividend of $1.5 and the dividend growth rate is 3%. Using DDM calculate the expected rate of return. 03: Is Stock (A) overpriced, underpriced of fairly priced? Where does it lie in relation to the SML? Using DDM what is the equilibrium price

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started