Answered step by step

Verified Expert Solution

Question

1 Approved Answer

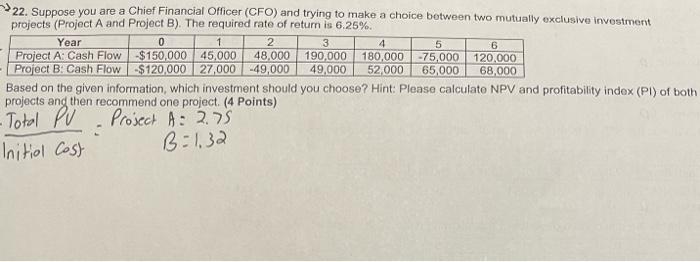

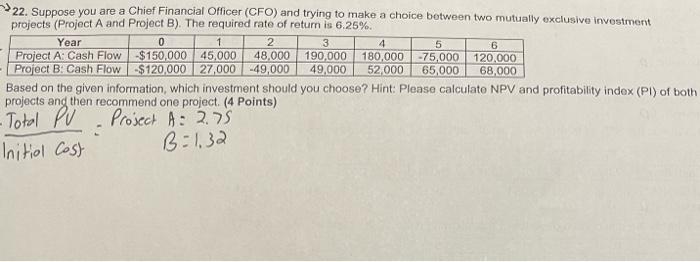

please solve Q22) and show how to do Q21) thanks 0 1 3 4 5 6 22. Suppose you are a Chief Financial Officer (CFO)

please solve Q22) and show how to do Q21) thanks

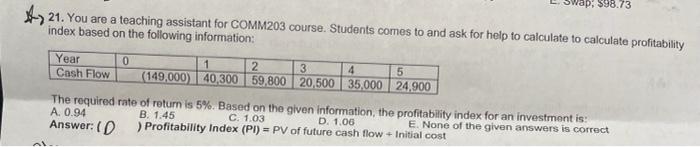

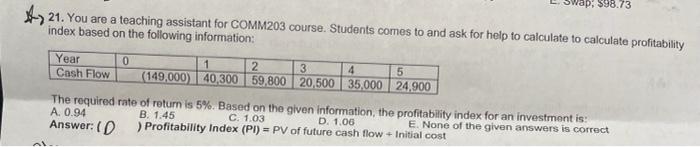

0 1 3 4 5 6 22. Suppose you are a Chief Financial Officer (CFO) and trying to make a choice between two mutually exclusive investment projects (Project A and Project B). The required rate of return is 6.25%. Year 2 Project A: Cash Flow $150,000 45.000 48.000 190,000 180,000 -75,000 120,000 Project B: Cash Flow $120,000 27,000 -49,000 49,000 52 000 65,000 68,000 Based on the given information, which investment should you choose? Hint: Please calculate NPV and profitability index (PI) of both projects ang then recommend one project (4 Points) Project A: 2.75 B:1.32 Initial Cost -Total Pu ap: 598.73 # 21. You are a teaching assistant for COMM203 course. Students comes to and ask for help to calculate to calculate profitability index based on the following information: Year Cash Flow 0 1 2 3 4 5 (149,000) 40,300 59.800 20.500 35,000 24.900 The required rate of return is 5%. Based on the given information, the profitability index for an investment is: A. 0.94 B. 1.45 C. 1.03 D. 1.06 E. None of the given answers is correct Answer:D ) Profitability Index (PI) = PV of future cash flow Initial cost

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started