Answered step by step

Verified Expert Solution

Question

1 Approved Answer

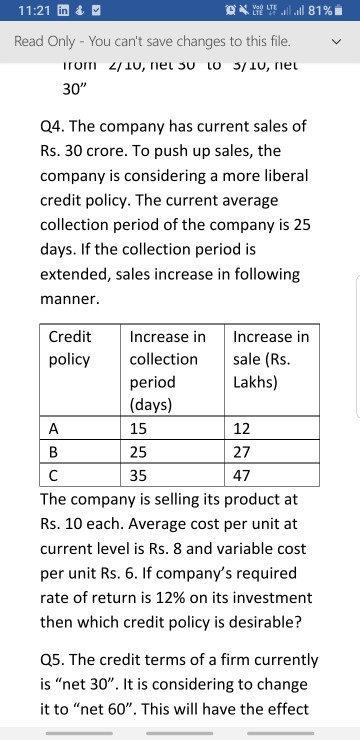

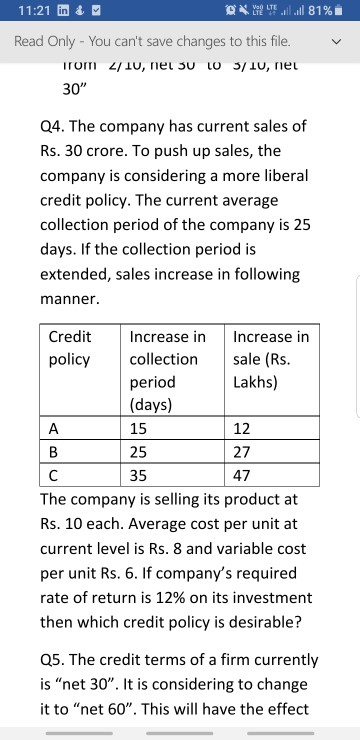

Please solve question 4 11:21 in O LT. 81% Read Only - You can't save changes to this file. From 2/10, net su LO 3/10,

Please solve question 4

11:21 in O LT. 81% Read Only - You can't save changes to this file. From 2/10, net su LO 3/10, nel 30" Q4. The company has current sales of Rs. 30 crore. To push up sales, the company is considering a more liberal credit policy. The current average collection period of the company is 25 days. If the collection period is extended, sales increase in following manner. Credit policy Increase in collection period (days) Increase in sale (Rs. Lakhs) 15 12 25 35 47 The company is selling its product at Rs. 10 each. Average cost per unit at current level is Rs. 8 and variable cost per unit Rs. 6. If company's required rate of return is 12% on its investment then which credit policy is desirable? Q5. The credit terms of a firm currently is "net 30". It is considering to change it to "net 60". This will have the effect 11:21 in O LT. 81% Read Only - You can't save changes to this file. From 2/10, net su LO 3/10, nel 30" Q4. The company has current sales of Rs. 30 crore. To push up sales, the company is considering a more liberal credit policy. The current average collection period of the company is 25 days. If the collection period is extended, sales increase in following manner. Credit policy Increase in collection period (days) Increase in sale (Rs. Lakhs) 15 12 25 35 47 The company is selling its product at Rs. 10 each. Average cost per unit at current level is Rs. 8 and variable cost per unit Rs. 6. If company's required rate of return is 12% on its investment then which credit policy is desirable? Q5. The credit terms of a firm currently is "net 30". It is considering to change it to "net 60". This will have the effectStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started