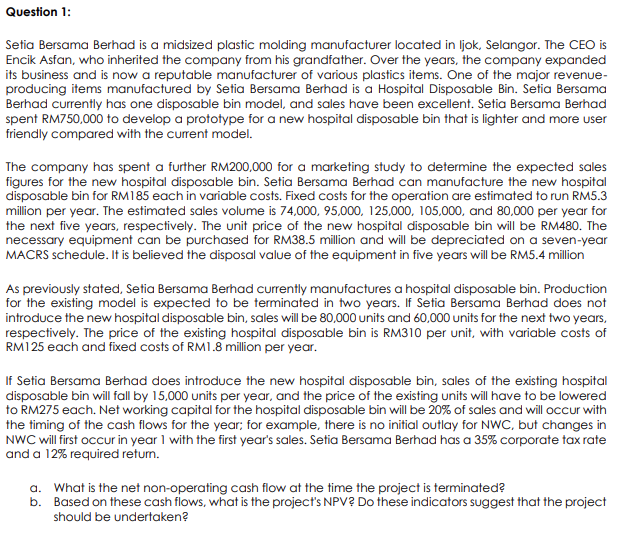

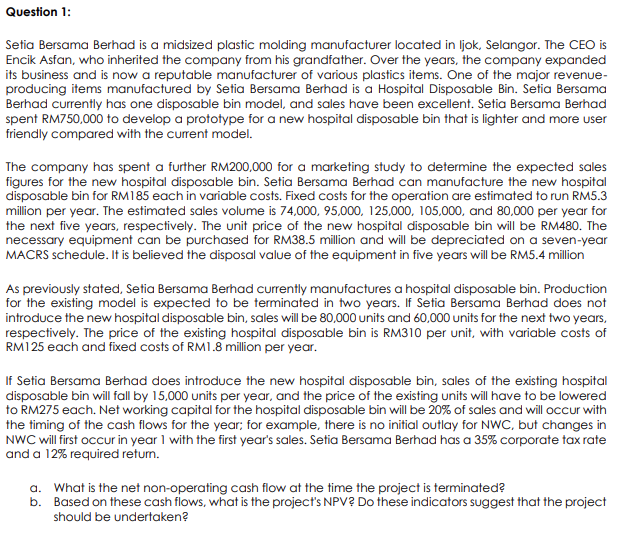

Please solve question (b), tq

Question 1: Setia Bersama Berhad is a midsized plastic molding manufacturer located in ljok, Selangor. The CEO is Encik Asfan, who inherited the company from his grandfather. Over the years, the company expanded its business and is now a reputable manufacturer of various plastics items. One of the major revenue- producing items manufactured by Setia Bersama Berhad is a Hospital Disposable Bin. Setia Bersama Berhad currently has one disposable bin model, and sales have been excellent. Setia Bersama Berhad spent RM750,000 to develop a prototype for a new hospital disposable bin that is lighter and more user friendly compared with the current model. The company has spent a further RM200,000 for a marketing study to determine the expected sales figures for the new hospital disposable bin. Setia Bersama Berhad can manufacture the new hospital disposable bin for RM185 each in variable costs. Fixed costs for the operation are estimated to run RM5.3 million per year. The estimated sales volume is 74,000, 95,000, 125,000, 105,000, and 80,000 per year for the next five years, respectively. The unit price of the new hospital disposable bin will be RM480. The necessary equipment can be purchased for RM38.5 million and will be depreciated on a seven-year MACRS schedule. It is believed the disposal value of the equipment in five years will be RM5.4 million As previously stated, Setia Bersama Berhad currently manufactures a hospital disposable bin. Production for the existing model is expected to be terminated in two years. If Setia Bersama Berhad does not introduce the new hospital disposable bin, sales will be 80.000 units and 60,000 units for the next two years, respectively. The price of the existing hospital disposable bin is RM310 per unit, with variable costs of RM125 each and fixed costs of RM1.8 million per year. If Setia Bersama Berhad does introduce the new hospital disposable bin, sales of the existing hospital disposable bin will fall by 15,000 units per year, and the price of the existing units will have to be lowered to RM275 each. Net working capital for the hospital disposable bin will be 20% of sales and will occur with the timing of the cash flows for the year, for example, there is no initial outlay for NWC, but changes in NWC will first occur in year 1 with the first year's sales. Setia Bersama Berhad has a 35% corporate tax rate and a 12% required return. a. What is the net non-operating cash flow at the time the project is terminated? b. Based on these cash flows, what is the project's NPV? Do these indicators suggest that the project should be undertaken? Question 1: Setia Bersama Berhad is a midsized plastic molding manufacturer located in ljok, Selangor. The CEO is Encik Asfan, who inherited the company from his grandfather. Over the years, the company expanded its business and is now a reputable manufacturer of various plastics items. One of the major revenue- producing items manufactured by Setia Bersama Berhad is a Hospital Disposable Bin. Setia Bersama Berhad currently has one disposable bin model, and sales have been excellent. Setia Bersama Berhad spent RM750,000 to develop a prototype for a new hospital disposable bin that is lighter and more user friendly compared with the current model. The company has spent a further RM200,000 for a marketing study to determine the expected sales figures for the new hospital disposable bin. Setia Bersama Berhad can manufacture the new hospital disposable bin for RM185 each in variable costs. Fixed costs for the operation are estimated to run RM5.3 million per year. The estimated sales volume is 74,000, 95,000, 125,000, 105,000, and 80,000 per year for the next five years, respectively. The unit price of the new hospital disposable bin will be RM480. The necessary equipment can be purchased for RM38.5 million and will be depreciated on a seven-year MACRS schedule. It is believed the disposal value of the equipment in five years will be RM5.4 million As previously stated, Setia Bersama Berhad currently manufactures a hospital disposable bin. Production for the existing model is expected to be terminated in two years. If Setia Bersama Berhad does not introduce the new hospital disposable bin, sales will be 80.000 units and 60,000 units for the next two years, respectively. The price of the existing hospital disposable bin is RM310 per unit, with variable costs of RM125 each and fixed costs of RM1.8 million per year. If Setia Bersama Berhad does introduce the new hospital disposable bin, sales of the existing hospital disposable bin will fall by 15,000 units per year, and the price of the existing units will have to be lowered to RM275 each. Net working capital for the hospital disposable bin will be 20% of sales and will occur with the timing of the cash flows for the year, for example, there is no initial outlay for NWC, but changes in NWC will first occur in year 1 with the first year's sales. Setia Bersama Berhad has a 35% corporate tax rate and a 12% required return. a. What is the net non-operating cash flow at the time the project is terminated? b. Based on these cash flows, what is the project's NPV? Do these indicators suggest that the project should be undertaken