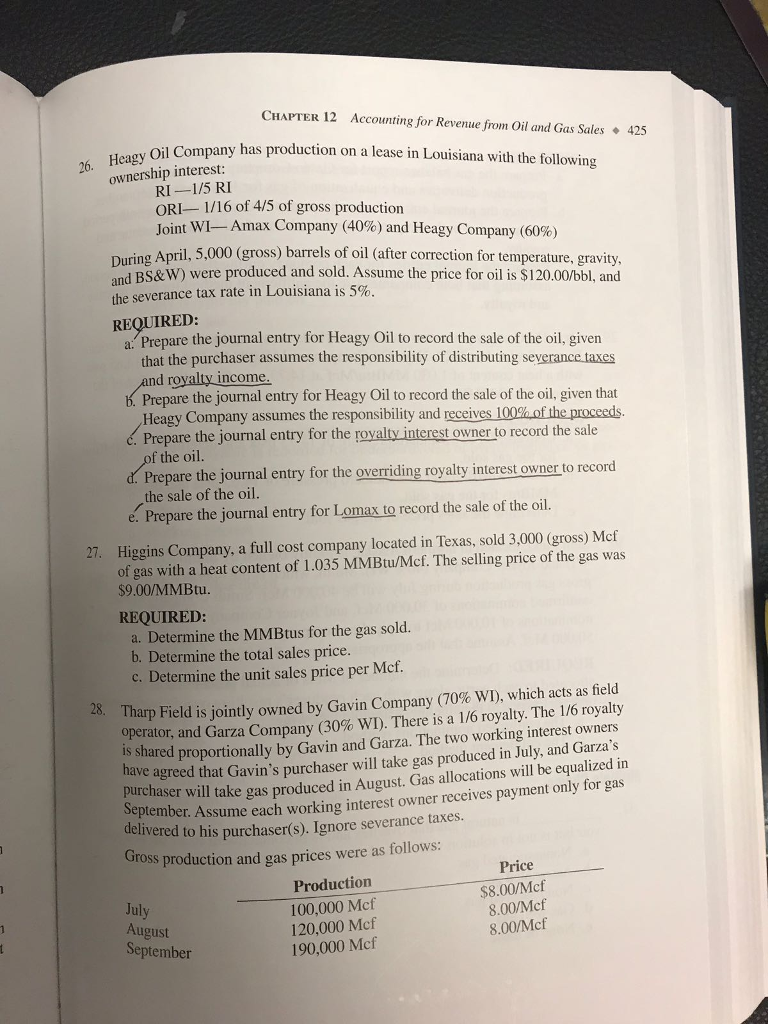

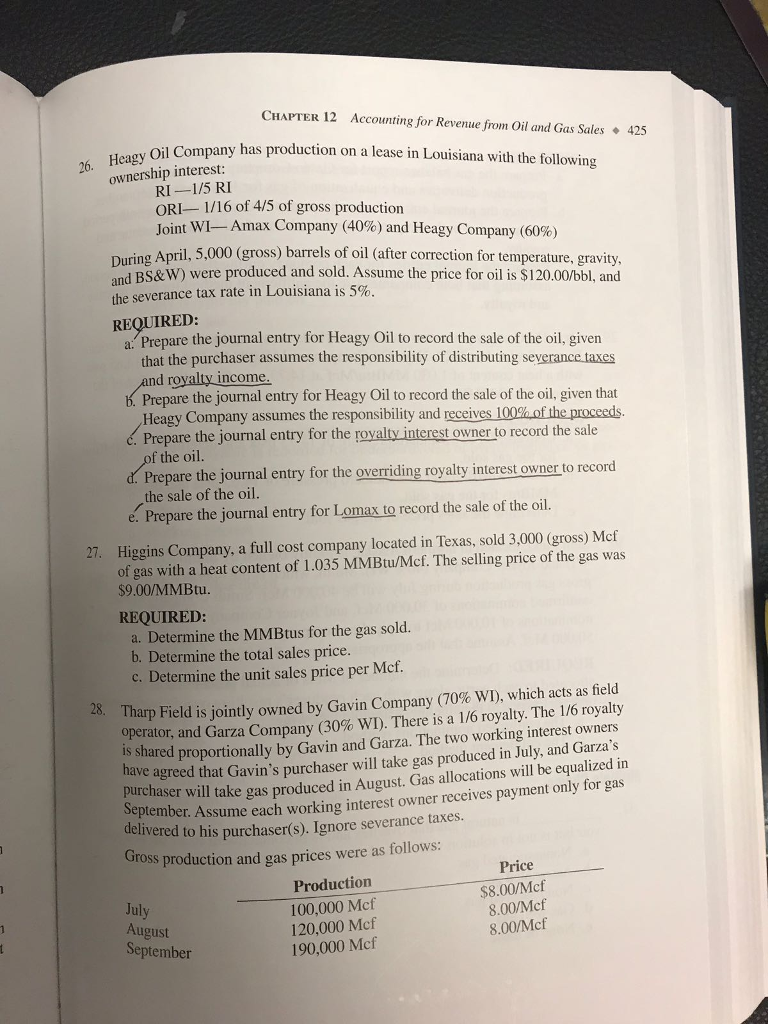

please solve question number 26 only

CHAPTER 12 Accounting for Revenue from Oil and Gas Sales425 1 Company has production on a lease in Louisiana with the following 26. Hea ownership interest: RI-1/5 RI ORl-1 / 16 of 4/5 of gross production Joint wi-Amax Company (40%) and Heagy Company (60%) uring April, 5,000 (gross) barrels of oil (after correction for temperature, gravity and BS&W) were produced and sold. Assume the price for oil is $120.00/bbl, and the severance tax rate in Louisiana is 5%. REQUIRED: a Prepare the journal entry for Heagy Oil to record the sale of the oil, given that the purchaser assumes the responsibility of distributing severance.taxes ro ncome b. Prepare the journal entry for Heagy Oil to record the sale of the oil, given that Heagy Company assumes the responsibility and receives 1 00% of the proceeds. . Prepare the journal entry for the rovalty interest owner to record the sale f the oil. Pregare the joumal entry for the averiding overriding royalty interest owner to record the sale of the oil. e. Prepare the journal entry for Lomax to record the sale of the oil. 27. Higgins Company, a full cost company located in Texas, sold 3,000 (gross) Mcf of gas with a heat content of 1.035 MMBtu/Mcf. The selling price of the gas was $9.00/MMBtu. REQUIRED: a. Determine the MMBtus for the gas sold. b. Determine the total sales price. c. Determine the unit sales price per Mcf. Tharp Field is jointly owned by Gavin Company (70% WI), which acts as field s shared proportionally by Gavin and Garza. The two working interest owners 28, operator, and Garza Company (30% wi). There is a 1/6 royalty. The I/6 royalty agreed that Gavin's purchaser will take gas produced in July, and Garza's purchaser will Se have take gas produced in August. Gas allocations will be equalized in r. Assume each working interest owner receives payment only for gas delivered to his purchaser(s). Ignore severance taxes. Gross production and gas prices were as follows: Production 100,000 Mcf 120,000 Mcf 190,000 Mcf Price $8.00/Mcf 8.00/Mcf 8.00/Mcf July August September CHAPTER 12 Accounting for Revenue from Oil and Gas Sales425 1 Company has production on a lease in Louisiana with the following 26. Hea ownership interest: RI-1/5 RI ORl-1 / 16 of 4/5 of gross production Joint wi-Amax Company (40%) and Heagy Company (60%) uring April, 5,000 (gross) barrels of oil (after correction for temperature, gravity and BS&W) were produced and sold. Assume the price for oil is $120.00/bbl, and the severance tax rate in Louisiana is 5%. REQUIRED: a Prepare the journal entry for Heagy Oil to record the sale of the oil, given that the purchaser assumes the responsibility of distributing severance.taxes ro ncome b. Prepare the journal entry for Heagy Oil to record the sale of the oil, given that Heagy Company assumes the responsibility and receives 1 00% of the proceeds. . Prepare the journal entry for the rovalty interest owner to record the sale f the oil. Pregare the joumal entry for the averiding overriding royalty interest owner to record the sale of the oil. e. Prepare the journal entry for Lomax to record the sale of the oil. 27. Higgins Company, a full cost company located in Texas, sold 3,000 (gross) Mcf of gas with a heat content of 1.035 MMBtu/Mcf. The selling price of the gas was $9.00/MMBtu. REQUIRED: a. Determine the MMBtus for the gas sold. b. Determine the total sales price. c. Determine the unit sales price per Mcf. Tharp Field is jointly owned by Gavin Company (70% WI), which acts as field s shared proportionally by Gavin and Garza. The two working interest owners 28, operator, and Garza Company (30% wi). There is a 1/6 royalty. The I/6 royalty agreed that Gavin's purchaser will take gas produced in July, and Garza's purchaser will Se have take gas produced in August. Gas allocations will be equalized in r. Assume each working interest owner receives payment only for gas delivered to his purchaser(s). Ignore severance taxes. Gross production and gas prices were as follows: Production 100,000 Mcf 120,000 Mcf 190,000 Mcf Price $8.00/Mcf 8.00/Mcf 8.00/Mcf July August September