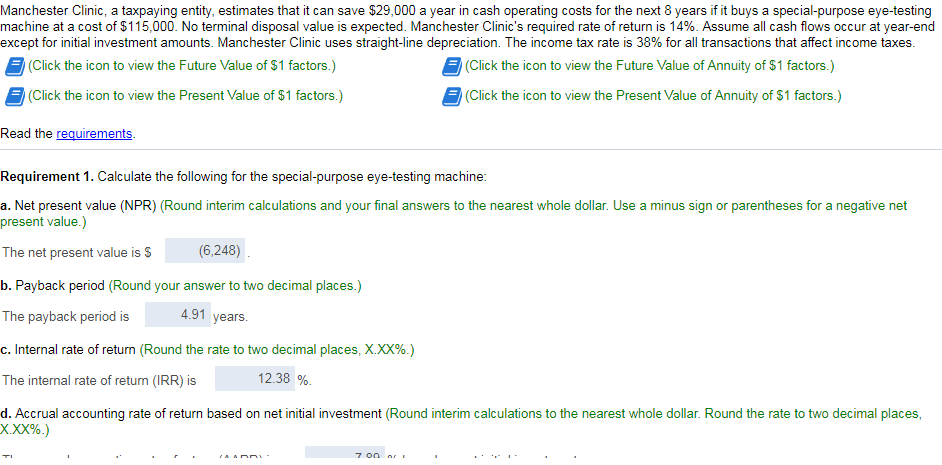

Question

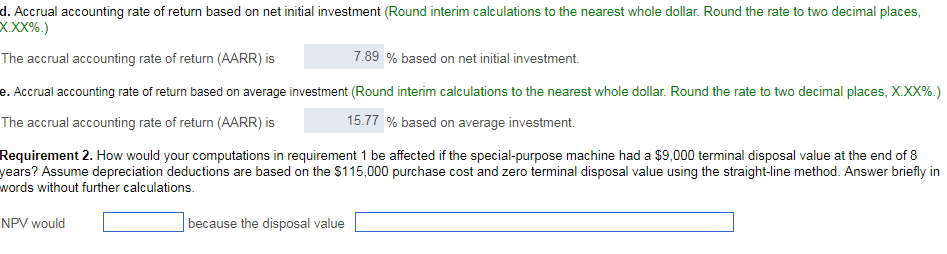

Please solve Requirement 2. Choose the correct answer among the following choices for the 1st blank? decrease increase net change Choose the correct answer among

Please solve Requirement 2. Choose the correct answer among the following choices for the 1st blank? decrease increase net change Choose the correct answer among the following choices for the 2nd blank? does not affect average annual operating income does not affect the net initial investment results in a decrease in average annual operating income results in a decrease to the net initial investment results in an increase in average annual operating income results in an increase in the total present value of cash inflows results in an increase to the net initial investment

Please solve Requirement 2. Choose the correct answer among the following choices for the 1st blank? decrease increase net change Choose the correct answer among the following choices for the 2nd blank? does not affect average annual operating income does not affect the net initial investment results in a decrease in average annual operating income results in a decrease to the net initial investment results in an increase in average annual operating income results in an increase in the total present value of cash inflows results in an increase to the net initial investment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started