Answered step by step

Verified Expert Solution

Question

1 Approved Answer

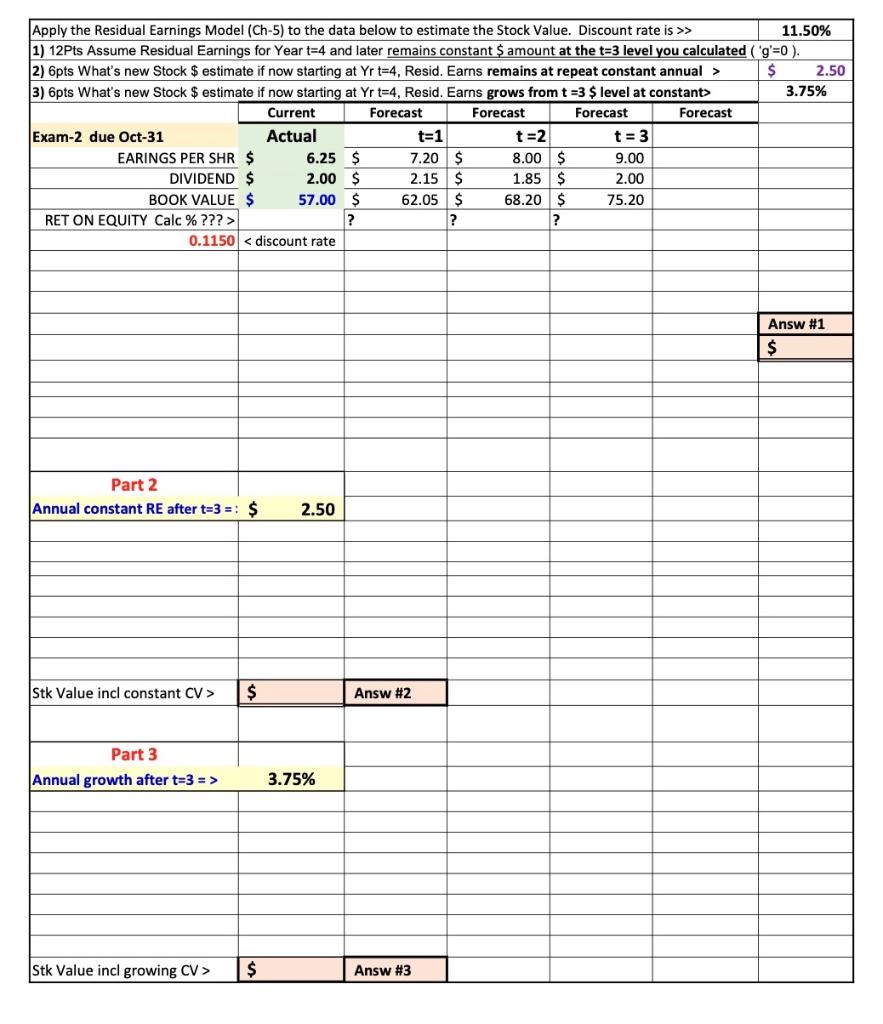

Please solve #'s 1, 2 and 3 using the Residual Earning Model. Thank you Apply the Residual Earnings Model (Ch-5) to the data below to

Please solve #'s 1, 2 and 3 using the Residual Earning Model. Thank you

Apply the Residual Earnings Model (Ch-5) to the data below to estimate the Stock Value. Discount rate is >> 11.50% 1) 12Pts Assume Residual Earnings for Year t=4 and later remains constant $ amount at the t=3 level you calculated ('g'=0 ). 2) 6pts What's new Stock $ estimate if now starting at Yr t=4, Resid. Earns remains at repeat constant annual > $ 2.50 3) 6pts What's new Stock $ estimate if now starting at Yr t=4, Resid. Earns grows from t =3 $ level at constant 3.75% Current Forecast Forecast Forecast Forecast Exam-2 due Oct-31 Actual t=1 t=2 t = 3 EARINGS PER SHR $ 6.25 $ 7.20$ 8.00 $ 9.00 DIVIDEND $ 2.00 $ 2.15$ 1.85$ 2.00 BOOK VALUE $ 57.00 $ 62.05 $ 68.20 $ 75.20 RET ON EQUITY Calc%??? > ? ? ? 0.1150 $ Answ #2 Part 3 Annual growth after t=3 => 3.75% Stk Value incl growing CV > $ Answ #3 Apply the Residual Earnings Model (Ch-5) to the data below to estimate the Stock Value. Discount rate is >> 11.50% 1) 12Pts Assume Residual Earnings for Year t=4 and later remains constant $ amount at the t=3 level you calculated ('g'=0 ). 2) 6pts What's new Stock $ estimate if now starting at Yr t=4, Resid. Earns remains at repeat constant annual > $ 2.50 3) 6pts What's new Stock $ estimate if now starting at Yr t=4, Resid. Earns grows from t =3 $ level at constant 3.75% Current Forecast Forecast Forecast Forecast Exam-2 due Oct-31 Actual t=1 t=2 t = 3 EARINGS PER SHR $ 6.25 $ 7.20$ 8.00 $ 9.00 DIVIDEND $ 2.00 $ 2.15$ 1.85$ 2.00 BOOK VALUE $ 57.00 $ 62.05 $ 68.20 $ 75.20 RET ON EQUITY Calc%??? > ? ? ? 0.1150 $ Answ #2 Part 3 Annual growth after t=3 => 3.75% Stk Value incl growing CV > $ Answ #3Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started