please solve specially part E, F , G. Thank you

please solve specially part E, F , G. Thank you

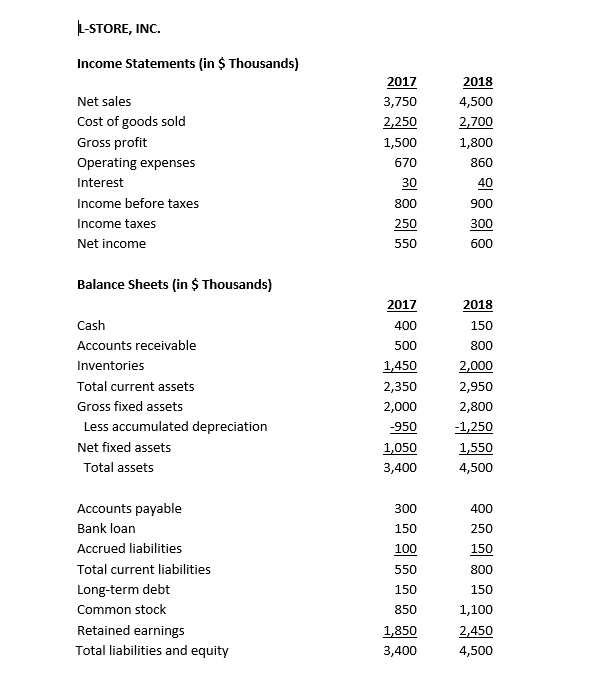

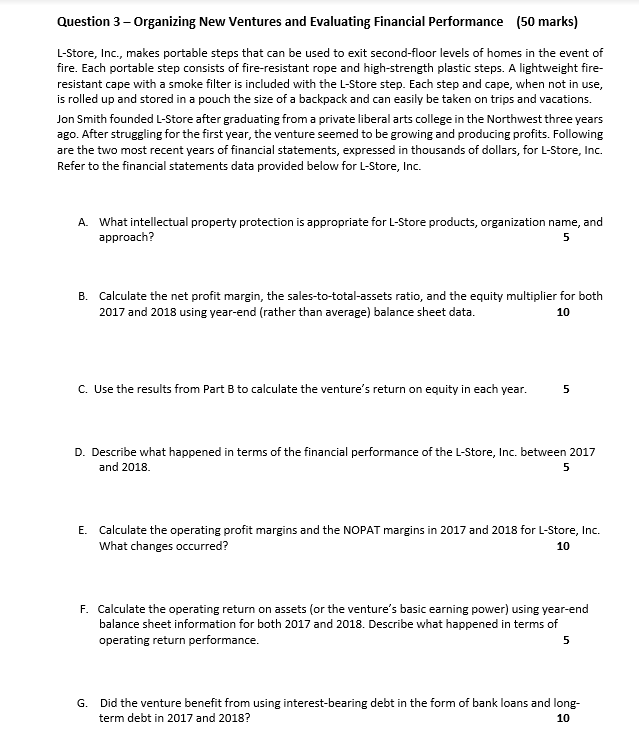

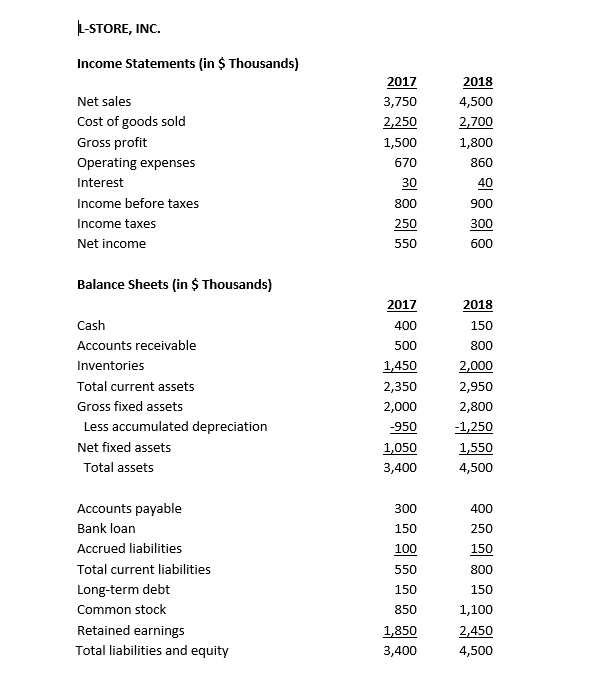

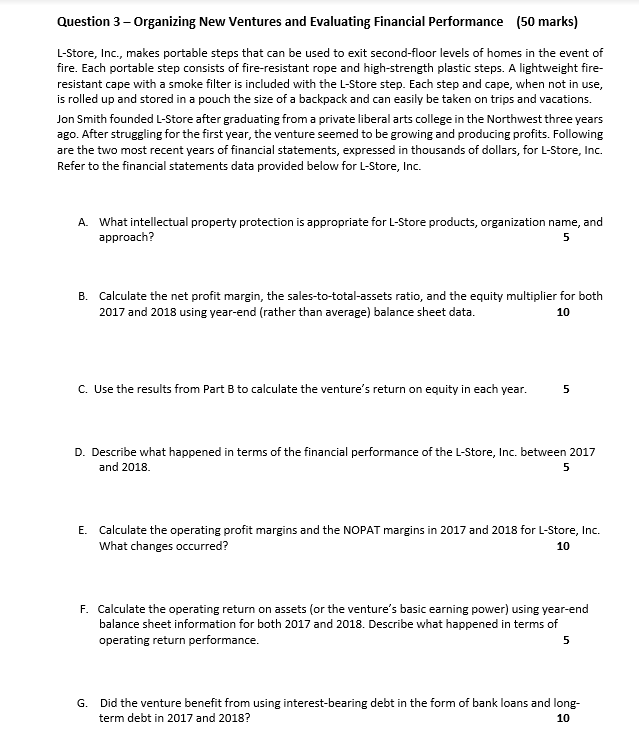

L-STORE, INC. Income Statements (in $ Thousands) 2017 3,750 2,250 1,500 670 30 2018 4,500 2,700 1,800 860 Net sales Cost of goods sold Gross profit Operating expenses Interest Income before taxes Income taxes Net income 40 800 900 250 300 600 550 Balance Sheets (in $ Thousands) 2018 Cash Accounts receivable Inventories Total current assets Gross fixed assets Less accumulated depreciation Net fixed assets Total assets 2017 400 500 1,450 2,350 2,000 150 800 2,000 2,950 2,800 -1,250 1,550 4,500 -950 1,050 3,400 300 150 100 400 250 150 550 800 Accounts payable Bank loan Accrued liabilities Total current liabilities Long-term debt Common stock Retained earnings Total liabilities and equity 150 150 850 1,850 3,400 1,100 2,450 4,500 Question 3 - Organizing New Ventures and Evaluating Financial Performance (50 marks) L-Store, Inc., makes portable steps that can be used to exit second-floor levels of homes in the event of fire. Each portable step consists of fire-resistant rope and high-strength plastic steps. A lightweight fire- resistant cape with a smoke filter is included with the L-Store step. Each step and cape, when not in use, is rolled up and stored in a pouch the size of a backpack and can easily be taken on trips and vacations. Jon Smith founded L-Store after graduating from a private liberal arts college in the Northwest three years ago. After struggling for the first year, the venture seemed to be growing and producing profits. Following are the two most recent years of financial statements, expressed in thousands of dollars, for L-Store, Inc. Refer to the financial statements data provided below for L-Store, Inc. A. What intellectual property protection is appropriate for L-Store products, organization name, and approach? 5 B. Calculate the net profit margin, the sales-to-total-assets ratio, and the equity multiplier for both 2017 and 2018 using year-end (rather than average) balance sheet data. 10 C. Use the results from Part B to calculate the venture's return on equity in each year. 5 D. Describe what happened in terms of the financial performance of the L-Store, Inc. between 2017 and 2018 5 E. Calculate the operating profit margins and the NOPAT margins in 2017 and 2018 for L-Store, Inc. What changes occurred? 10 F. Calculate the operating return on assets (or the venture's basic earning power) using year-end balance sheet information for both 2017 and 2018. Describe what happened in terms of operating return performance. 5 G. Did the venture benefit from using interest-bearing debt in the form of bank loans and long- term debt in 2017 and 2018? 10

please solve specially part E, F , G. Thank you

please solve specially part E, F , G. Thank you