Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve step by step for my understanding and my learning thank you plz solve this question and plz give me step by step solution

please solve step by step for my understanding and my learning thank you

plz solve this question and plz give me step by step solution with all calculations and all formulas for my learning thanks the question is Q6 tesco

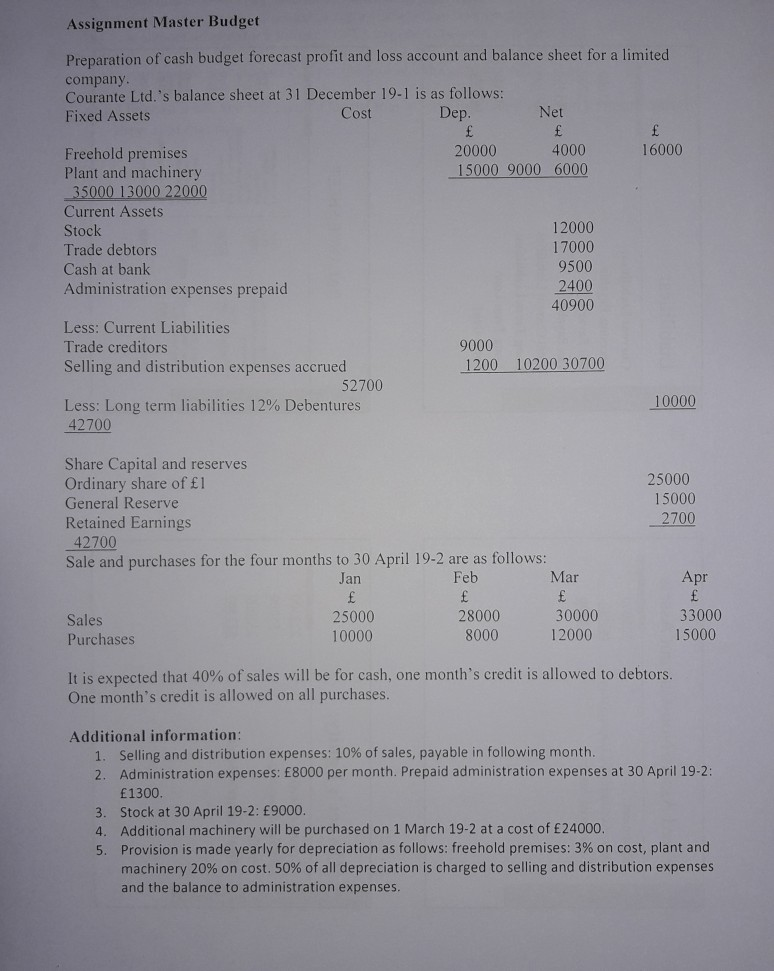

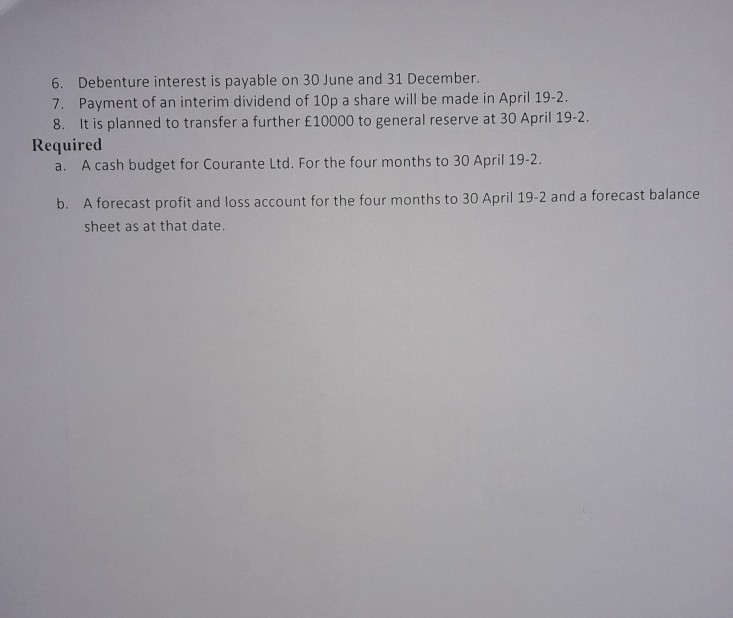

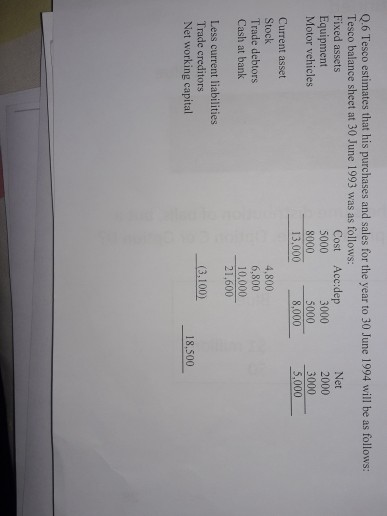

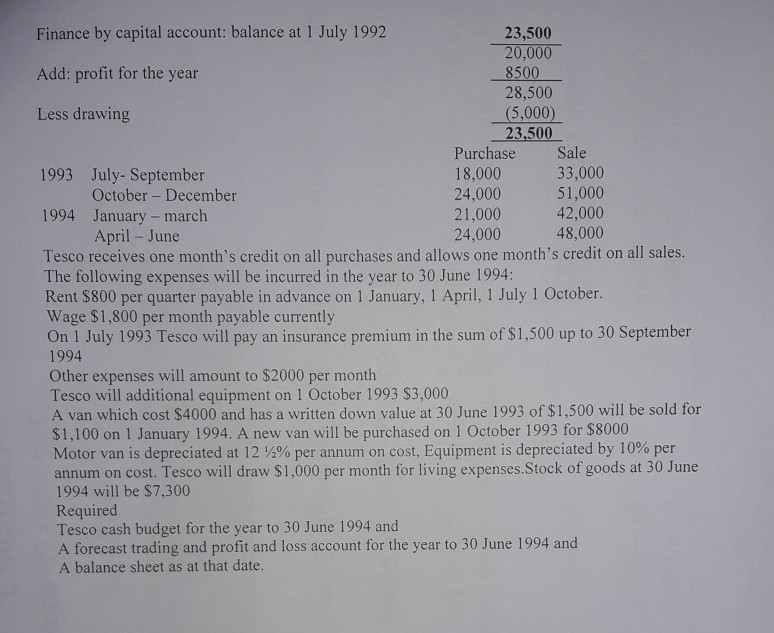

Assignment Master Budget Preparation of cash budget forecast profit and loss account and balance sheet for a limited company Courante Ltd.'s balance sheet at 31 December 19-1 is as follows: Fixed Assets Cost Dep. Net 16000 20000 4000 15000 9000 6000 Freehold premises Plant and machinery 35000 13000 22000 Current Assets Stock Trade debtors Cash at bank Administration expenses prepaid 12000 17000 9500 2400 40900 9000 1200 10200 30700 Less: Current Liabilities Trade creditors Selling and distribution expenses accrued 52700 Less: Long term liabilities 12% Debentures 42700 10000 Share Capital and reserves Ordinary share of 1 General Reserve Retained Earnings 42700 Sale and purchases for the four months to 30 April 19-2 are as follows: Mar 25000 15000 2700 Jan Feb Apr Sales Purchases 25000 10000 28000 8000 30000 12000 33000 15000 It is expected that 40% of sales will be for cash, one month's credit is allowed to debtors. One month's credit is allowed on all purchases. Additional information: 1. Selling and distribution expenses: 10% of sales, payable in following month. 2. Administration expenses: 8000 per month. Prepaid administration expenses at 30 April 19-2: 1300 3. Stock at 30 April 19-2: 9000. 4. Additional machinery will be purchased on 1 March 19-2 at a cost of 24000. 5. Provision is made yearly for depreciation as follows: freehold premises: 3% on cost, plant and machinery 20% on cost. 50% of all depreciation is charged to selling and distribution expenses and the balance to administration expenses. 6. Debenture interest is payable on 30 June and 31 December 7. Payment of an interim dividend of 10p a share will be made in April 19-2. 8. It is planned to transfer a further 10000 to general reserve at 30 April 19-2. Required a. A cash budget for Courante Ltd. For the four months to 30 April 19-2. b. A forecast profit and loss account for the four months to 30 April 19-2 and a forecast balance sheet as at that date. 0.6 Tesco estimates that his purchases and sales for the year to 30 June 1994 will be as follows: Tesco balance sheet at 30 June 1993 was as follows: Fixed assets Cost Acc.dep Net Equipment 5000 3000 2000 Motor vehicles 8000 5000 3000 13.000 8,000 5,000 Current asset Stock 4.800 Trade debtors 6,800 Cash at bank 10,000 21,600 Less current liabilities Trade creditors (3,100) Net working capital 18.500 Finance by capital account: balance at 1 July 1992 23,500 20,000 Add: profit for the year 8500 28,500 Less drawing (5,000) 23,500 Purchase Sale 1993 July-September 18,000 33,000 October - December 24.000 51,000 1994 January - march 21,000 42,000 April - June 24,000 48,000 Tesco receives one month's credit on all purchases and allows one month's credit on all sales. The following expenses will be incurred in the year to 30 June 1994: Rent $800 per quarter payable in advance on 1 January, 1 April, 1 July 1 October. Wage $1,800 per month payable currently On 1 July 1993 Tesco will pay an insurance premium in the sum of $1,500 up to 30 September 1994 Other expenses will amount to $2000 per month Tesco will additional equipment on 1 October 1993 $3,000 A van which cost $4000 and has a written down value at 30 June 1993 of $1,500 will be sold for $1,100 on 1 January 1994. A new van will be purchased on 1 October 1993 for $8000 Motor van is depreciated at 12 12% per annum on cost, Equipment is depreciated by 10% per annum on cost. Tesco will draw $1,000 per month for living expenses. Stock of goods at 30 June 1994 will be $7,300 Required Tesco cash budget for the year to 30 June 1994 and A forecast trading and profit and loss account for the year to 30 June 1994 and A balance sheet as at that dateStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started