Please Solve the 4 questions. makes sure you solve all parts of the question

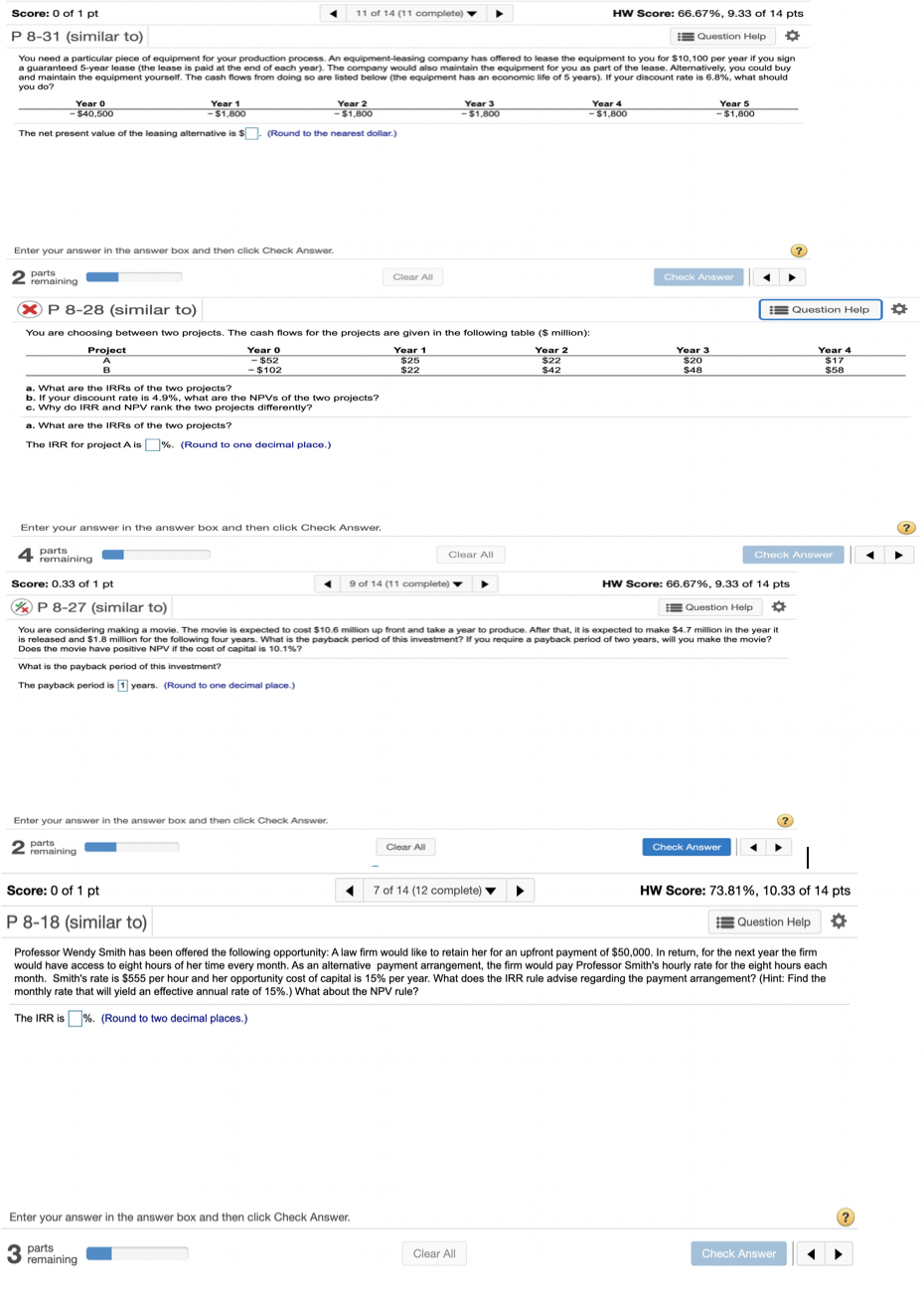

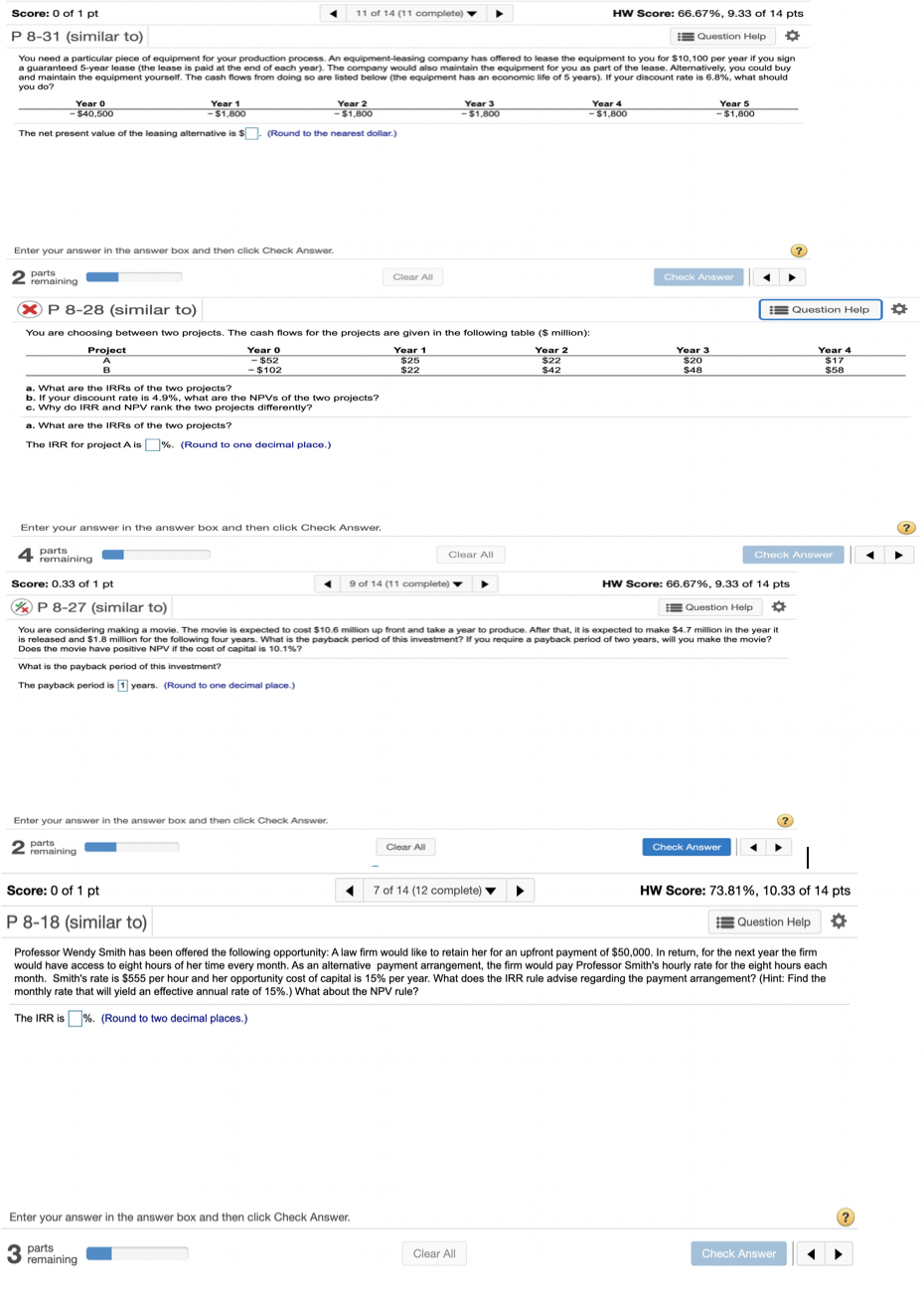

11 of 14 (11 complete) HW Score: 66.67%, 9.33 of 14 pts Score: 0 of 1 pt P 8-31 (similar to) 15 Question Help You need a particular piece of equipment for your production process. An equipment-leasing company has offered to lease the equipment to you for $10,100 per year if you sign a guaranteed 5-year lease (the lease is paid at the end of each year). The company would also maintain the equipment for you as part of the lease. Alternatively, you could buy and maintain the equipment yourself. The cash flows from doing so are listed below the equipment has an economic life of 5 years). If your discount rate is 6.8%, what should you do? Year 5 Year O - $40.500 Year 1 -$1,800 Year 2 -$1.800 Year 3 -$1,800 Year 4 - $1,800 -$1,800 The net present value of the leasing alternative is $ (Round to the nearest dollar.) Enter your answer in the answer box and then click Check Answer. o 2 parts remaining Clear All Check Answer | Question Help Year 3 $20 $48 Year 4 $17 $58 XP 8-28 (similar to) You are choosing between two projects. The cash flows for the projects are given in the following table ($ million): Project Year o Year 1 Year 2 - $52 $25 $22 -$102 $22 $42 a. What are the IRRs of the two projects? b. If your discount rate is 4.9%, what are the NPVs of the two projects? c. Why do IRR and NPV rank the two projects differently? a. What are the IRRs of the two projects? The IRR for project A is %. (Round to one decimal place.) Enter your answer in the answer box and then click Check Answer. A parts 4 remaining Clear All Check Answer Score: 0.33 of 1 pt 9 of 14 (11 complete) HW Score: 66.67%, 9.33 of 14 pts WP 8-27 (similar to) Question Help You are considering making a movie. The movie is expected to cost $10.6 million up front and take a year to produce. After that, it is expected to make $4.7 million in the year it is released and $1.8 million for the following four years. What is the payback period of this investment? If you require a payback period of two years, will you make the movie? Does the movie have positive NPV if the cost of capital is 10.1%7 What is the payback period of this investment? The payback period is 1 years. (Round to one decimal place.) Enter your answer in the answer box and then click Check Answer 2