Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the above problem. Thank You! Sweet Ltd is a manufacturer of confectionery and biscuits that commenced its business in late 2018. The company

Please solve the above problem. Thank You!

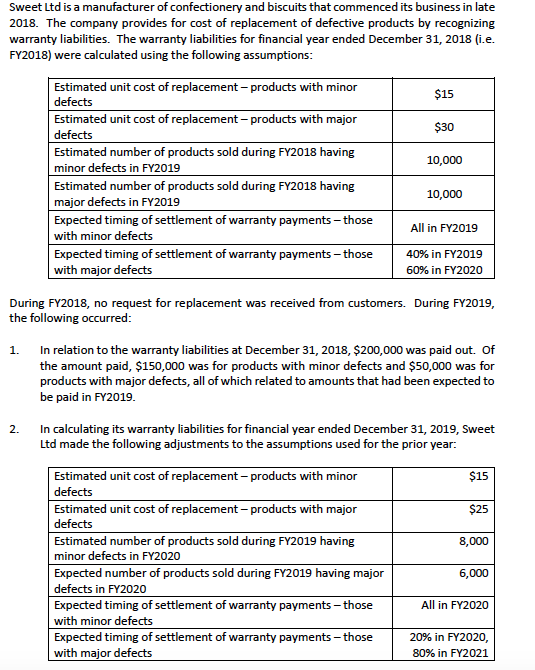

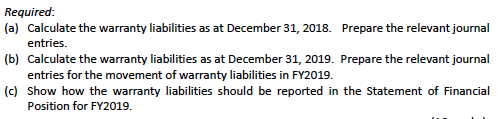

Sweet Ltd is a manufacturer of confectionery and biscuits that commenced its business in late 2018. The company provides for cost of replacement of defective products by recognizing warranty liabilities. The warranty liabilities for financial year ended December 31, 2018 (i.e. FY2018) were calculated using the following assumptions Estimated unit cost of replacement- products with minor defects Estimated unit cost of replacement defects Estimated number of products sold during FY2018 having minor defects in FY2019 Estimated number of products sold during FY2018 having major defects in FY2019 Expected timing of settlement of warranty payments-those with minor defects Expected timing of settlement of warranty payments-those with major defects 15 -products with major $30 10,000 10,000 All in FY2019 | 40% in FY2019 60% in FY2020 During FY2018, no request for replacement was received from customers. During FY2019, the following occurred In relation to the warranty liabilities at December 31, 2018, $200,000 was paid out. Of the amount paid, $150,000 was for products with minor defects and $50,000 was for products with major defects, all of which related to amounts that had been expected to be paid in FY2019 1. 2. In calculating its warranty liabilities for financial year ended December 31, 2019, Sweet Ltd made the following adjustments to the assumptions used for the prior year: Estimated unit cost of replacement- products with minor defects Estimated unit cost of replacement- products with major defects Estimated number of products sold during FY2019 having minor defects in FY2020 Expected number of products sold during FY2019 having major defects in FY2020 Expected timing of settlement of warranty payments-those with minor defects Expected timing of settlement of warranty payments-those with major defects 15 $25 8,000 6,000 All in FY2020 20% in FY2020 80% in FY2021 Required (a) Calculate the warranty liabilities as at December 31, 2018. (b) (c) Show how the warranty liabilities should be reported in the Statement of Financial Prepare the relevant journal entries. Calculate the warranty liabilities as at December 31, 2019. Prepare the relevant journal entries for the movement of warranty liabilities in FY2019. Position for FY2019Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started