Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the below Financial Management Question in step by step in details explanation 3.a) Capital budgeting is one of the most discussed and central

Please solve the below Financial Management Question in step by step in details explanation

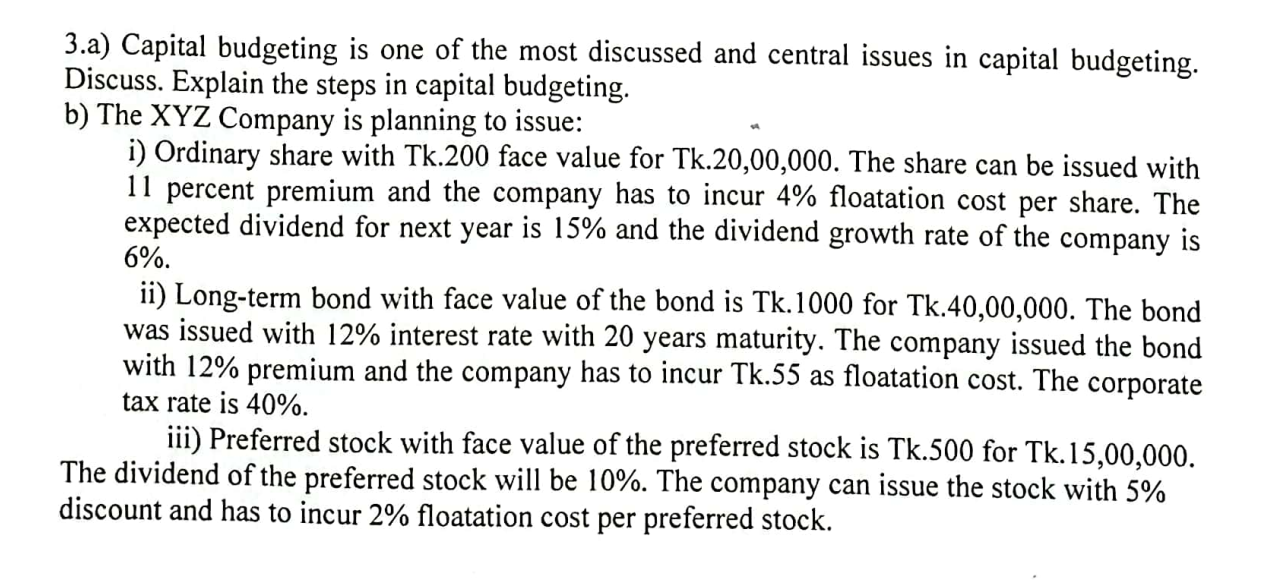

3.a) Capital budgeting is one of the most discussed and central issues in capital budgeting. Discuss. Explain the steps in capital budgeting. b) The XYZ Company is planning to issue: i) Ordinary share with Tk.200 face value for Tk.20,00,000. The share can be issued with 11 percent premium and the company has to incur 4% floatation cost per share. The expected dividend for next year is 15% and the dividend growth rate of the company is 6%. ii) Long-term bond with face value of the bond is Tk.1000 for Tk.40,00,000. The bond was issued with 12% interest rate with 20 years maturity. The company issued the bond with 12% premium and the company has to incur Tk.55 as floatation cost. The corporate tax rate is 40%. iii) Preferred stock with face value of the preferred stock is Tk.500 for Tk.15,00,000. The dividend of the preferred stock will be 10%. The company can issue the stock with 5% discount and has to incur 2% floatation cost per preferred stock

3.a) Capital budgeting is one of the most discussed and central issues in capital budgeting. Discuss. Explain the steps in capital budgeting. b) The XYZ Company is planning to issue: i) Ordinary share with Tk.200 face value for Tk.20,00,000. The share can be issued with 11 percent premium and the company has to incur 4% floatation cost per share. The expected dividend for next year is 15% and the dividend growth rate of the company is 6%. ii) Long-term bond with face value of the bond is Tk.1000 for Tk.40,00,000. The bond was issued with 12% interest rate with 20 years maturity. The company issued the bond with 12% premium and the company has to incur Tk.55 as floatation cost. The corporate tax rate is 40%. iii) Preferred stock with face value of the preferred stock is Tk.500 for Tk.15,00,000. The dividend of the preferred stock will be 10%. The company can issue the stock with 5% discount and has to incur 2% floatation cost per preferred stock Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started