Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the below questions and 2021 is the year which need to use for tax calculations. Martha is a self-employed tax accountant who drives

Please solve the below questions and 2021 is the year which need to use for tax calculations.

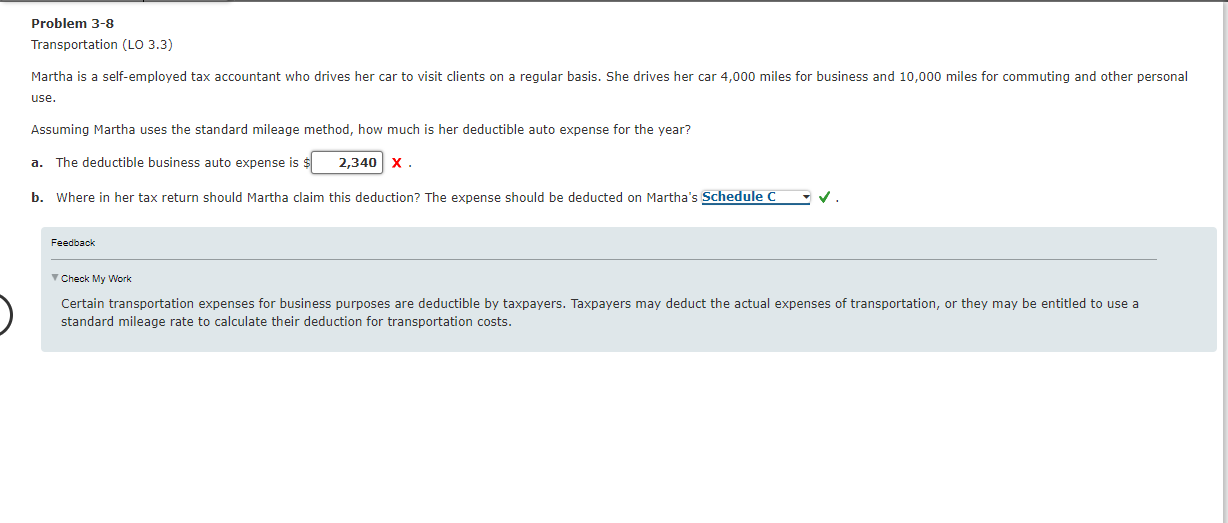

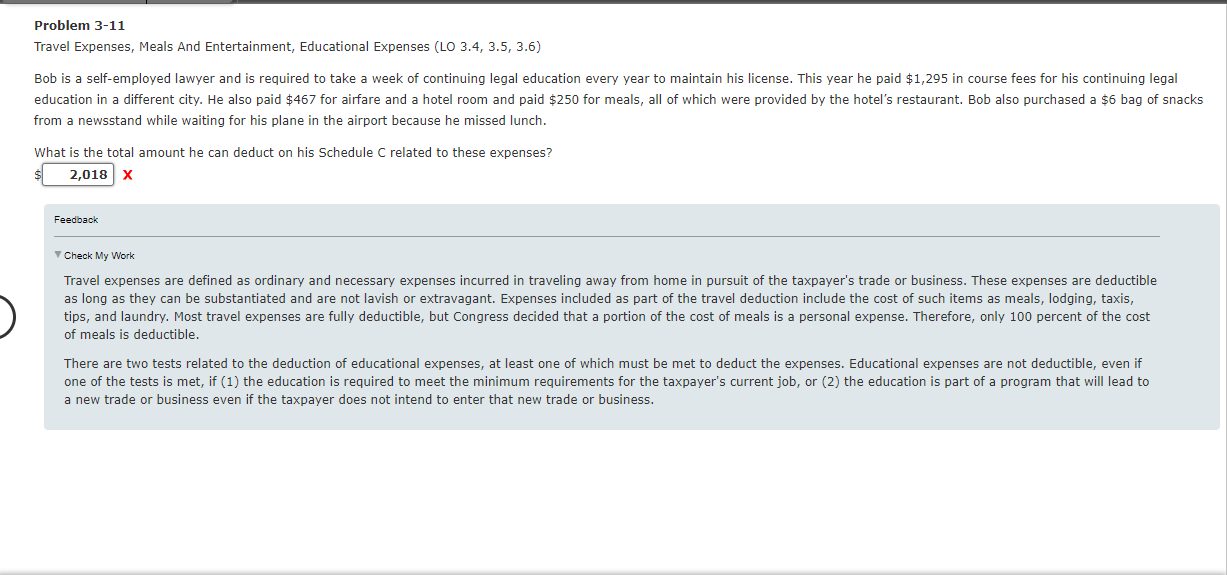

Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 miles for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her deductible auto expense for the year? a. The deductible business auto expense is $ x. b. Where in her tax return should Martha claim this deduction? The expense should be deducted on Martha's Feedback 7 Check My Work Certain transportation expenses for business purposes are deductible by taxpayers. Taxpayers may deduct the actual expenses of transportation, or they may be entitled to use a standard mileage rate to calculate their deduction for transportation costs. Problem 3-11 Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6) from a newsstand while waiting for his plane in the airport because he missed lunch. What is the total amount he can deduct on his Schedule C related to these expenses? $x Feedback Check My Work of meals is deductible. a new trade or business even if the taxpayer does not intend to enter that new trade or business

Martha is a self-employed tax accountant who drives her car to visit clients on a regular basis. She drives her car 4,000 miles for business and 10,000 miles for commuting and other personal use. Assuming Martha uses the standard mileage method, how much is her deductible auto expense for the year? a. The deductible business auto expense is $ x. b. Where in her tax return should Martha claim this deduction? The expense should be deducted on Martha's Feedback 7 Check My Work Certain transportation expenses for business purposes are deductible by taxpayers. Taxpayers may deduct the actual expenses of transportation, or they may be entitled to use a standard mileage rate to calculate their deduction for transportation costs. Problem 3-11 Travel Expenses, Meals And Entertainment, Educational Expenses (LO 3.4, 3.5, 3.6) from a newsstand while waiting for his plane in the airport because he missed lunch. What is the total amount he can deduct on his Schedule C related to these expenses? $x Feedback Check My Work of meals is deductible. a new trade or business even if the taxpayer does not intend to enter that new trade or business Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started