please solve the c,d,e(answer of a is given),you can directly leave AIMMS(you may don"t have this software).

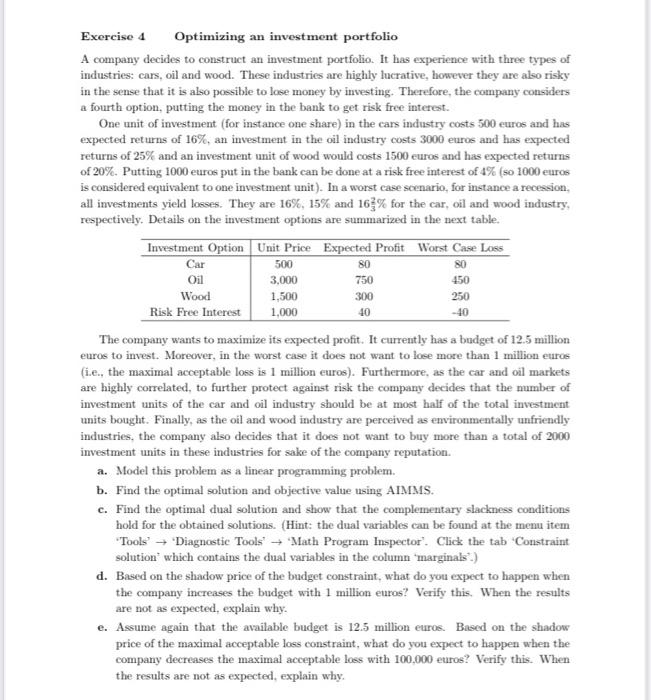

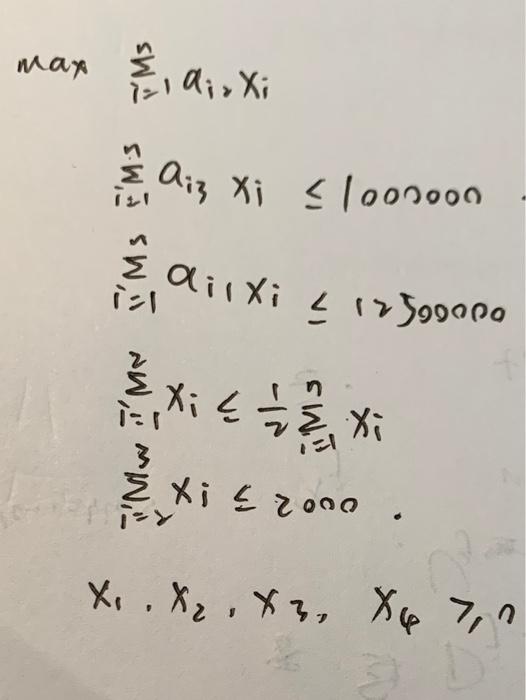

Exercise 4 Optimizing an investment portfolio A company decides to construct an investment portfolio. It has experience with three types of industries: cars, oil and wood. These industries are highly lucrative, however they are also risky in the sense that it is also possible to lose money by investing. Therefore, the company considers a fourth option, putting the money in the bank to get risk free interest. One unit of investment (for instance one share) in the cars industry costs 500 euros and has expected returns of 16%, an investment in the oil industry costs 3000 euros and has expected returns of 25% and an investment unit of wood would costs 1500 euros and has expected returns of 20%. Putting 1000 euros put in the bank can be done at a risk free interest of 4% (so 1000 euros is considered equivalent to one investment unit). In a worst case scenario, for instance a recession, all investments yield losses. They are 16%, 15% and 16% for the car, oil and wood industry, respectively. Details on the investment options are summarized in the next table. Investment Option Unit Price Expected Profit Worst Case Loss Car 500 80 80 Oil 750 450 Wood 3,000 1,500 1,000 300 250 Risk Free Interest 40 -40 The company wants to maximize its expected profit. It currently has a budget of 12.5 million euros to invest. Moreover, in the worst case it does not want to lose more than 1 million euros (i.e., the maximal acceptable loss is 1 million euros). Furthermore, as the car and oil markets are highly correlated to further protect against risk the company decides that the mumber of investment units of the car and oil industry should be at most half of the total investment units bought. Finally, as the oil and wood industry are perceived as environmentally unfriendly industries, the company also decides that it does not want to buy more than a total of 2000 investment units in these industries for sake of the company reputation. a. Model this problem as a linear programming problem. b. Find the optimal solution and objective value using AIMMS. C. Find the optimal dual solution and show that the complementary slackness conditions hold for the obtained solutions. (Hint: the dual variables can be found at the menu item "Tools Diagnostic Tools' + Math Program Inspector". Click the tab Constraint solution which contains the dual variables in the column 'marginals) d. Based on the shadow price of the budget constraint, what do you expect to happen when the company increases the budget with 1 million euros? Verify this. When the results are not as expected, explain why e. Assume again that the available budget is 12.5 million euros. Based on the shadow price of the maximal acceptable loss constraint, what do you expect to happen when the company decreases the maximal acceptable loss with 100.000 euros? Verify this. When the results are not as expected, explain why. ; Aiz xi