please solve the following

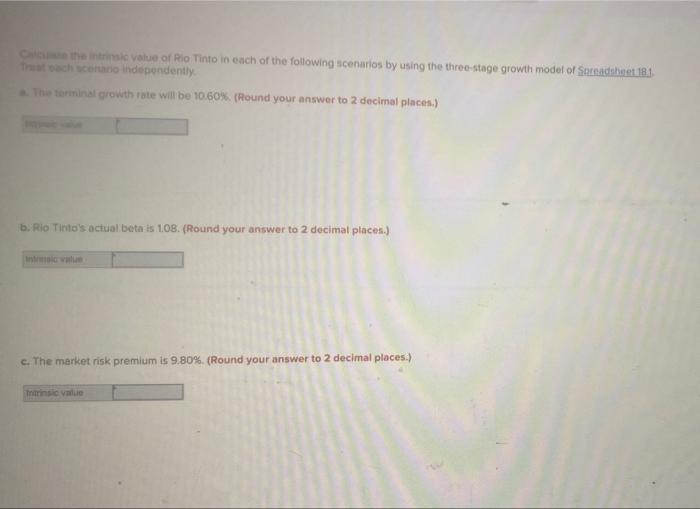

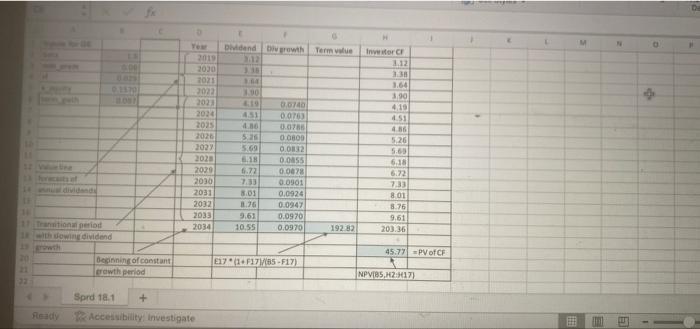

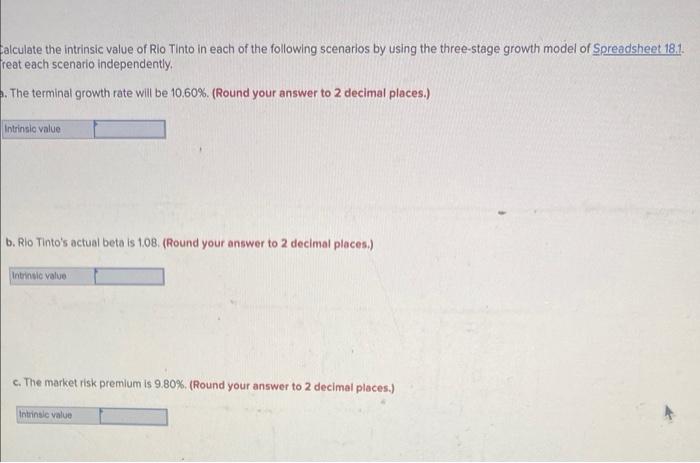

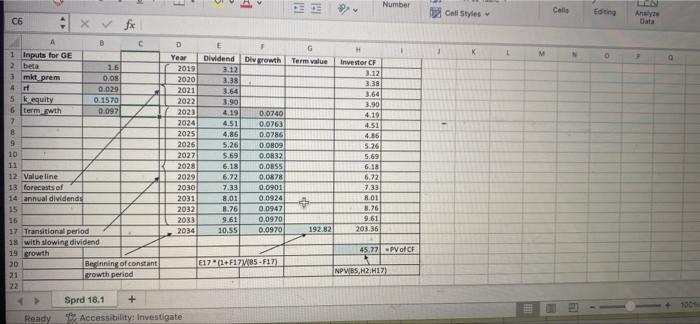

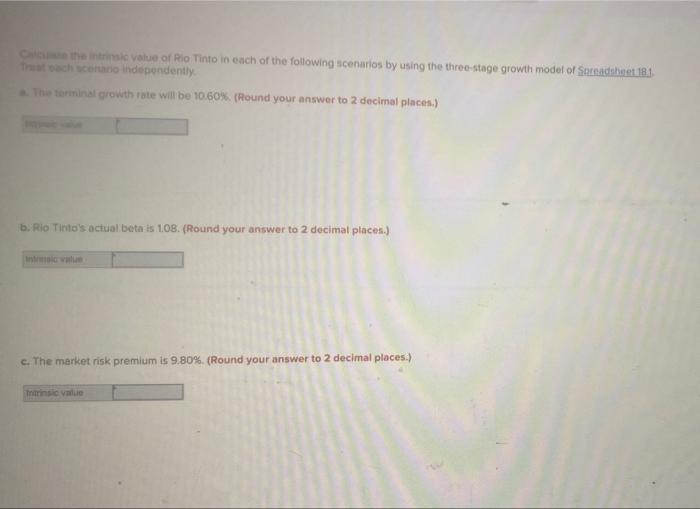

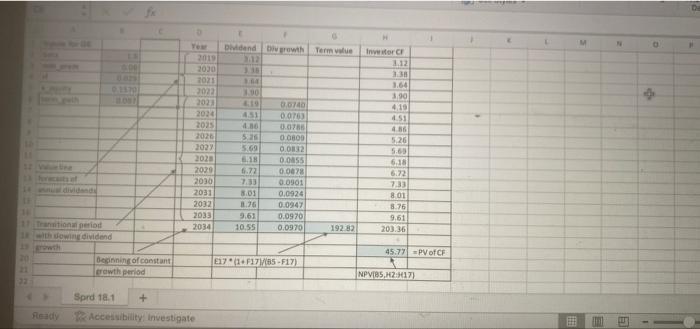

Cause the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1 Treat each scenario independently. a. The terminal growth rate will be 10.60%. (Round your answer to 2 decimal places.) b. Rio Tinto's actual beta is 1.08. (Round your answer to 2 decimal places.) Intric value c. The market risk premium is 9.80%. (Round your answer to 2 decimal places.) Intrinsic value 0.1570 Dividend Div growth Term value 3.12 3.38 164 3.90 0.0740 4.51 0.0763 4.86 0.0786 5.26 0.0809 5.69 0.0832 6.18 0.0055 6.72 0.0078 7.33 0.0901 8.01 0.0924 8.76 0.0947 9.61 0.0970 10.55 0.0970 E17 (1+F17/(85-F17) 2019 2030 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 17 VW tine 13 forecasts of 14ual dividends 17 Transitional period 18 with dowing dividend 20 Beginning of constant growth period 32 Sprd 18.1 + Ready Accessibility: Investigate 192.82 Investor CF T 3.12 3.38 3.64 1.90 4.19 4.51 4.86 5.26 5.69 6.18 6.72 7.33 8.01 8.76 9.61 203.36 4 45.77 PV of CF NPV(B5,H2H17) L M N E ET 0 Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. reat each scenario independently. . The terminal growth rate will be 10.60%. (Round your answer to 2 decimal places.) Intrinsic value b. Rio Tinto's actual beta is 1.08. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.80 %. (Round your answer to 2 decimal places.) Intrinsic value C6 A 1 Inputs for GE 2 beta 3 mkt prem 4 rf 5 k equity 6 term gwth 11 12 Valueline 13 forecasts of 14 annual dividends period 18 with slowing dividend 19 growth > Sprd 18.1 + Ready HEHEHEHEH 10 15 16 20 21 22 x fx B 1.6 0.08 0.029 0.1570 0.097 C Beginning of constant growth period E D Year 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Accessibility: Investigate F > E Dividend Div growth 3.12 3.38 3.64 3.90 4.19 0.0740 4.51 0.0763 4.86 0.0786 5.26 0.0809 5.69 0.0832 6.18 0.0855 6.72 0.0878 7.33 0.0901 8.01 0.0924 8.76 0.0947 9.61 0,0970 10.55 0.0970 E17 (1+F1785-F17) IM H Term value + 192.82 Number T Investor CF 3.12 3.38 3.64 3.90 4.19 4.51 4.86 5.26 5.69 6.18 6.72 7.33 8.01 8.76 9.61 203.36 45.77 PV of CF NPVBS,H2 H17) 3 Cell Styles K M Celle N Editing O LEN Analyze Q 100% Cause the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1 Treat each scenario independently. a. The terminal growth rate will be 10.60%. (Round your answer to 2 decimal places.) b. Rio Tinto's actual beta is 1.08. (Round your answer to 2 decimal places.) Intric value c. The market risk premium is 9.80%. (Round your answer to 2 decimal places.) Intrinsic value 0.1570 Dividend Div growth Term value 3.12 3.38 164 3.90 0.0740 4.51 0.0763 4.86 0.0786 5.26 0.0809 5.69 0.0832 6.18 0.0055 6.72 0.0078 7.33 0.0901 8.01 0.0924 8.76 0.0947 9.61 0.0970 10.55 0.0970 E17 (1+F17/(85-F17) 2019 2030 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 17 VW tine 13 forecasts of 14ual dividends 17 Transitional period 18 with dowing dividend 20 Beginning of constant growth period 32 Sprd 18.1 + Ready Accessibility: Investigate 192.82 Investor CF T 3.12 3.38 3.64 1.90 4.19 4.51 4.86 5.26 5.69 6.18 6.72 7.33 8.01 8.76 9.61 203.36 4 45.77 PV of CF NPV(B5,H2H17) L M N E ET 0 Calculate the intrinsic value of Rio Tinto in each of the following scenarios by using the three-stage growth model of Spreadsheet 18.1. reat each scenario independently. . The terminal growth rate will be 10.60%. (Round your answer to 2 decimal places.) Intrinsic value b. Rio Tinto's actual beta is 1.08. (Round your answer to 2 decimal places.) Intrinsic value c. The market risk premium is 9.80 %. (Round your answer to 2 decimal places.) Intrinsic value C6 A 1 Inputs for GE 2 beta 3 mkt prem 4 rf 5 k equity 6 term gwth 11 12 Valueline 13 forecasts of 14 annual dividends period 18 with slowing dividend 19 growth > Sprd 18.1 + Ready HEHEHEHEH 10 15 16 20 21 22 x fx B 1.6 0.08 0.029 0.1570 0.097 C Beginning of constant growth period E D Year 2019 2020 2021 2022 2023 2024 2025 2026 2027 2028 2029 2030 2031 2032 2033 2034 Accessibility: Investigate F > E Dividend Div growth 3.12 3.38 3.64 3.90 4.19 0.0740 4.51 0.0763 4.86 0.0786 5.26 0.0809 5.69 0.0832 6.18 0.0855 6.72 0.0878 7.33 0.0901 8.01 0.0924 8.76 0.0947 9.61 0,0970 10.55 0.0970 E17 (1+F1785-F17) IM H Term value + 192.82 Number T Investor CF 3.12 3.38 3.64 3.90 4.19 4.51 4.86 5.26 5.69 6.18 6.72 7.33 8.01 8.76 9.61 203.36 45.77 PV of CF NPVBS,H2 H17) 3 Cell Styles K M Celle N Editing O LEN Analyze Q 100%