Please solve the following

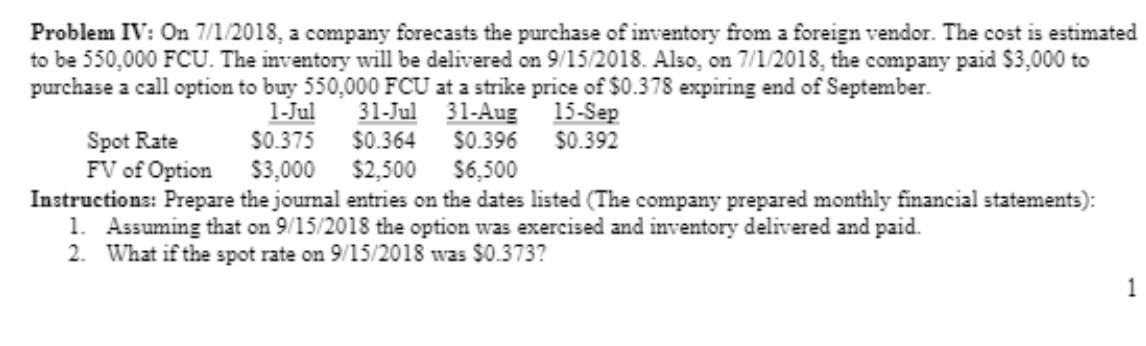

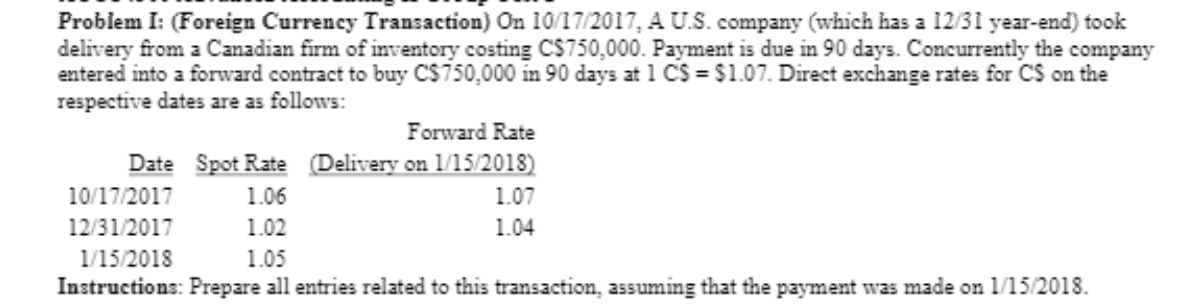

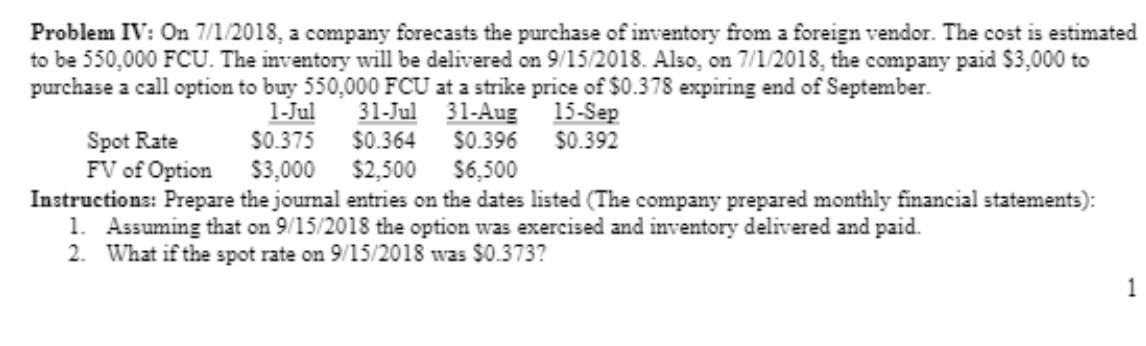

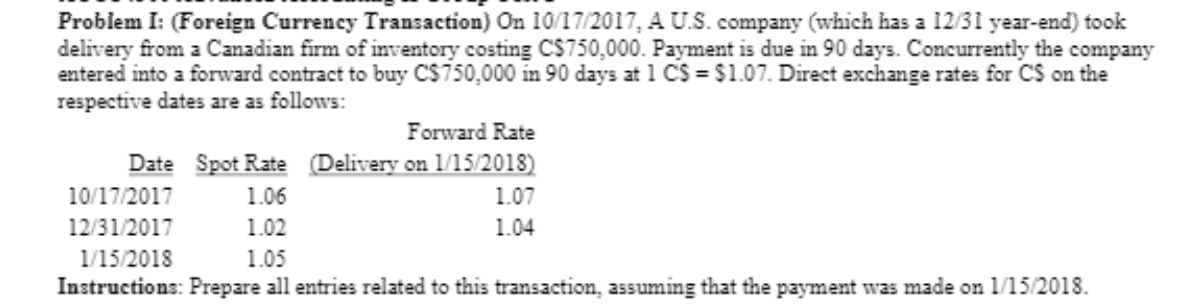

Problem IV: On 7/1/2018, a company forecasts the purchase of inventory from a foreign vendor. The cost is estimated to be 550.000 FCU. The inventory will be delivered on 9/15/2018. Also, on 7/1/2018, the company paid $3,000 to purchase a call option to buy 550.000 FCU at a strike price of $0.378 expiring end of September. 1-Jul 31-Jul 31-Aug 15-Sep Spot Rate $0.375 $0.364 $0.396 $0.392 FV of Option $3,000 $2,500 $6,500 Instructions: Prepare the journal entries on the dates listed (The company prepared monthly financial statements): 1. Assuming that on 9/15/2018 the option was exercised and inventory delivered and paid. 2. What if the spot rate on 9/15/2018 was $0.373? 1 Problem I: (Foreign Currency Transaction) On 10/17/2017, A U.S.company (which has a 12/31 year-end) took delivery from a Canadian firm of inventory costing CS750,000. Payment is due in 90 days. Concurrently the company entered into a forward contract to buy C$750,000 in 90 days at 1 CS = $1.07. Direct exchange rates for Cs on the respective dates are as follows: Forward Rate Date Spot Rate Delivery on 1/15/2018) 10/17/2017 1.06 1.07 12/31/2017 1.02 1.04 1/15/2018 1.05 Instructions: Prepare all entries related to this transaction, assuming that the payment was made on 1/15/2018. Problem IV: On 7/1/2018, a company forecasts the purchase of inventory from a foreign vendor. The cost is estimated to be 550.000 FCU. The inventory will be delivered on 9/15/2018. Also, on 7/1/2018, the company paid $3,000 to purchase a call option to buy 550.000 FCU at a strike price of $0.378 expiring end of September. 1-Jul 31-Jul 31-Aug 15-Sep Spot Rate $0.375 $0.364 $0.396 $0.392 FV of Option $3,000 $2,500 $6,500 Instructions: Prepare the journal entries on the dates listed (The company prepared monthly financial statements): 1. Assuming that on 9/15/2018 the option was exercised and inventory delivered and paid. 2. What if the spot rate on 9/15/2018 was $0.373? 1 Problem I: (Foreign Currency Transaction) On 10/17/2017, A U.S.company (which has a 12/31 year-end) took delivery from a Canadian firm of inventory costing CS750,000. Payment is due in 90 days. Concurrently the company entered into a forward contract to buy C$750,000 in 90 days at 1 CS = $1.07. Direct exchange rates for Cs on the respective dates are as follows: Forward Rate Date Spot Rate Delivery on 1/15/2018) 10/17/2017 1.06 1.07 12/31/2017 1.02 1.04 1/15/2018 1.05 Instructions: Prepare all entries related to this transaction, assuming that the payment was made on 1/15/2018