Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the following questions 1. The following are selected data for Lopez Furniture: Using the selected data above, determine total (a) direct materials, (b)

Please solve the following questions

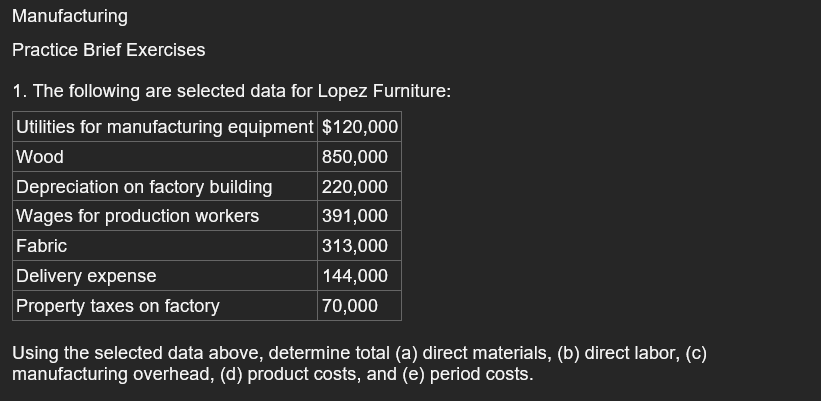

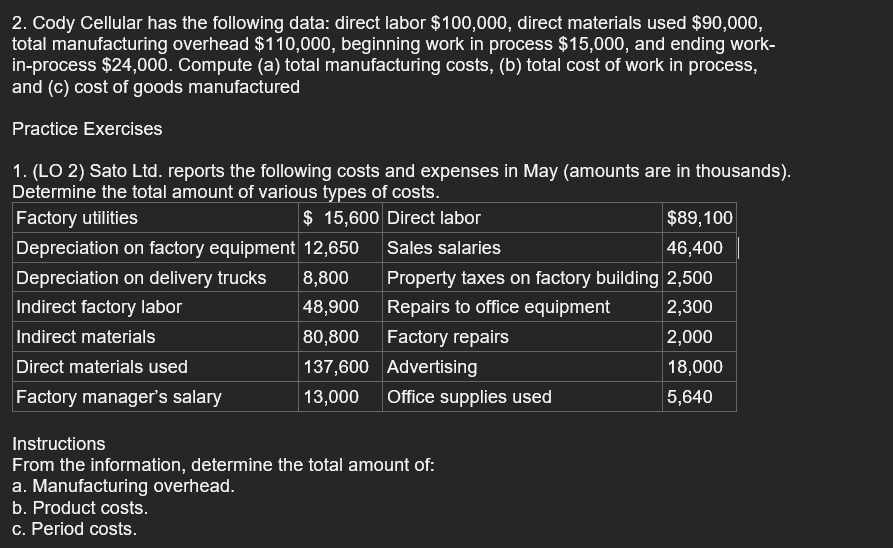

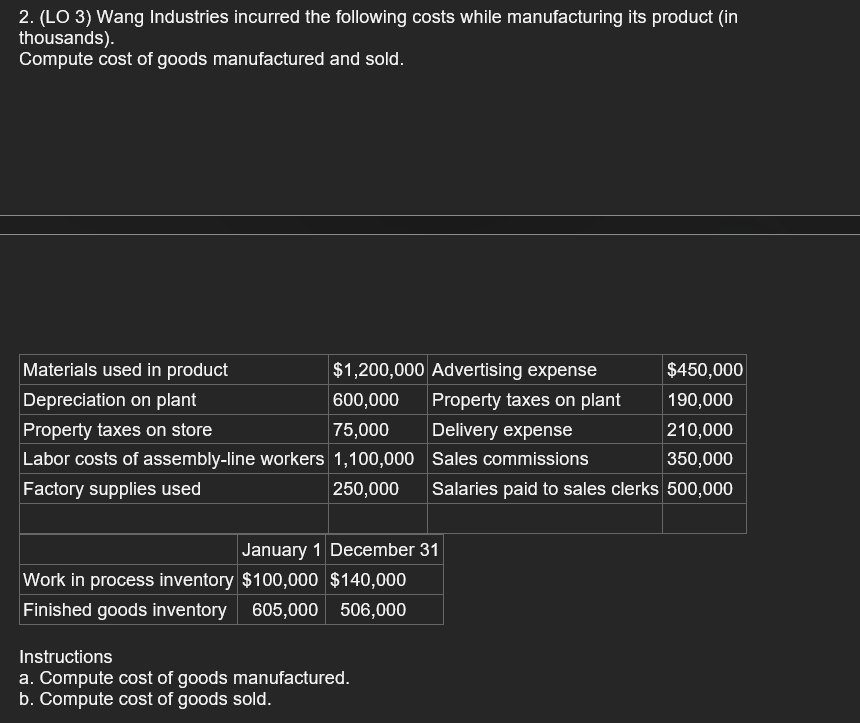

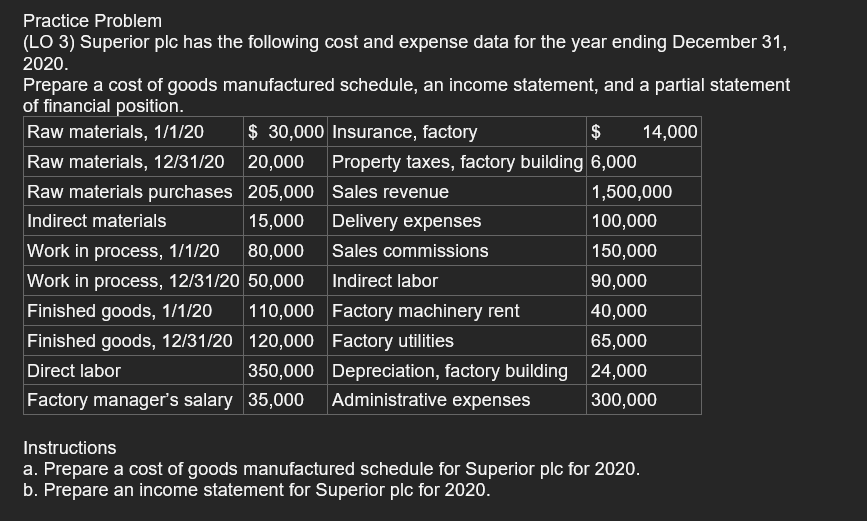

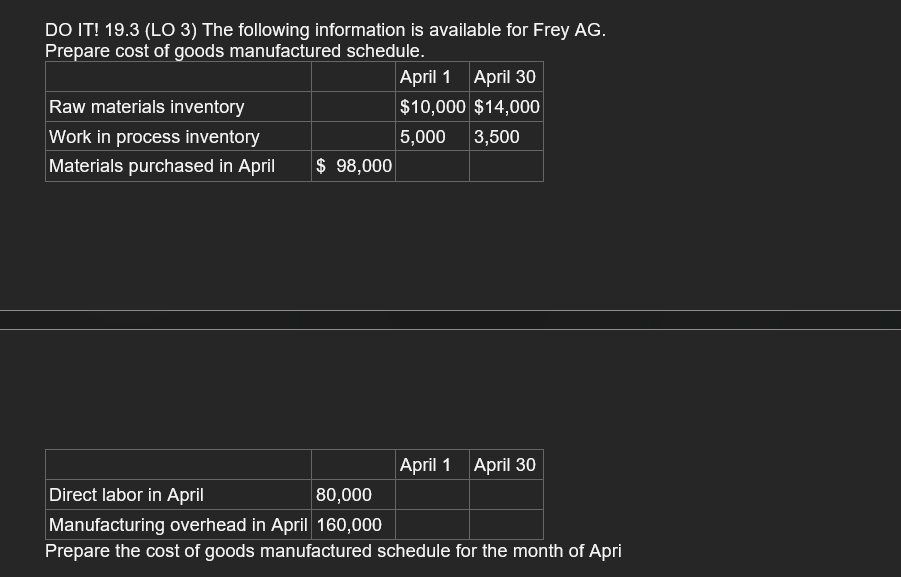

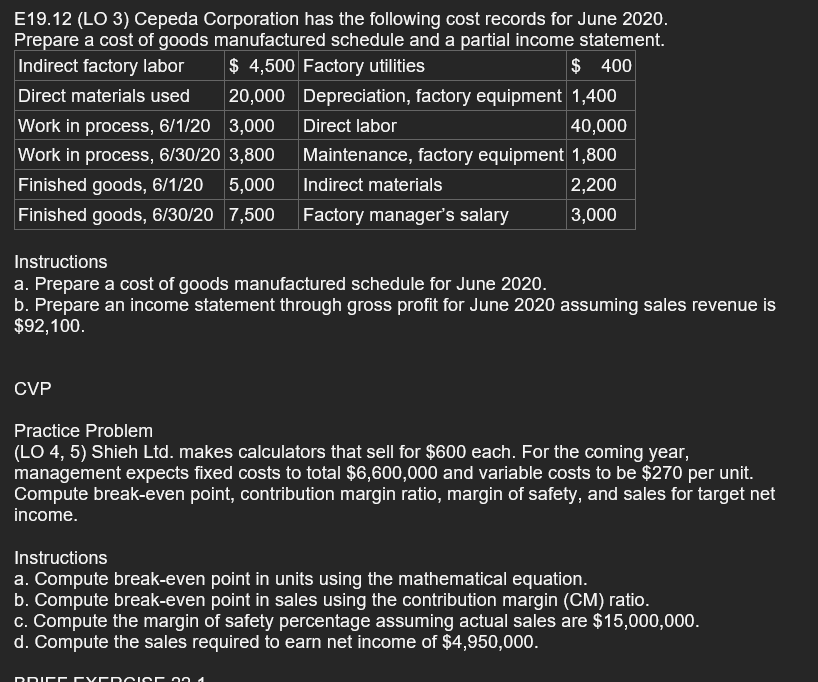

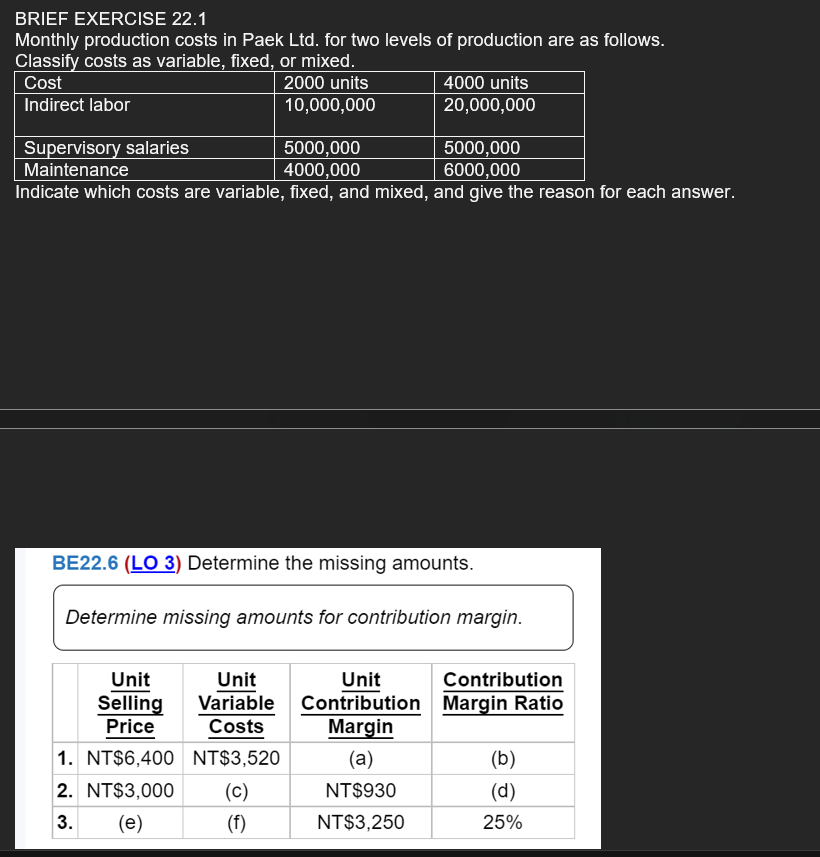

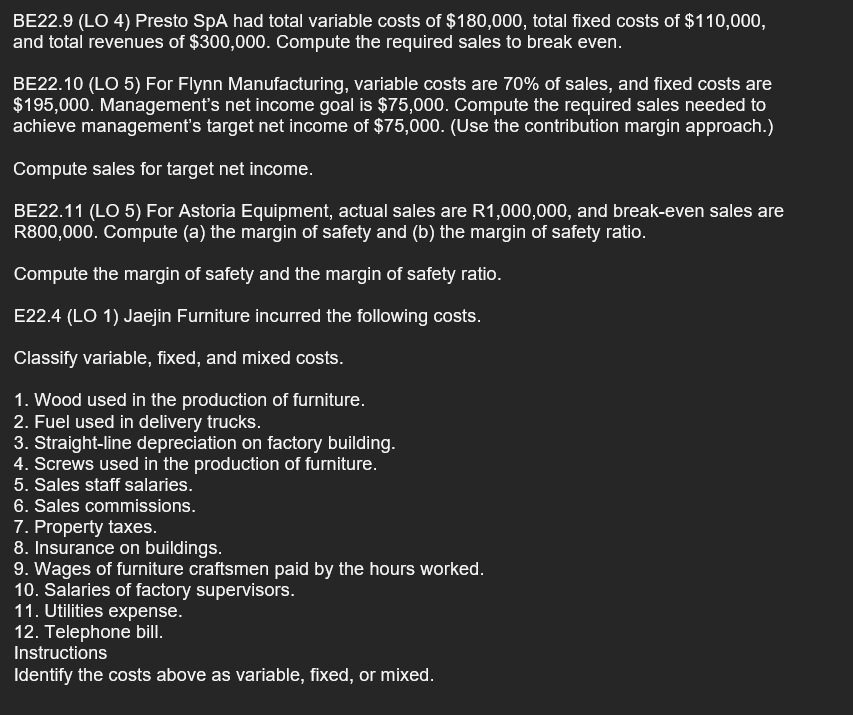

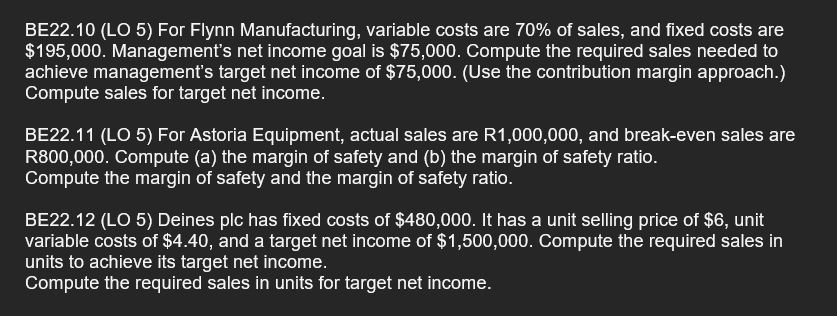

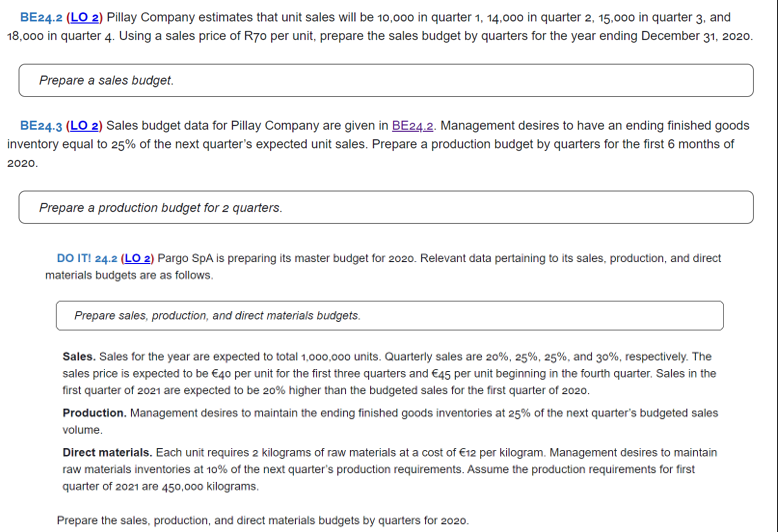

1. The following are selected data for Lopez Furniture: Using the selected data above, determine total (a) direct materials, (b) direct labor, (c manufacturing overhead, (d) product costs, and (e) period costs. 2. Cody Cellular has the following data: direct labor $100,000, direct materials used $90,000, total manufacturing overhead $110,000, beginning work in process $15,000, and ending workin-process $24,000. Compute (a) total manufacturing costs, (b) total cost of work in process, and (c) cost of goods manufactured Practice Exercises 1. (LO 2) Sato Ltd. reports the following costs and expenses in May (amounts are in thousands). Determine the total amount of various types of costs. Instructions From the information, determine the total amount of: a. Manufacturing overhead. b. Product costs. c. Period costs. 2. (LO 3) Wang Industries incurred the following costs while manufacturing its product (in thousands). Compute cost of goods manufactured and sold. Practice Problem (LO 3) Superior plc has the following cost and expense data for the year ending December 31, 2020. Prepare a cost of goods manufactured schedule, an income statement, and a partial statement of financial nosition. Instructions a. Prepare a cost of goods manufactured schedule for Superior plc for 2020 . b. Prepare an income statement for Superior plc for 2020. DO IT! 19.3 (LO 3) The following information is available for Frey AG. Prepare cost of goods manufactured schedule. E19.12 (LO 3) Cepeda Corporation has the following cost records for June 2020. Prepare a cost of goods manufactured schedule and a partial income statement. Instructions a. Prepare a cost of goods manufactured schedule for June 2020. b. Prepare an income statement through gross profit for June 2020 assuming sales revenue is $92,100. CVP Practice Problem (LO 4, 5) Shieh Ltd. makes calculators that sell for $600 each. For the coming year, management expects fixed costs to total $6,600,000 and variable costs to be $270 per unit. Compute break-even point, contribution margin ratio, margin of safety, and sales for target net income. Instructions a. Compute break-even point in units using the mathematical equation. b. Compute break-even point in sales using the contribution margin (CM) ratio. c. Compute the margin of safety percentage assuming actual sales are $15,000,000. d. Compute the sales required to earn net income of $4,950,000. BRIEF EXERCISE 22.1 Monthly production costs in Paek Ltd. for two levels of production are as follows. Classify costs as variable, fixed, or mixed. Indicate which costs are variable, fixed, and mixed, and give the reason for each answer. BE22.6 ( 3) Determine the missing amounts. Determine missing amounts for contribution margin. BE22.9 (LO 4) Presto SpA had total variable costs of $180,000, total fixed costs of $110,000, and total revenues of $300,000. Compute the required sales to break even. BE22.10 (LO 5) For Flynn Manufacturing, variable costs are 70\% of sales, and fixed costs are $195,000. Management's net income goal is $75,000. Compute the required sales needed to achieve management's target net income of $75,000. (Use the contribution margin approach.) Compute sales for target net income. BE22.11 (LO 5) For Astoria Equipment, actual sales are R1,000,000, and break-even sales are R800,000. Compute (a) the margin of safety and (b) the margin of safety ratio. Compute the margin of safety and the margin of safety ratio. E22.4 (LO 1) Jaejin Furniture incurred the following costs. Classify variable, fixed, and mixed costs. 1. Wood used in the production of furniture. 2. Fuel used in delivery trucks. 3. Straight-line depreciation on factory building. 4. Screws used in the production of furniture. 5. Sales staff salaries. 6. Sales commissions. 7. Property taxes. 8. Insurance on buildings. 9. Wages of furniture craftsmen paid by the hours worked. 10. Salaries of factory supervisors. 11. Utilities expense. 12. Telephone bill. Instructions Identify the costs above as variable, fixed, or mixed. BE22.10 (LO 5) For Flynn Manufacturing, variable costs are 70% of sales, and fixed costs are $195,000. Management's net income goal is $75,000. Compute the required sales needed to achieve management's target net income of $75,000. (Use the contribution margin approach.) Compute sales for target net income. BE22.11 (LO 5) For Astoria Equipment, actual sales are R1,000,000, and break-even sales are R800,000. Compute (a) the margin of safety and (b) the margin of safety ratio. Compute the margin of safety and the margin of safety ratio. BE22.12 (LO 5) Deines plc has fixed costs of $480,000. It has a unit selling price of $6, unit variable costs of $4.40, and a target net income of $1,500,000. Compute the required sales in units to achieve its target net income. Compute the required sales in units for target net income. BE24.2 (LO 2) Pillay Company estimates that unit sales will be 10,000 in quarter 1,14,000 in quarter 2, 15,000 in quarter 3 , and 18,000 in quarter 4 . Using a sales price of R70 per unit, prepare the sales budget by quarters for the year ending December 31,2020 . ( BE24.3 ( LO2 ) Sales budget data for Pillay Company are given in BE244.2. Management desires to have an ending finished goods inventory equal to 25% of the next quarter's expected unit sales. Prepare a production budget by quarters for the first 6 months of 2020. DO IT! 24.2 (LO 2) Pargo SpA is preparing its master budget for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 20%,25%,25%, and 30%, respectively. The sales price is expected to be 40 per unit for the first three quarters and 45 per unit beginning in the fourth quarter. Sales in the first quarter of 2021 are expected to be 20% higher than the budgeted sales for the first quarter of 2020 . Production. Management desires to maintain the ending finished goods inventories at 25% of the next quarter's budgeted sales volume. Direct materials. Each unit requires 2 kilograms of raw materials at a cost of 12 per kilogram. Management desires to maintain raw materials inventories at 10% of the next quarter's production requirements. Assume the production requirements for first quarter of 2021 are 450,000 kilograms. Prepare the sales, production, and direct materials budgets by quarters for 2020

1. The following are selected data for Lopez Furniture: Using the selected data above, determine total (a) direct materials, (b) direct labor, (c manufacturing overhead, (d) product costs, and (e) period costs. 2. Cody Cellular has the following data: direct labor $100,000, direct materials used $90,000, total manufacturing overhead $110,000, beginning work in process $15,000, and ending workin-process $24,000. Compute (a) total manufacturing costs, (b) total cost of work in process, and (c) cost of goods manufactured Practice Exercises 1. (LO 2) Sato Ltd. reports the following costs and expenses in May (amounts are in thousands). Determine the total amount of various types of costs. Instructions From the information, determine the total amount of: a. Manufacturing overhead. b. Product costs. c. Period costs. 2. (LO 3) Wang Industries incurred the following costs while manufacturing its product (in thousands). Compute cost of goods manufactured and sold. Practice Problem (LO 3) Superior plc has the following cost and expense data for the year ending December 31, 2020. Prepare a cost of goods manufactured schedule, an income statement, and a partial statement of financial nosition. Instructions a. Prepare a cost of goods manufactured schedule for Superior plc for 2020 . b. Prepare an income statement for Superior plc for 2020. DO IT! 19.3 (LO 3) The following information is available for Frey AG. Prepare cost of goods manufactured schedule. E19.12 (LO 3) Cepeda Corporation has the following cost records for June 2020. Prepare a cost of goods manufactured schedule and a partial income statement. Instructions a. Prepare a cost of goods manufactured schedule for June 2020. b. Prepare an income statement through gross profit for June 2020 assuming sales revenue is $92,100. CVP Practice Problem (LO 4, 5) Shieh Ltd. makes calculators that sell for $600 each. For the coming year, management expects fixed costs to total $6,600,000 and variable costs to be $270 per unit. Compute break-even point, contribution margin ratio, margin of safety, and sales for target net income. Instructions a. Compute break-even point in units using the mathematical equation. b. Compute break-even point in sales using the contribution margin (CM) ratio. c. Compute the margin of safety percentage assuming actual sales are $15,000,000. d. Compute the sales required to earn net income of $4,950,000. BRIEF EXERCISE 22.1 Monthly production costs in Paek Ltd. for two levels of production are as follows. Classify costs as variable, fixed, or mixed. Indicate which costs are variable, fixed, and mixed, and give the reason for each answer. BE22.6 ( 3) Determine the missing amounts. Determine missing amounts for contribution margin. BE22.9 (LO 4) Presto SpA had total variable costs of $180,000, total fixed costs of $110,000, and total revenues of $300,000. Compute the required sales to break even. BE22.10 (LO 5) For Flynn Manufacturing, variable costs are 70\% of sales, and fixed costs are $195,000. Management's net income goal is $75,000. Compute the required sales needed to achieve management's target net income of $75,000. (Use the contribution margin approach.) Compute sales for target net income. BE22.11 (LO 5) For Astoria Equipment, actual sales are R1,000,000, and break-even sales are R800,000. Compute (a) the margin of safety and (b) the margin of safety ratio. Compute the margin of safety and the margin of safety ratio. E22.4 (LO 1) Jaejin Furniture incurred the following costs. Classify variable, fixed, and mixed costs. 1. Wood used in the production of furniture. 2. Fuel used in delivery trucks. 3. Straight-line depreciation on factory building. 4. Screws used in the production of furniture. 5. Sales staff salaries. 6. Sales commissions. 7. Property taxes. 8. Insurance on buildings. 9. Wages of furniture craftsmen paid by the hours worked. 10. Salaries of factory supervisors. 11. Utilities expense. 12. Telephone bill. Instructions Identify the costs above as variable, fixed, or mixed. BE22.10 (LO 5) For Flynn Manufacturing, variable costs are 70% of sales, and fixed costs are $195,000. Management's net income goal is $75,000. Compute the required sales needed to achieve management's target net income of $75,000. (Use the contribution margin approach.) Compute sales for target net income. BE22.11 (LO 5) For Astoria Equipment, actual sales are R1,000,000, and break-even sales are R800,000. Compute (a) the margin of safety and (b) the margin of safety ratio. Compute the margin of safety and the margin of safety ratio. BE22.12 (LO 5) Deines plc has fixed costs of $480,000. It has a unit selling price of $6, unit variable costs of $4.40, and a target net income of $1,500,000. Compute the required sales in units to achieve its target net income. Compute the required sales in units for target net income. BE24.2 (LO 2) Pillay Company estimates that unit sales will be 10,000 in quarter 1,14,000 in quarter 2, 15,000 in quarter 3 , and 18,000 in quarter 4 . Using a sales price of R70 per unit, prepare the sales budget by quarters for the year ending December 31,2020 . ( BE24.3 ( LO2 ) Sales budget data for Pillay Company are given in BE244.2. Management desires to have an ending finished goods inventory equal to 25% of the next quarter's expected unit sales. Prepare a production budget by quarters for the first 6 months of 2020. DO IT! 24.2 (LO 2) Pargo SpA is preparing its master budget for 2020. Relevant data pertaining to its sales, production, and direct materials budgets are as follows. Sales. Sales for the year are expected to total 1,000,000 units. Quarterly sales are 20%,25%,25%, and 30%, respectively. The sales price is expected to be 40 per unit for the first three quarters and 45 per unit beginning in the fourth quarter. Sales in the first quarter of 2021 are expected to be 20% higher than the budgeted sales for the first quarter of 2020 . Production. Management desires to maintain the ending finished goods inventories at 25% of the next quarter's budgeted sales volume. Direct materials. Each unit requires 2 kilograms of raw materials at a cost of 12 per kilogram. Management desires to maintain raw materials inventories at 10% of the next quarter's production requirements. Assume the production requirements for first quarter of 2021 are 450,000 kilograms. Prepare the sales, production, and direct materials budgets by quarters for 2020 Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started