Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the incorrect ones Prepare the statement of cash flows for the current year ended December 3 1 , using the indirect method to

Please solve the incorrect ones Prepare the statement of cash flows for the current year ended December using the indirect method to present cash flows from operating activities.

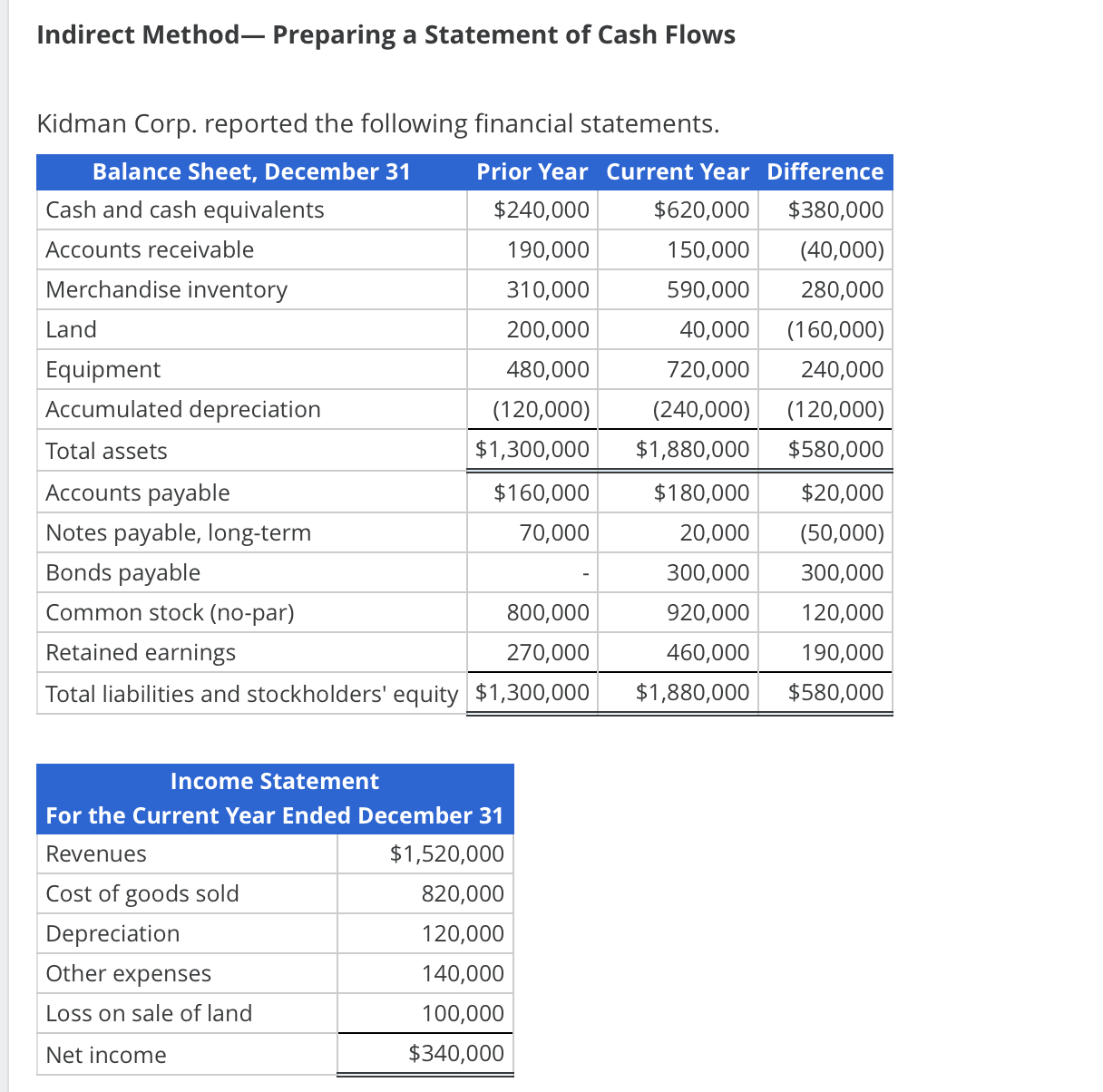

Note: Include a negative sign for any amount that would be subtracted in the statement of cash flows.Indirect Method Preparing a Statement of Cash Flows

Kidman Corp. reported the following financial statements.

tableBalance Sheet, December Prior Year,Current Year,DifferenceCash and cash equivalents,$$$Accounts receivable,Merchandise inventory,LandEquipmentAccumulated depreciation,Total assets,$$$Accounts payable,$$$Notes payable, longterm,Bonds payable,Common stock noparRetained earnings,Total liabilities and stockholders' equity,$$$

tableIncome StatementFor the Current Year Ended December Revenues$Cost of goods sold,DepreciationOther expenses,Loss on sale of land,Net income,$

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started