Please solve the "Per Unit" and "Total" (Red sign on the right top). Thank you so much.

Please solve the "Per Unit" and "Total" (Red sign on the right top). Thank you so much.

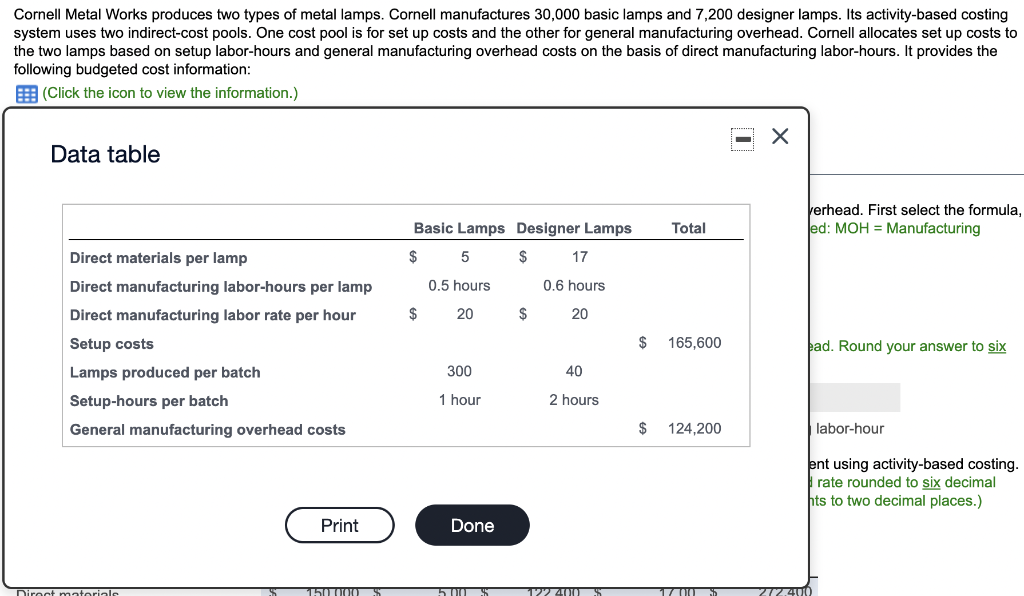

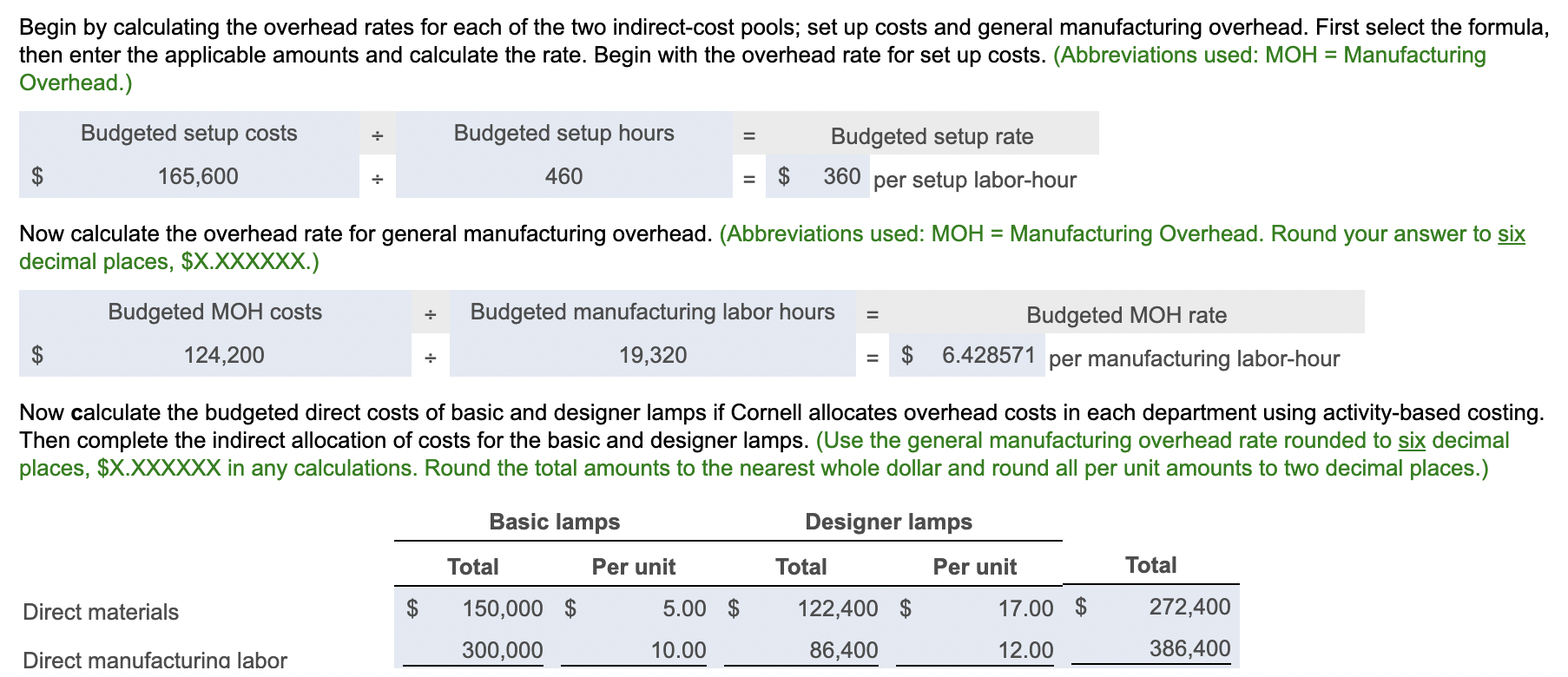

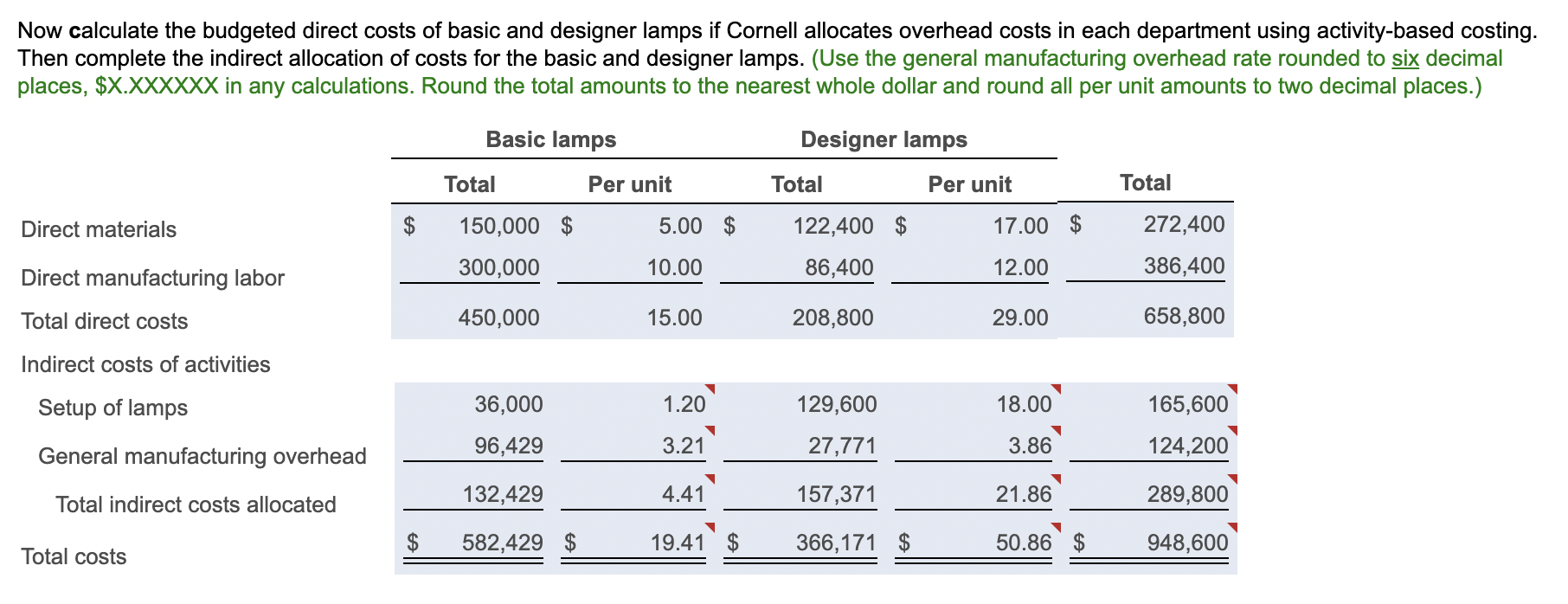

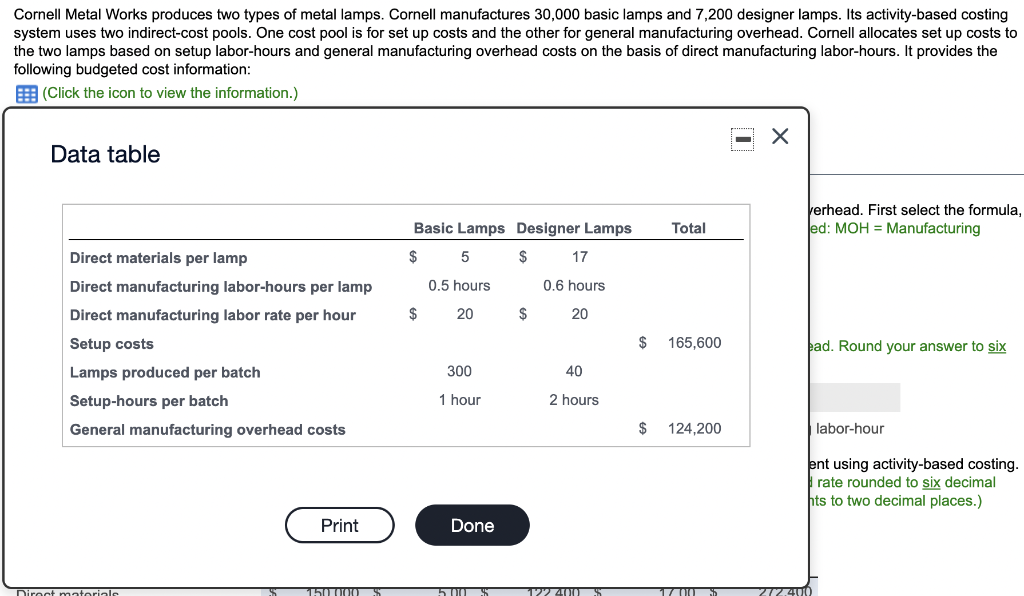

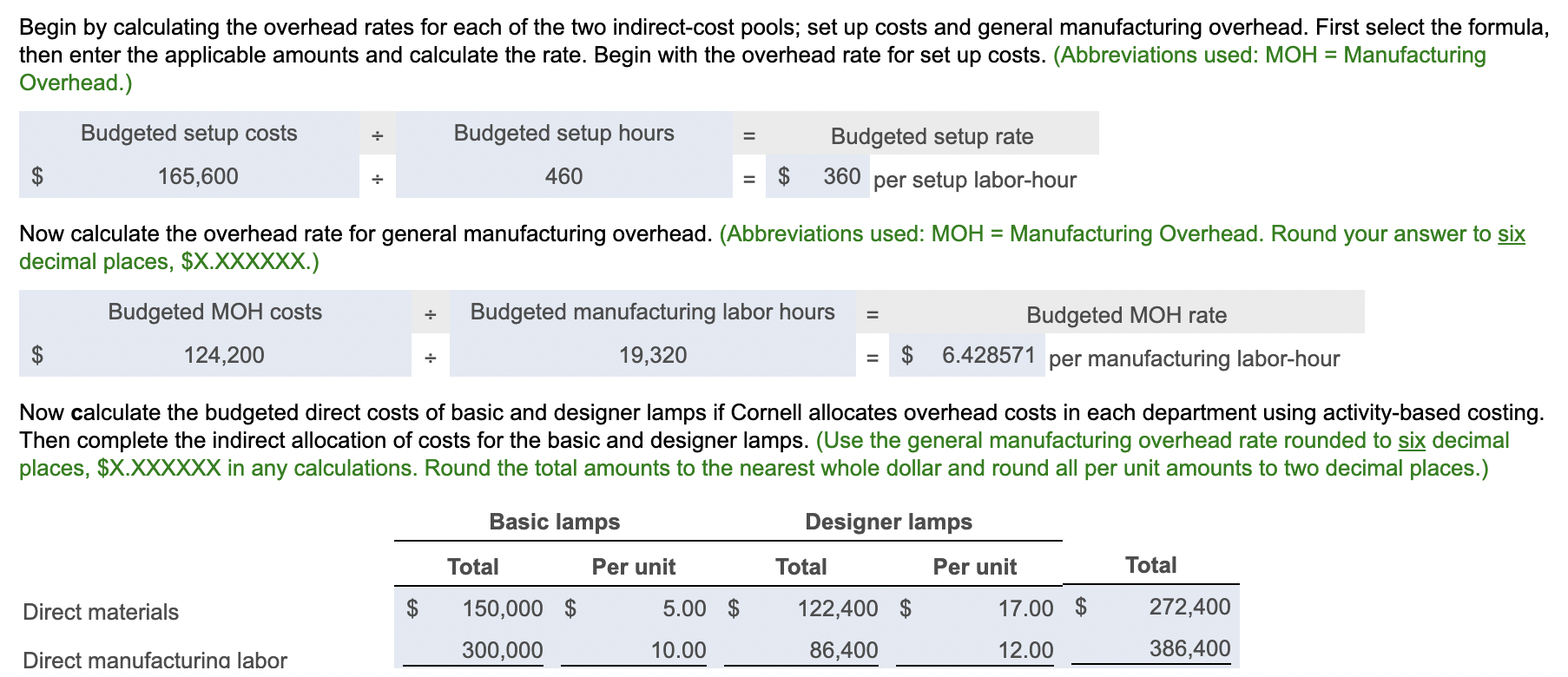

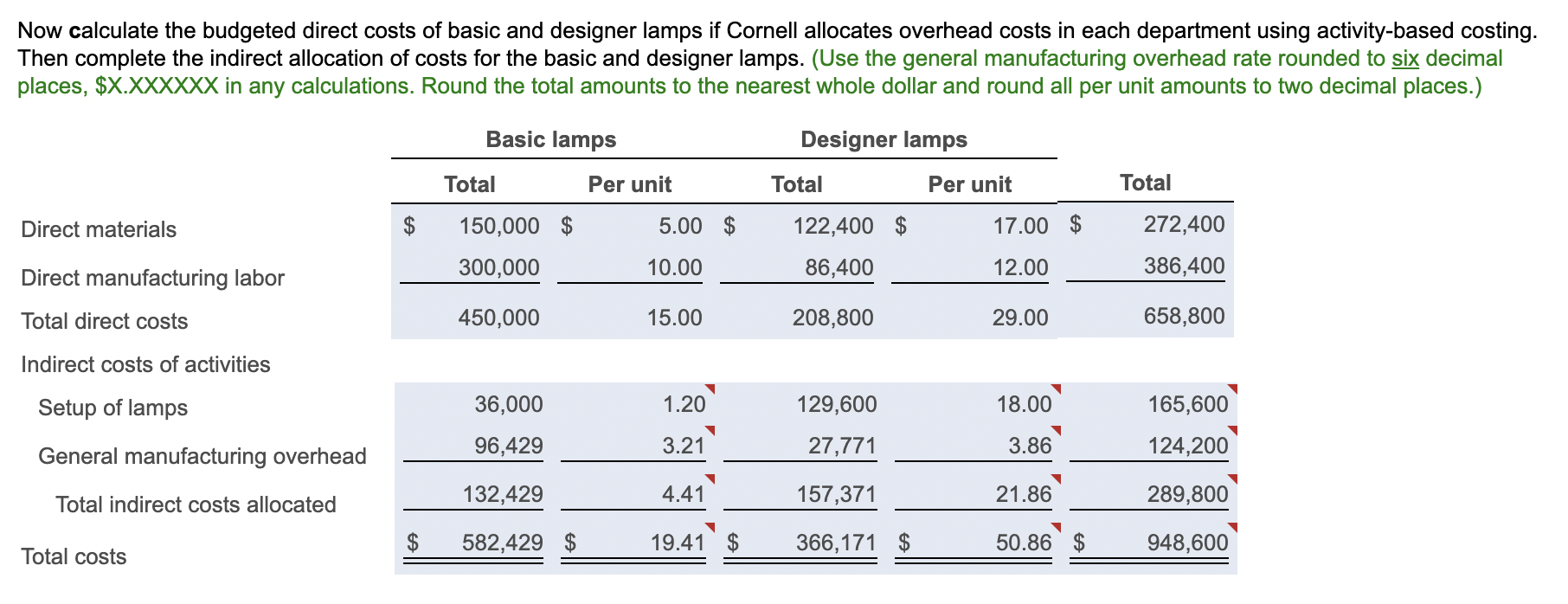

Cornell Metal Works produces two types of metal lamps. Cornell manufactures 30,000 basic lamps and 7,200 designer lamps. Its activity-based costing system uses two indirect-cost pools. One cost pool is for set up costs and the other for general manufacturing overhead. Cornell allocates set up costs to the two lamps based on setup labor-hours and general manufacturing overhead costs on the basis of direct manufacturing labor-hours. It provides the following budgeted cost information: (Click the icon to view the information.) Data table Verhead. First select the formula, Jed: MOH = Manufacturing Total Basic Lamps Designer Lamps $ 5 $ 17 Direct materials per lamp 0.5 hours 0.6 hours $ 20 $ 20 $ 165,600 pad. Round your answer to six Direct manufacturing labor-hours per lamp Direct manufacturing labor rate per hour Setup costs Lamps produced per batch Setup-hours per batch General manufacturing overhead costs 300 40 1 hour 2 hours $ 124,200 labor-hour ent using activity-based costing. rate rounded to six decimal hts to two decimal places.) Print Done Direct materiale hu 12.2010 Z72 400 Begin by calculating the overhead rates for each of the two indirect-cost pools; set up costs and general manufacturing overhead. First select the formula, then enter the applicable amounts and calculate the rate. Begin with the overhead rate for set up costs. (Abbreviations used: MOH = Manufacturing Overhead.) Budgeted setup costs Budgeted setup hours = Budgeted setup rate 360 per setup labor-hour $ 165,600 - 460 - $ Now calculate the overhead rate for general manufacturing overhead. (Abbreviations used: MOH = Manufacturing Overhead. Round your answer to six decimal places, $X.XXXXXX.) Budgeted MOH costs + Budgeted manufacturing labor hours = Budgeted MOH rate 6.428571 per manufacturing labor-hour $ 124,200 19,320 $ Now calculate the budgeted direct costs of basic and designer lamps if Cornell allocates overhead costs in each department using activity-based costing. Then complete the indirect allocation of costs for the basic and designer lamps. (Use the general manufacturing overhead rate rounded to six decimal places, $X.XXXXXX in any calculations. Round the total amounts to the nearest whole dollar and round all per unit amounts to two decimal places.) Basic lamps Designer lamps Total Per unit Total Per unit Total Direct materials $ 150,000 $ 5.00 $ 122,400 $ 17.00 $ 272,400 386,400 300,000 10.00 Direct manufacturina labor 86,400 12.00 Now calculate the budgeted direct costs of basic and designer lamps if Cornell allocates overhead costs in each department using activity-based costing. Then complete the indirect allocation of costs for the basic and designer lamps. (Use the general manufacturing overhead rate rounded to six decimal places, $X.XXXXXX in any calculations. Round the total amounts to the nearest whole dollar and round all per unit amounts to two decimal places.) Basic lamps Designer lamps Total Per unit Total Per unit Total Direct materials 150,000 $ 5.00 $ 122,400 $ 17.00 $ 272,400 300,000 10.00 86,400 12.00 Direct manufacturing labor 386,400 Total direct costs 450,000 15.00 208,800 29.00 658,800 Indirect costs of activities Setup of lamps 1.20 129,600 18.00 165,600 36,000 96,429 3.21 General manufacturing overhead 27,771 3.86 124,200 132,429 4.41 157,371 21.86 Total indirect costs allocated 289,800 582,429 $ 19.41 $ 366,171 $ 50.86 $ 948,600 Total costs

Please solve the "Per Unit" and "Total" (Red sign on the right top). Thank you so much.

Please solve the "Per Unit" and "Total" (Red sign on the right top). Thank you so much.