Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the problem and provide detailed explanations with reasonings. Thanks. Jayco Inc. started its operations in 2016 . Its sales, all on account, totalled

Please solve the problem and provide detailed explanations with reasonings. Thanks.

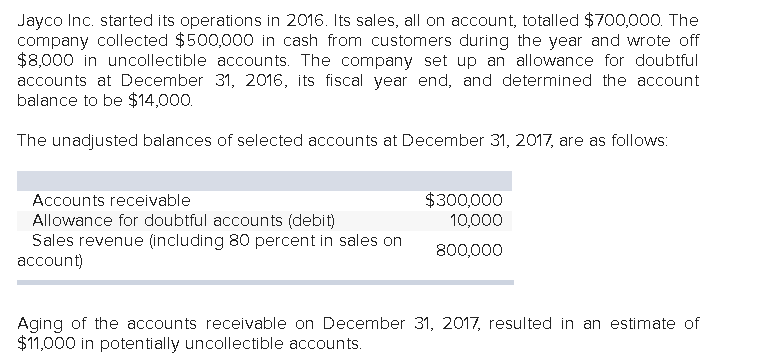

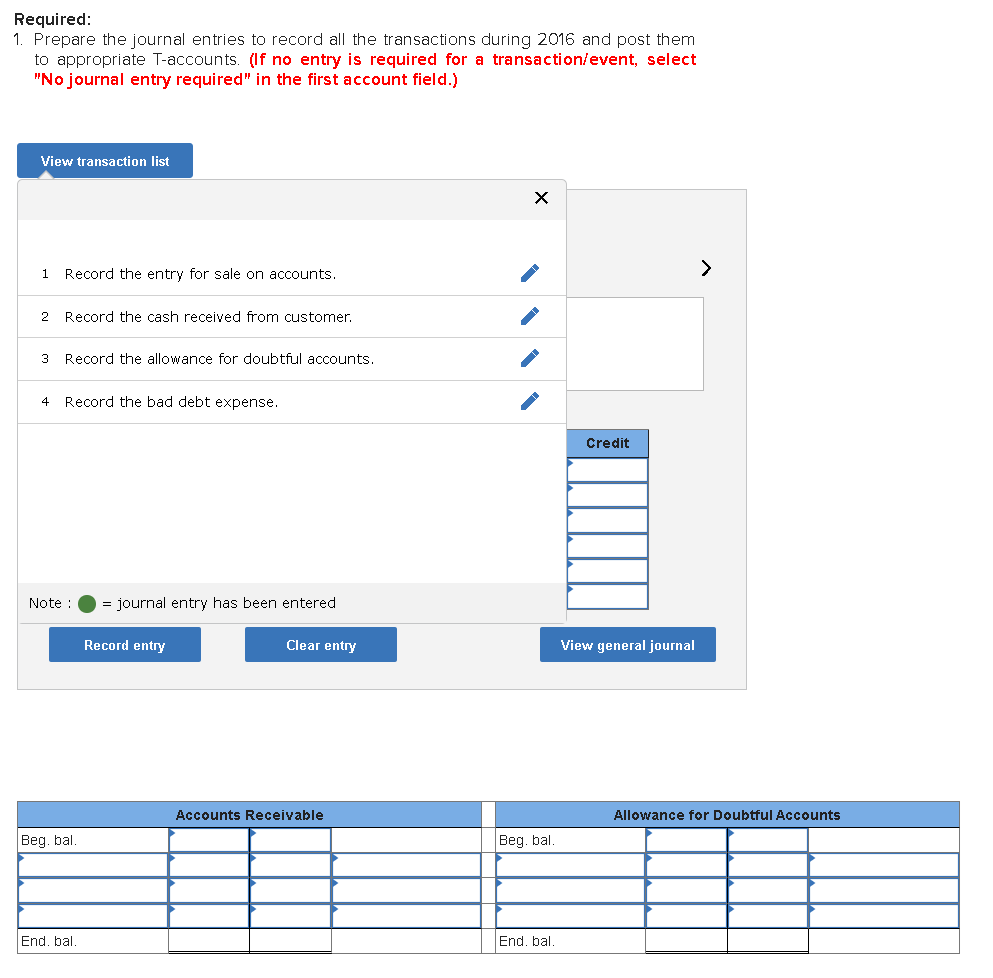

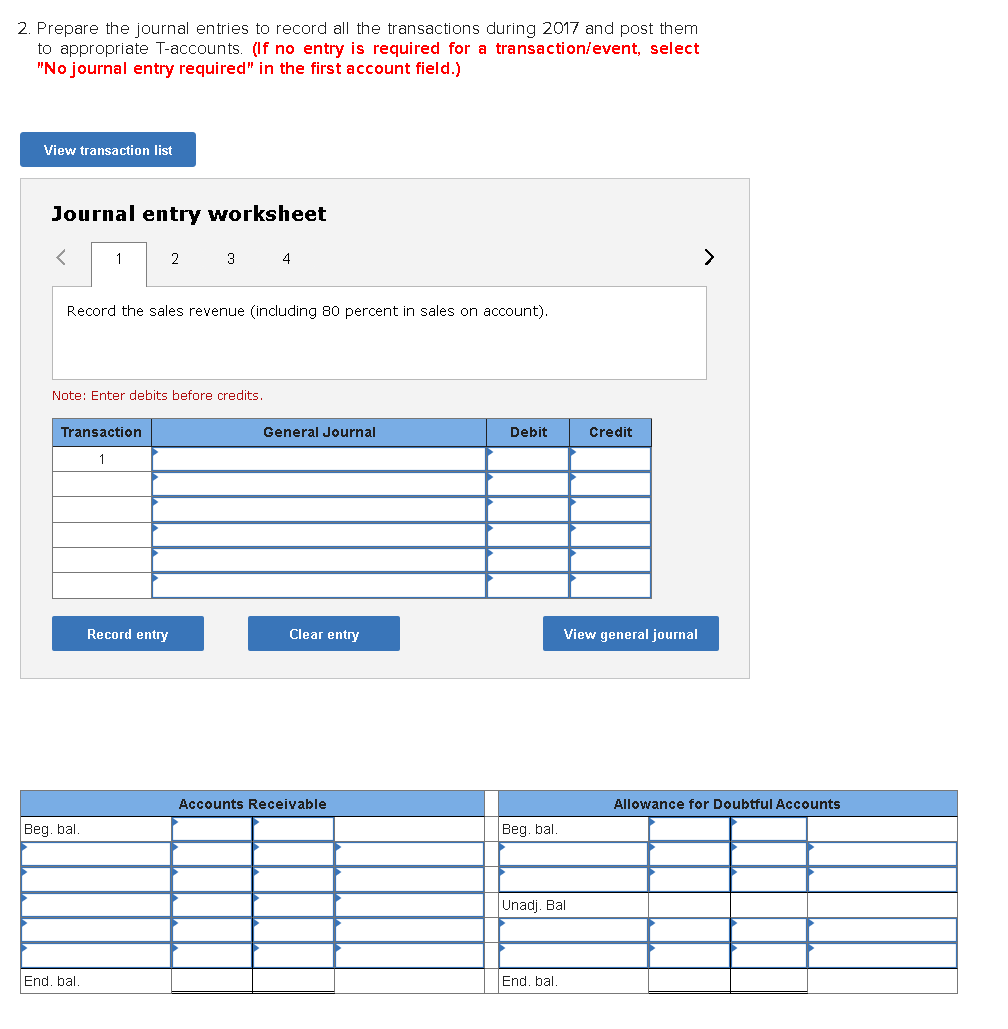

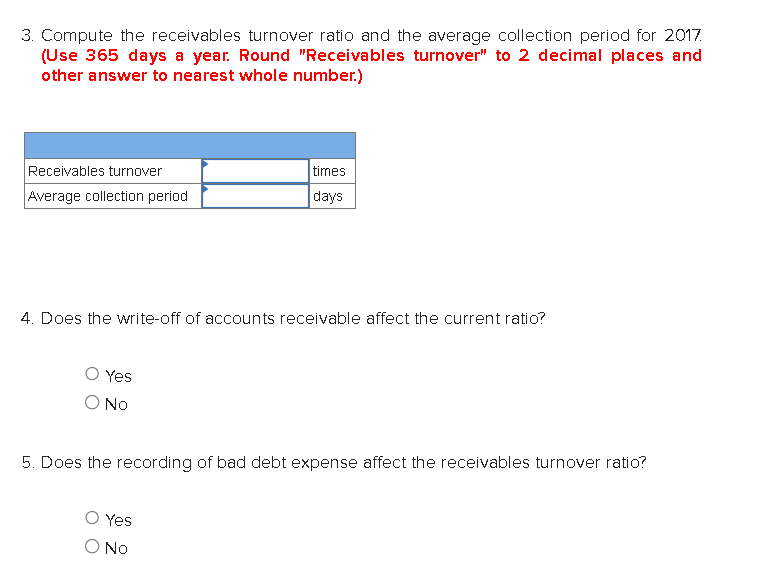

Jayco Inc. started its operations in 2016 . Its sales, all on account, totalled $700,000. The company collected $500,000 in cash from customers during the year and wrote off $8,000 in uncollectible accounts. The company set up an allowance for doubtful accounts at December 31, 2016, its fiscal year end, and determined the account balance to be $14,000. The unadjusted balances of selected accounts at December 31, 2017, are as follows: Aging of the accounts receivable on December 31,2017 , resulted in an estimate of $11,000 in potentially uncollectible accounts. Required: 1. Prepare the journal entries to record all the transactions during 2016 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) 1 Record the entry for sale on accounts. 2 Record the cash received from customer. 3 Record the allowance for doubtful accounts. 4 Record the bad debt expense. Credit Note : = journal entry has been entered 2. Prepare the journal entries to record all the transactions during 2017 and post them to appropriate T-accounts. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) Journal entry worksheet 4 Record the sales revenue (including 80 percent in sales on account). Note: Enter debits before credits. 3. Compute the receivables turnover ratio and the average collection period for 2017 . (Use 365 days a year. Round "Receivables turnover" to 2 decimal places and other answer to nearest whole number.) 4. Does the write-off of accounts receivable affect the current ratio? Yes No 5. Does the recording of bad debt expense affect the receivables turnover ratio? Yes NoStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started