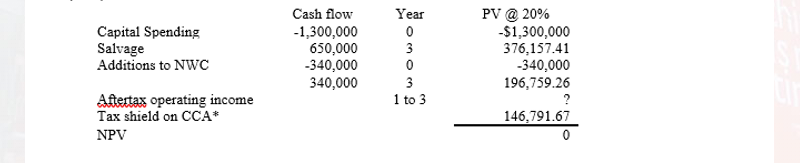

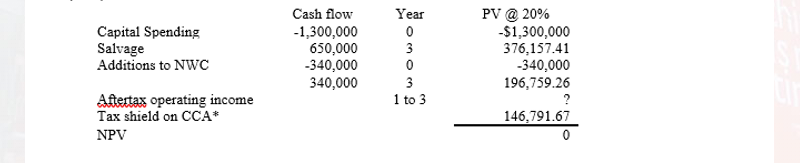

Please solve the problem below by making a table, using the format provided in the first picture, and articulate how the after-tax operating income should be calculated for the scenario. Correct result provided in the end. Be mindful about the tax law of Canada, where capital cost allowance (CCA) is the fixed rate that depreciates the remaining cost of the fixed asset every year except for the first year when only half of the cost shall be depreciated. PV of tax shield on CCA has been calculated correctly as shown in the result.

TEMPLATE

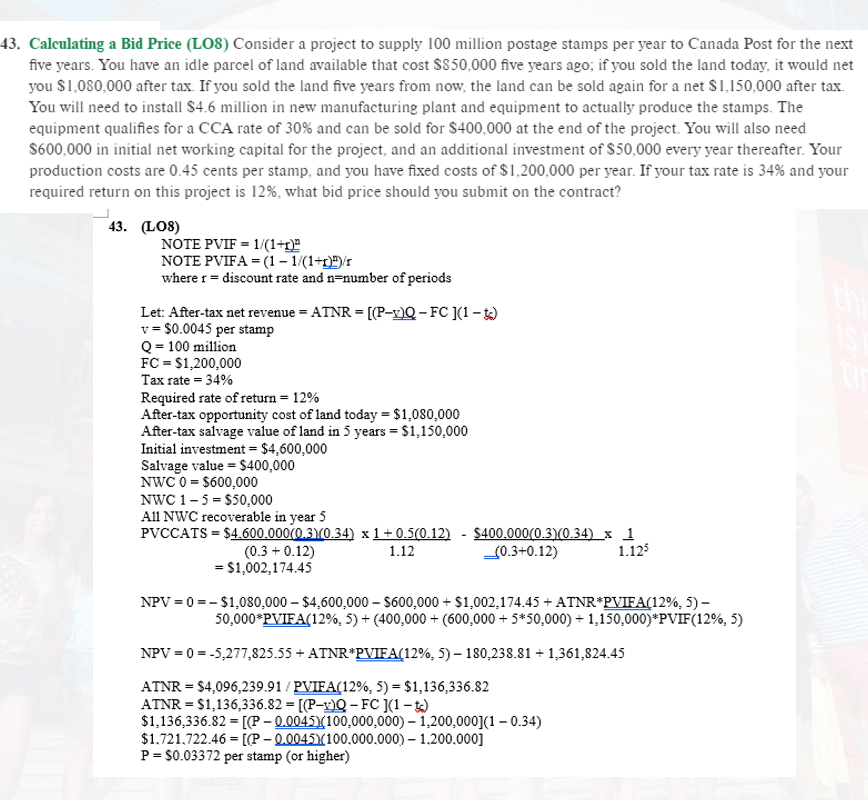

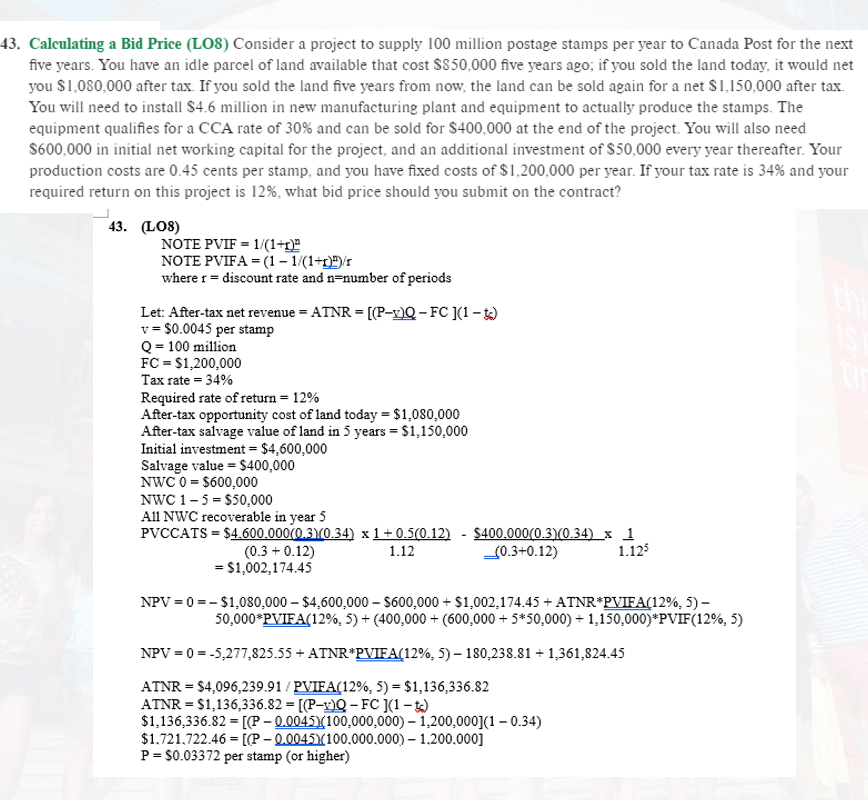

PROBLEM - please create a table to further explain the result

Year 0 Capital Spending Salvage Additions to NWC Cash flow -1,300,000 650,000 -340,000 340,000 PV @ 20% -$1,300,000 376.157.41 -340,000 196,759.26 0 1 to 3 Aftertax operating income Tax shield on CCA* NPV 146,791.67 43. Calculating a Bid Price (LOS) Consider a project to supply 100 million postage stamps per year to Canada Post for the next five years. You have an idle parcel of land available that cost $850,000 five years ago, if you sold the land today, it would net you $1,080,000 after tax. If you sold the land five years from now, the land can be sold again for a net $1,150,000 after tax. You will need to install $4.6 million in new manufacturing plant and equipment to actually produce the stamps. The equipment qualifies for a CCA rate of 30% and can be sold for $400,000 at the end of the project. You will also need $600,000 in initial net working capital for the project, and an additional investment of $50,000 every year thereafter. Your production costs are 0.45 cents per stamp, and you have fixed costs of $1,200,000 per year. If your tax rate is 34% and your required return on this project is 12%, what bid price should you submit on the contract? 43. (LOS) NOTE PVIF = 1/(1+0) NOTE PVIFA = (1 - 1/(1+0)/ where r = discount rate and n=number of periods Let: After-tax net revenue = ATNR = [(P-1) - FC ](1 t) v = $0.0045 per stamp Q = 100 million FC = $1,200.000 Tax rate = 34% Required rate of return = 12% After-tax opportunity cost of land today = $1,080,000 After-tax salvage value of land in 5 years $1,150.000 Initial investment = $4,600,000 Salvage value = $400,000 NWC 0 = $600,000 NWC 1-5 = $50,000 All NWC recoverable in year 5 PVCCATS = $4.600.000(0.370.34) x 1 +0.5(0.12) - $400,000(0.3/0.34) x (0.3 +0.12) 1.12 _(0.3+0.12) = $1,002,174.45 1 1.125 NPV = 0 =-$1,080,000 - $4.600,000 - $600,000+ $1,002.174.45 + ATNR*PVIFA(12%, 5) - 50,000*PVIFA(12%, 5) + (400,000 + (600,000 + 5*50,000) + 1,150,000)*PVIF(12%, 5) NPV = 0) = -5,277,825.55+ ATNR*PVIFA(12%, 5) - 180.238.81 + 1,361,824.45 ATNR = $4,096,239.91/PVIFA(12%, 5) - $1,136,336.82 ATNR = $1,136,336.82 = [(P-vQ-FC ](1 -t.) $1,136,336.82 = [(P-0.0045x100,000,000) - 1.200,000](1 - 0.34) $1,721,722.46 = [(P-0.0045Y100.000.000) - 1.200.000) P = $0.03372 per stamp (or higher) Year 0 Capital Spending Salvage Additions to NWC Cash flow -1,300,000 650,000 -340,000 340,000 PV @ 20% -$1,300,000 376.157.41 -340,000 196,759.26 0 1 to 3 Aftertax operating income Tax shield on CCA* NPV 146,791.67 43. Calculating a Bid Price (LOS) Consider a project to supply 100 million postage stamps per year to Canada Post for the next five years. You have an idle parcel of land available that cost $850,000 five years ago, if you sold the land today, it would net you $1,080,000 after tax. If you sold the land five years from now, the land can be sold again for a net $1,150,000 after tax. You will need to install $4.6 million in new manufacturing plant and equipment to actually produce the stamps. The equipment qualifies for a CCA rate of 30% and can be sold for $400,000 at the end of the project. You will also need $600,000 in initial net working capital for the project, and an additional investment of $50,000 every year thereafter. Your production costs are 0.45 cents per stamp, and you have fixed costs of $1,200,000 per year. If your tax rate is 34% and your required return on this project is 12%, what bid price should you submit on the contract? 43. (LOS) NOTE PVIF = 1/(1+0) NOTE PVIFA = (1 - 1/(1+0)/ where r = discount rate and n=number of periods Let: After-tax net revenue = ATNR = [(P-1) - FC ](1 t) v = $0.0045 per stamp Q = 100 million FC = $1,200.000 Tax rate = 34% Required rate of return = 12% After-tax opportunity cost of land today = $1,080,000 After-tax salvage value of land in 5 years $1,150.000 Initial investment = $4,600,000 Salvage value = $400,000 NWC 0 = $600,000 NWC 1-5 = $50,000 All NWC recoverable in year 5 PVCCATS = $4.600.000(0.370.34) x 1 +0.5(0.12) - $400,000(0.3/0.34) x (0.3 +0.12) 1.12 _(0.3+0.12) = $1,002,174.45 1 1.125 NPV = 0 =-$1,080,000 - $4.600,000 - $600,000+ $1,002.174.45 + ATNR*PVIFA(12%, 5) - 50,000*PVIFA(12%, 5) + (400,000 + (600,000 + 5*50,000) + 1,150,000)*PVIF(12%, 5) NPV = 0) = -5,277,825.55+ ATNR*PVIFA(12%, 5) - 180.238.81 + 1,361,824.45 ATNR = $4,096,239.91/PVIFA(12%, 5) - $1,136,336.82 ATNR = $1,136,336.82 = [(P-vQ-FC ](1 -t.) $1,136,336.82 = [(P-0.0045x100,000,000) - 1.200,000](1 - 0.34) $1,721,722.46 = [(P-0.0045Y100.000.000) - 1.200.000) P = $0.03372 per stamp (or higher)