please solve the problems

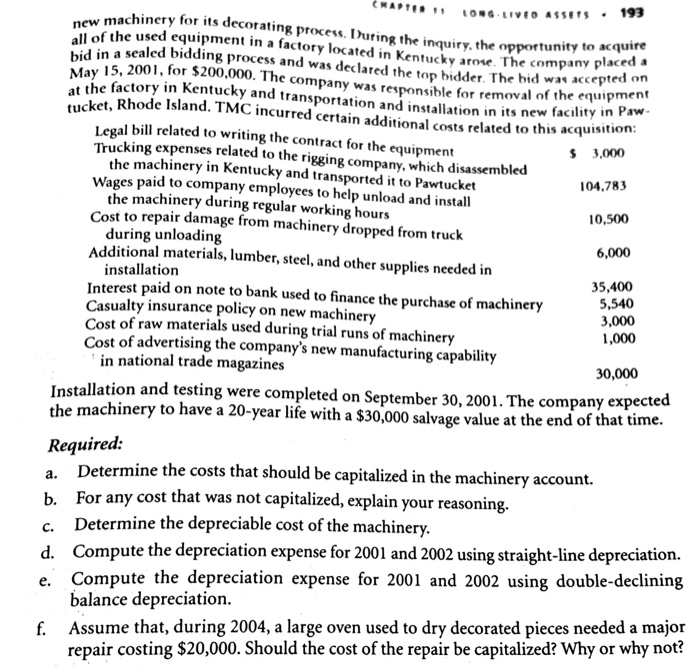

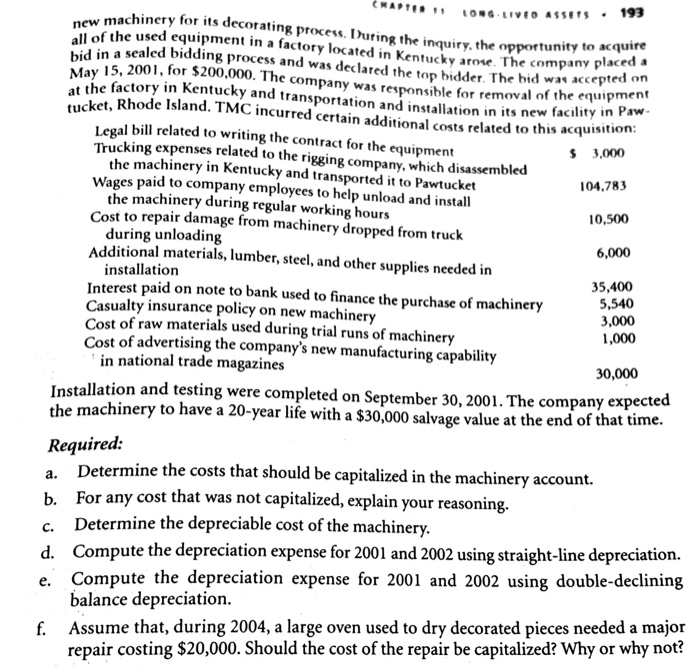

d. Assum $400,000. Prepare the journal entry to record the sale. P11-7 During 2001, TMC Corporation was expanding its operations into a new manufacturing process for decorating plastic parts. The company was investigating the acquisition of 10,500 LONG LIVEO ASSETS . 193 new machinery for its decorating process. During the inquiry, the opportunity to acquire bid in a sealed bidding process and was declared the top bidder. The bid was accepted en a May 15, 2001, for $200,000. The company was responsible for removal of the equipment at the factory in Kentucky and transportation and installation in its new facility in Paw- tucket, Rhode Island. TMC incurred certain additional costs related to this acquisition: Legal bill related to writing the contract for the equipment Trucking expenses related to the rigging company, which disassembled $ 3,000 the machinery in Kentucky and transported it to Pawtucket Wages paid to company employees to help unload and install 104,783 the machinery during regular working hours Cost to repair damage from machinery dropped from truck during unloading 6,000 Additional materials, lumber, steel, and other supplies needed in installation 35,400 Interest paid on note to bank used to finance the purchase of machinery 5,540 Casualty insurance policy on new machinery Cost of raw materials used during trial runs of machinery 1,000 Cost of advertising the company's new manufacturing capability in national trade magazines 30,000 Installation and testing were completed on September 30, 2001. The company expected the machinery to have a 20-year life with a $30,000 salvage value at the end of that time. Required: Determine the costs that should be capitalized in the machinery account. b. For any cost that was not capitalized, explain your reasoning. Determine the depreciable cost of the machinery. d. Compute the depreciation expense for 2001 and 2002 using straight-line depreciation. e. Compute the depreciation expense for 2001 and 2002 using double-declining balance depreciation. f. Assume that, during 2004, a large oven used to dry decorated pieces needed a major repair costing $20,000. Should the cost of the repair be capitalized? Why or why not? 3,000 a. c