Answered step by step

Verified Expert Solution

Question

1 Approved Answer

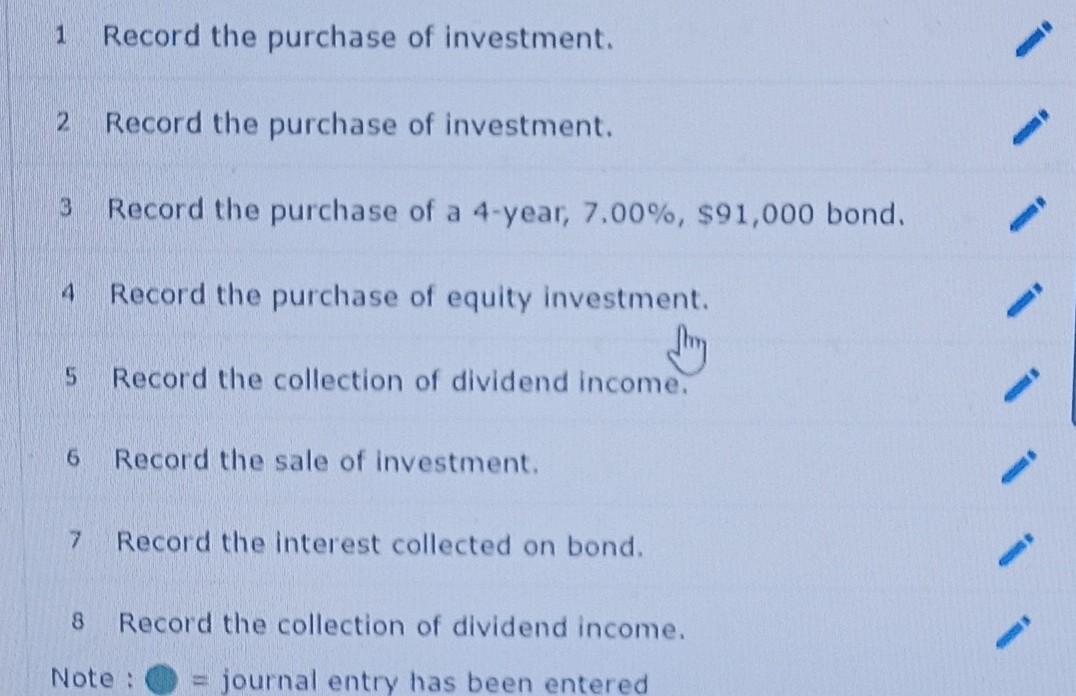

please solve the question 9 Record the collection of dividend income. 10 Record the interest collected on bond. 11 Record the interest collected on bond.

please solve the question

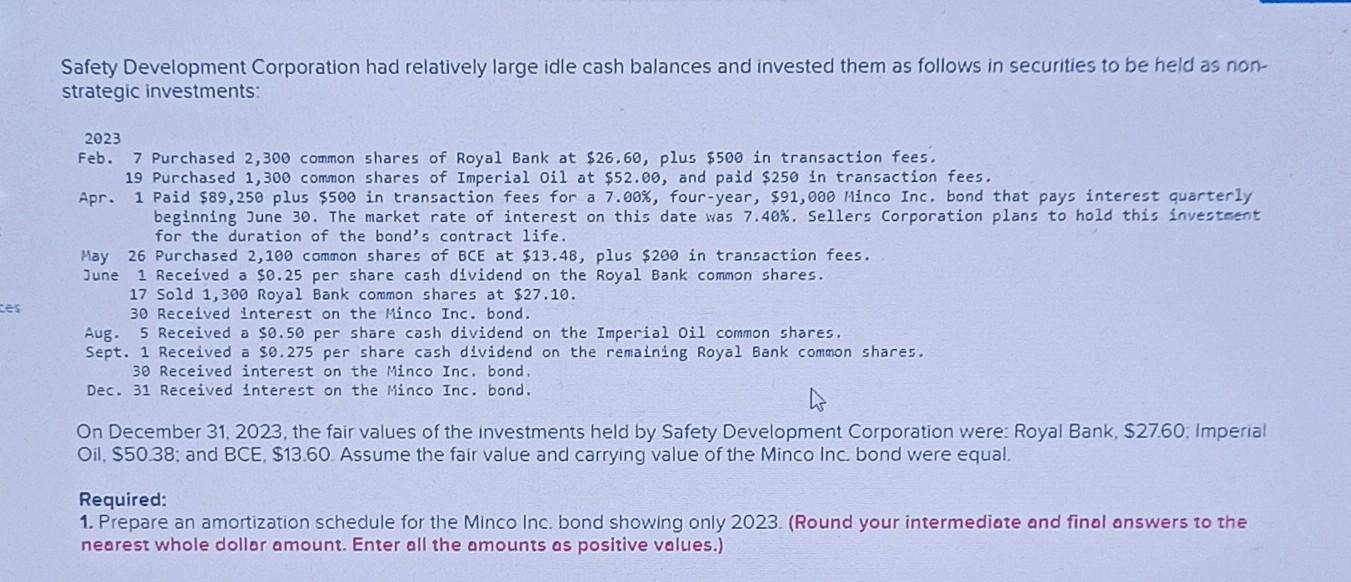

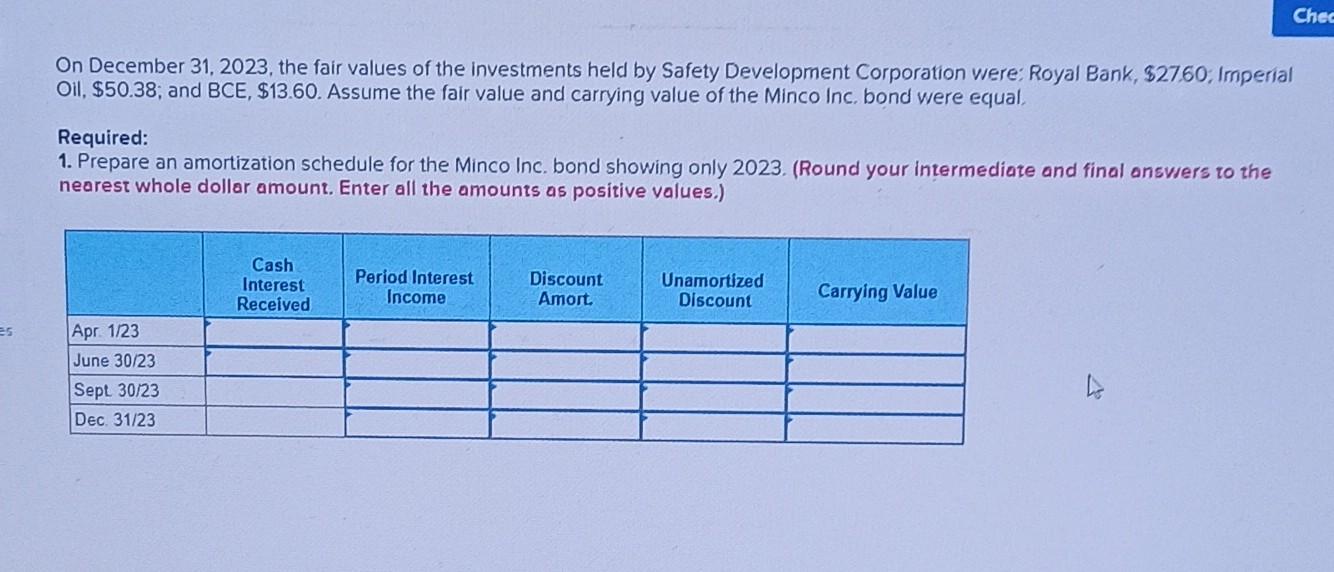

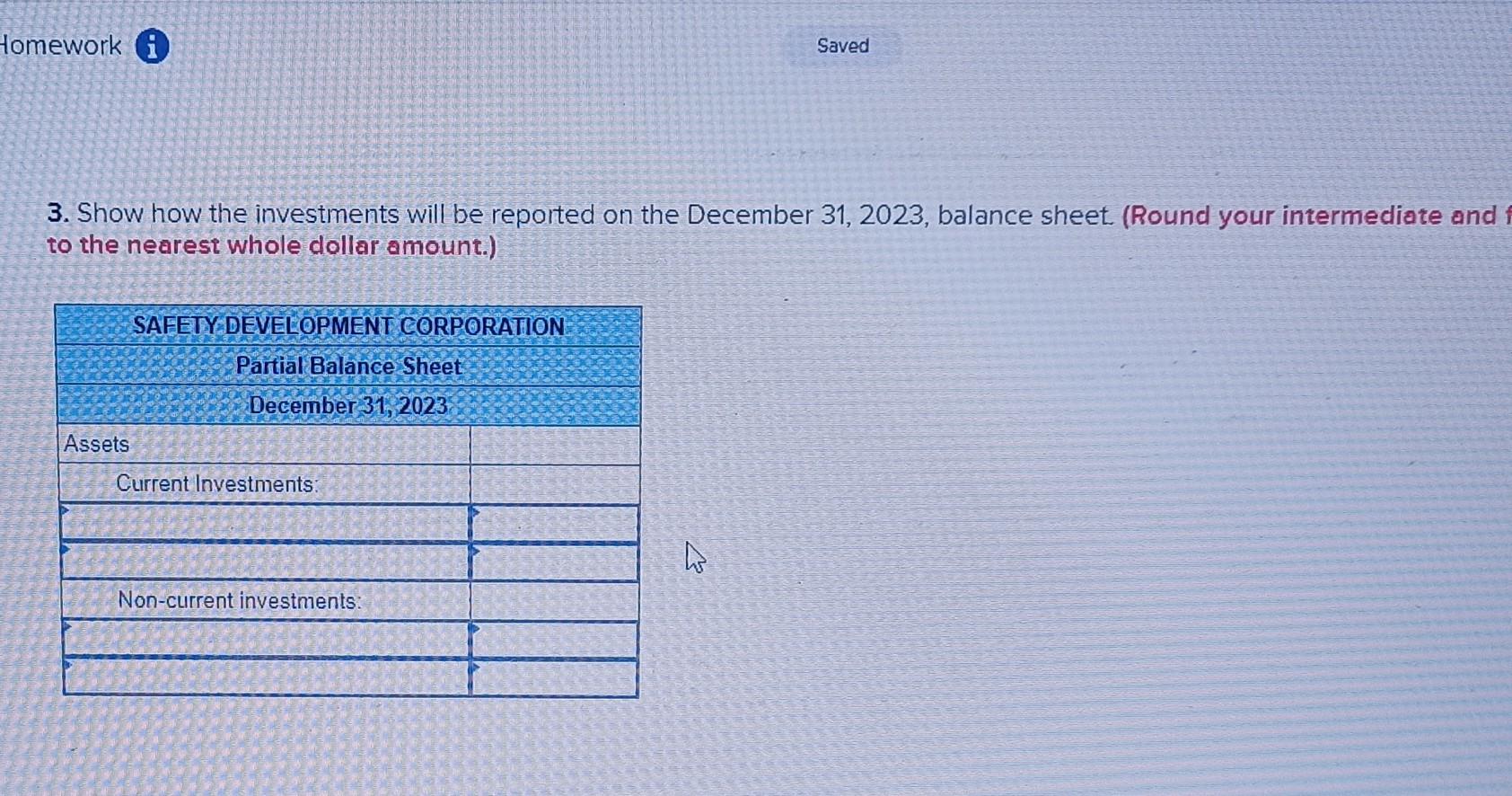

9 Record the collection of dividend income. 10 Record the interest collected on bond. 11 Record the interest collected on bond. Note: = journal entry has been entered On December 31,2023 , the fair values of the investments held by Safety Development Corporation viere: Royal Bank, \\$27.60; Imperial Oil, \\$50.38; and BCE, \\$13.60. Assume the fair value and carrying value of the Minco Inc. bond were equal, Required: 1. Prepare an amortization schedule for the Minco Inc. bond showing only 2023 . (Round your intermediate and final answers to the nearest whole dollar amount. Enter all the amounts as positive values.) Analysis Component: If the falr value adjustment is not recorded by Safety Development Corporation, what is the impact on the financial statements? 1 Record the purchase of investment. 2 Record the purchase of investment. 3 Record the purchase of a 4-year, \7.00 bond. 4 Record the purchase of equity investment. 5 Record the collection of dividend income. 6 Record the sale of investment. 7 Record the interest collected on bond. 8 Record the collection of dividend income. Safety Development Corporation had relatively large idle cash balances and invested them as follows in securities to be held as nonstrategic investments: 2023 Feb. 7 Purchased 2,300 common shares of Royal Bank at \\( \\$ 26.60 \\), plus \\( \\$ 500 \\) in transaction fees. 19 Purchased 1,300 common shares of Imperial 0 il at \\( \\$ 52.00 \\), and paid \\( \\$ 250 \\) in transaction fees. Apr. 1 Paid \\( \\$ 89,250 \\) plus \\( \\$ 500 \\) in transaction fees for a \7.00, four-year, \\( \\$ 91,000 \\) Minco Inc. bond that pays interest quarterly beginning June 30 . The market rate of interest on this date was \7.40. Sellers Corporation plans to hold this investent for the duration of the bond's contract life. May 26 Purchased 2,100 common shares of BCE at \\( \\$ 13.48 \\), plus \\( \\$ 200 \\) in transaction fees. June 1 Received a \\( \\$ 0.25 \\) per share cash dividend on the Royal Bank common shares. 17 Sold 1,300 Royal Bank common shares at \\( \\$ 27.10 \\). 30 Received interest on the Minco Inc. bond. Aug. 5 Received a \\( \\$ 0.50 \\) per share cash dividend on the Imperial oil common shares. Sept. 1 Received a \\( \\$ 0.275 \\) per share cash dividend on the remaining Royal Bank common shares. 30 Received interest on the Minco Inc. bond. Dec. 31 Received interest on the Minco Inc. bond. On December 31, 2023, the fair values of the investments held by Safety Development Corporation were: Royal Bank, \\$27.60: Imperial Oil, \\$50.38; and BCE, \\$13.60. Assume the fair value and carrying value of the Minco Inc. bond were equal. Required: 1. Prepare an amortization schedule for the Minco Inc. bond showing only 2023 . (Round your intermediate and final answers to the nearest whole dollar amount. Enter all the amounts as positive values.) 3. Show how the investments will be reported on the December 31,2023 , balance sheet. (Round your intermediate and to the nearest whole dollar amount.)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started