Answered step by step

Verified Expert Solution

Question

1 Approved Answer

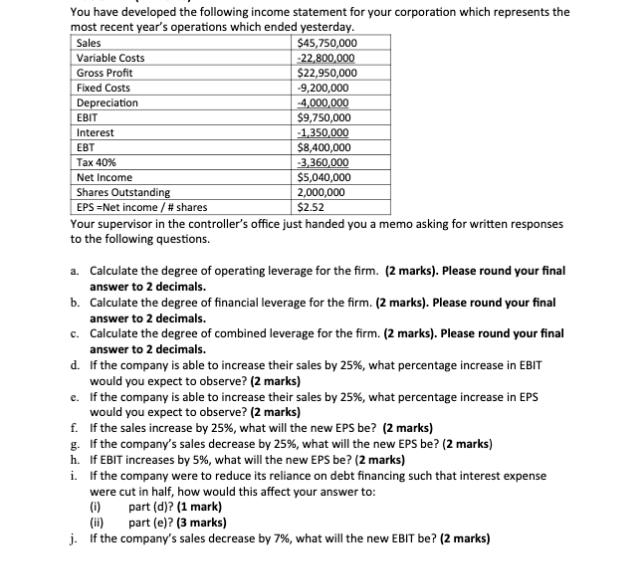

Please solve the question parts e, f, g, and h. Thank you. You have developed the following income statement for your corporation which represents the

Please solve the question parts e, f, g, and h. Thank you.

You have developed the following income statement for your corporation which represents the most recent year's operations which ended yesterday. Sales $45,750,000 Variable costs -22,800,000 Gross Profit $22,950,000 Fixed Costs -9,200,000 Depreciation 4,000,000 EBIT $9,750,000 Interest -1,350,000 EBT $8,400,000 Tax 40% -3,360,000 Net Income $5,040,000 Shares Outstanding 2,000,000 EPS =Net income / # shares $2.52 Your supervisor in the controller's office just handed you a memo asking for written responses to the following questions. a. Calculate the degree of operating leverage for the firm. (2 marks). Please round your final answer to 2 decimals. b. Calculate the degree of financial leverage for the firm. (2 marks). Please round your final answer to 2 decimals. c. Calculate the degree of combined leverage for the firm. (2 marks). Please round your final answer to 2 decimals. d. If the company is able to increase their sales by 25%, what percentage increase in EBIT would you expect to observe? (2 marks) e. If the company is able to increase their sales by 25%, what percentage increase in EPS would you expect to observe? (2 marks) f. If the sales increase by 25%, what will the new EPS be? (2 marks) g. If the company's sales decrease by 25%, what will the new EPS be? (2 marks) h. If EBIT increases by 5%, what will the new EPS be? (2 marks) i. If the company were to reduce its reliance on debt financing such that interest expense were cut in half, how would this affect your answer to: (1) part (d)? (1 mark) part (e)? (3 marks) j. If the company's sales decrease by 7%, what will the new EBIT be? (2 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started