Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please solve the question soon Mr. Tony is working in the Financial Department of a company that manufactures leather products. The company is considering two

please solve the question soon

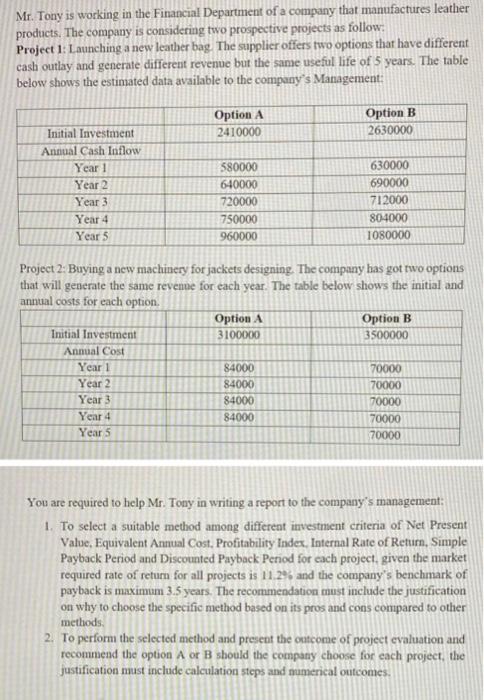

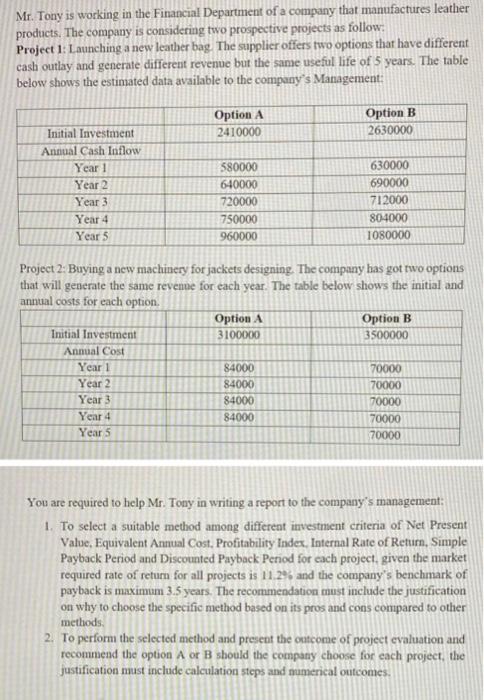

Mr. Tony is working in the Financial Department of a company that manufactures leather products. The company is considering two prospective projects as follow: Project 1: Launching a new leather bag. The supplier offers two options that have different cash outlay and generate different revenue but the same useful life of 5 years. The table below shows the estimated data available to the company's Management: Option A 2410000 Option B 2630000 Initial Investment Annual Cash Inflow Year 1 Year 2 Year 3 Year 4 Year 5 580000 640000 720000 750000 960000 630000 690000 712000 804000 1080000 Project 2: Buying a new machinery for jackets designing. The company has got two options that will generate the same revenue for each year. The table below shows the initial and annual costs for each option Option A Option B Initial Investment 3100000 3500000 Annual Cost Year 1 84000 70000 Year 2 84000 70000 Year 3 84000 70000 Year 4 84000 70000 Year 5 70000 You are required to help Mr. Tony in writing a report to the company's management: 1. To select a suitable method among different investment criteria of Net Present Value, Equivalent Annual Cost. Profitability Index. Internal Rate of Return, Simple Payback Period and Discounted Payback period for each project. given the market required rate of return for all projects is 11.2% and the company's benchmark of payback is maximam 3.5 years. The recommendation must include the justification on why to choose the specific method based on its pros and cons compared to other methods 2. To perform the selected method and present the outcome of project evaluation and recommend the option A or B should the company choose for each project, the justification must include calculation steps and numerical outcomes

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started