Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please solve the questions from part c to the end in details. Thank you! 1. Suppose today is Nov, 4th2022. The price of XYZ 's

Please solve the questions from part c to the end in details. Thank you!

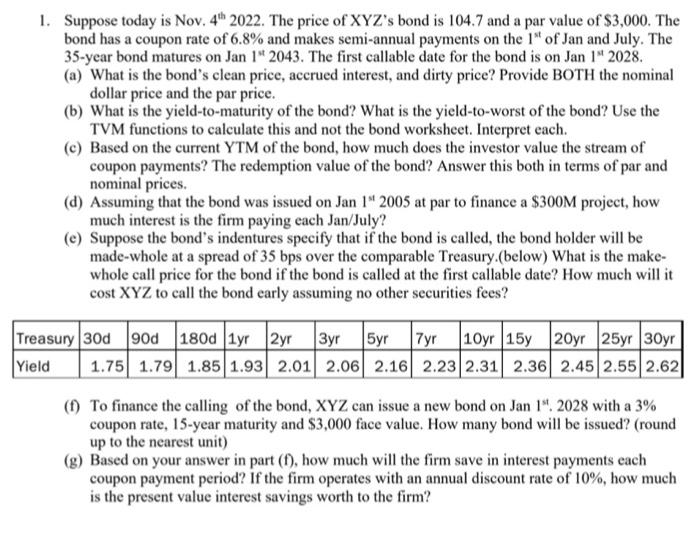

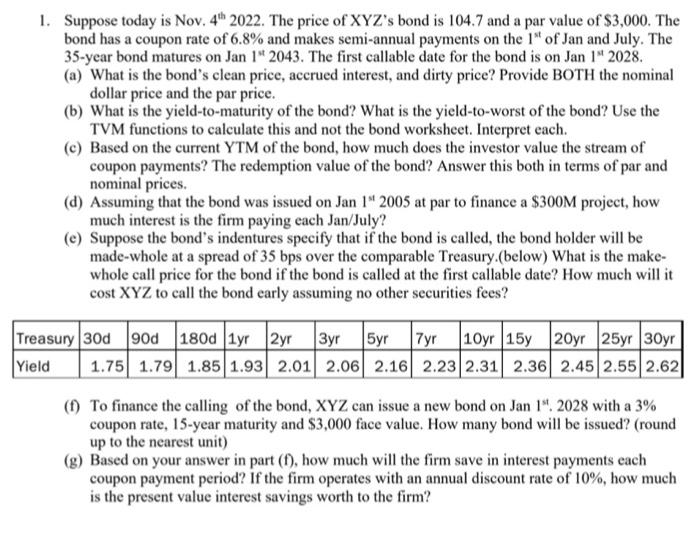

1. Suppose today is Nov, 4th2022. The price of XYZ 's bond is 104.7 and a par value of $3,000. The bond has a coupon rate of 6.8% and makes semi-annual payments on the 1st of Jan and July. The 35-year bond matures on Jan 1" 2043. The first callable date for the bond is on Jan 1" 2028. (a) What is the bond's clean price, accrued interest, and dirty price? Provide BOTH the nominal dollar price and the par price. (b) What is the yield-to-maturity of the bond? What is the yield-to-worst of the bond? Use the TVM functions to calculate this and not the bond worksheet. Interpret each. (c) Based on the current YTM of the bond, how much does the investor value the stream of coupon payments? The redemption value of the bond? Answer this both in terms of par and nominal prices. (d) Assuming that the bond was issued on Jan 1"2005 at par to finance a $300M project, how much interest is the firm paying each Jan/July? (e) Suppose the bond's indentures specify that if the bond is called, the bond holder will be made-whole at a spread of 35 bps over the comparable Treasury.(below) What is the makewhole call price for the bond if the bond is called at the first callable date? How much will it cost XYZ to call the bond early assuming no other securities fees? (f) To finance the calling of the bond, XYZ can issue a new bond on Jan 1:. 2028 with a 3% coupon rate, 15-year maturity and $3,000 face value. How many bond will be issued? (round up to the nearest unit) (g) Based on your answer in part ( f), how much will the firm save in interest payments each coupon payment period? If the firm operates with an annual discount rate of 10%, how much is the present value interest savings worth to the firm

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started